I love the headline:

Grocery Store Chain Tax?

- Thread starter Ron in Regina

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Worked with the carbon tax rebates for some, didn’t it? From Post#3 here:I love the headline:

Developers welcome GST rebate for rentals, but fear flurry of activity will drive up prices

So in order to lower prices they will drive up prices. Well thought out.

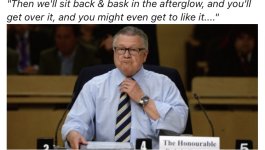

April Fools!! Here's your Carbon Tax F#ckers!!!

"This isn't an April fool's joke": Scott Moe on carbon tax...

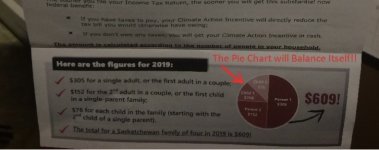

From April Fools, 2019. The math seemed sound.

As long as you couldn’t math, or owned a calculator, or have a Calculator app on your phone, etc….

…& potentially coming to a grocery store near you on top of what you’re already paying.

Grocer summit to 'take the heat off' Ottawa, not tackle food inflation: experts — Global News

As Ottawa prepares to summon grocery executives to come up with a plan to address food inflation, some analysts say the move is 'disingenuous.'

Disingenuous? Really? Naaaaah.

Grocer summit to 'take the heat off' Ottawa, not tackle food inflation: experts — Global News

As Ottawa prepares to summon grocery executives to come up with a plan to address food inflation, some analysts say the move is 'disingenuous.'apple.news

W N.A dollar worth a dollar or euro would make things 25% cheaper.

What I would like to see the grocery CEO’s do is bring evidence that the carbon tax is a large contributor to groceries Going up. The truck driver/owner has to pay carbon taxes on the fuel, on the tires he buys, on the repairs he buys, the meals that he has to buy so he can drive. Everything that Canadians buy has many levels of tax on it, and with inflation kicking in, the government gets more GST, sounds like what a PIMP would do to his girls. Did I just label Just-in as a pimp?

This is what many of us here and elsewhere have had the foresight to have forecast since at least April Fools Day of 2019 or earlier…..

April Fools!! Here's your Carbon Tax F#ckers!!!

"This isn't an April fool's joke": Scott Moe on carbon tax...

….& it escalates every year on April Fools Day, at every step in the chain for all of us, with no endpoint, to what end? Beyond financially crippling us individually, and as a nation, what goal is it achieving?What I would like to see the grocery CEO’s do is bring evidence that the carbon tax is a large contributor to groceries Going up. The truck driver/owner has to pay carbon taxes on the fuel, on the tires he buys, on the repairs he buys, the meals that he has to buy so he can drive. Everything that Canadians buy has many levels of tax on it, and with inflation kicking in, the government gets more GST, sounds like what a PIMP would do to his girls. Did I just label Just-in as a pimp?

The much-ballyhooed meeting between the CEOs of some large grocery chains and Innovation Minister Francois-Philippe Champagne was theatre of the absurd.

apple.news

Prime Minister Justin Trudeau last week vowed to bring grocery stores to heel by Thanksgiving and tame massive increases in the cost of food.

apple.news

Prime Minister Justin Trudeau last week vowed to bring grocery stores to heel by Thanksgiving and tame massive increases in the cost of food.

Trudeau said his government will ask the five largest chains — Loblaws, Metro, Empire, Walmart and Costco — to comply with his request.

“If their plan doesn’t provide real relief for the middle class and people working hard to join it, then we will take further action and we’re not ruling anything out, including tax measures,” Trudeau said.

Fighting words, indeed, from someone whose father infamously made the mistake of bringing in wage and price controls in a failed attempt to combat inflation when he was PM.

Champagne was a little less specific after Monday’s meeting, saying the grocery stores had agreed to work with the government to “stabilize” prices.

So at what level will those prices “stabilize?” If it’s at their present levels, then thanks, but no thanks. We’d like to see market forces bring down the prices to something more reasonable — and then stabilize. If by “stabilizing,” Champagne and the grocery honchos mean they’ll enshrine high prices into our grocery carts forever, then we’ll take a hard pass.

Grocery prices rose 8.5% year over year in July. August data shows that figure at 4% with gasoline price hikes the main cause of the increase. So, the Liberals’ carbon tax is fuelling inflation.

Link. Above. More, etc…

EDITORIAL: Clean-up needed in the grocery aisle — Toronto Sun

The much-ballyhooed meeting between the CEOs of some large grocery chains and Innovation Minister Francois-Philippe Champagne was theatre of the absurd. Prime Minister Justin Trudeau last week vowed to bring grocery stores to heel by Thanksgiving and tame massive increases in the cost of food...

Trudeau said his government will ask the five largest chains — Loblaws, Metro, Empire, Walmart and Costco — to comply with his request.

“If their plan doesn’t provide real relief for the middle class and people working hard to join it, then we will take further action and we’re not ruling anything out, including tax measures,” Trudeau said.

Fighting words, indeed, from someone whose father infamously made the mistake of bringing in wage and price controls in a failed attempt to combat inflation when he was PM.

Champagne was a little less specific after Monday’s meeting, saying the grocery stores had agreed to work with the government to “stabilize” prices.

So at what level will those prices “stabilize?” If it’s at their present levels, then thanks, but no thanks. We’d like to see market forces bring down the prices to something more reasonable — and then stabilize. If by “stabilizing,” Champagne and the grocery honchos mean they’ll enshrine high prices into our grocery carts forever, then we’ll take a hard pass.

Grocery prices rose 8.5% year over year in July. August data shows that figure at 4% with gasoline price hikes the main cause of the increase. So, the Liberals’ carbon tax is fuelling inflation.

Link. Above. More, etc…

“If their plan doesn’t provide real relief for the middle class and people working hard to join it, then we will take further action and we’re not ruling anything out, including tax measures,” Trudeau said.

Why is everything thing with Trudeau about taxes? We all know who ends up paying in the end.

Why is everything thing with Trudeau about taxes? We all know who ends up paying in the end.

Sometimes it’s not about taxes, sometimes it’s just about Banning something or else.“If their plan doesn’t provide real relief for the middle class and people working hard to join it, then we will take further action and we’re not ruling anything out, including tax measures,” Trudeau said.

Why is everything thing with Trudeau about taxes? We all know who ends up paying in the end.

Sunny Ways Peoplekind…

And yet the only factor you cited in the food price rise was the carbon tax.

"For every complex problem there is a solution that is simple, clear, and wrong."

--HL Mencken

My short answer would be, it’s not helping the cost of food, and I knew that something will come out eventually that I can copy and paste in….So here is….something.On this site the stock answer is to whimper about True Dope.

While it’s clear that prices have spiked — Statistics Canada said there was an 11.4 per cent increase in food prices last year — when it comes to what’s actually causing food inflation, things are a bit more complicated. There are multiple factors at play. Everything from supply-chain disruptions to supply management and the war in Ukraine has contributed to an increase in costs.

The carbon tax has also played a role, but experts can’t agree on how much.

What we know about how much the carbon tax is to blame for spiking food costs in Canada — National Post

While it's clear that grocery prices have spiked, when it comes to what's actually causing food inflation, things are a bit more complicated

While it’s clear that prices have spiked — Statistics Canada said there was an 11.4 per cent increase in food prices last year — when it comes to what’s actually causing food inflation, things are a bit more complicated. There are multiple factors at play. Everything from supply-chain disruptions to supply management and the war in Ukraine has contributed to an increase in costs. The carbon tax has also played a role, but experts can’t agree on how much.

The Bank of Canada said this month the carbon price contributes about 0.15 percentage points to inflation overall. That amount was the same whether inflation was at its peak of 8.1 per cent in June 2022 or 3.3 per cent in July. There is no clear figure for groceries. While the tax is not applied directly to food, and the bulk of carbon emissions from the agricultural sector are exempted, it can still indirectly raise costs of production and transportation of food.

University of Calgary economist Trevor Tombe estimates that the carbon tax is responsible for less than one per cent of grocery price increases.

“The best estimates we have show very clearly that carbon taxes do increase food prices, but do so modestly. Certainly not by an amount that’s in any way comparable to the magnitude, just the truly dramatic increase, in food prices that we’ve seen over the last few years,” he said.

Tombe used a Statistics Canada modelling program that analyzes the relationship between taxation and personal finances and takes into account, for example, increased costs of heating on a corner store, when figuring out how much grocery prices have been affected by the tax.

In Alberta, the carbon tax has increased prices by about 0.3 per cent, Tombe said. That’s just 30 cents on a $100 bill. In Manitoba it’s 0.9 per cent and in Ontario it’s 0.4 per cent.

“That doesn’t mean that we should or shouldn’t be concerned about small amounts. A variety of small contributing factors can add up,” Tombe said.

At present, Canada’s carbon tax is set at $65 per tonne of greenhouse-gas emissions. But it is set to increase to $170 by 2030, which would amplify its effects.

There could also be outlier products that are more expensive than other products.

“Especially in winter months, two-thirds of our fruits and vegetables in Canada are imported, and so have greater trucking distances or a little more fuel intensity. Different crops have different fuel intensities as well,” said Tombe.

Currently, the carbon tax works out to about 14 cents per litre of gasoline and 17 cents per litre of diesel.

High fuel prices have previously shown up in grocery prices, but it’s not a sure thing, said James Vercammen, a professor at the Saunder School of Business at the University of British Columbia. He said that there have been a number of periods in the last couple of decades where oil prices were extremely high, but it didn’t necessarily translate into high prices on store shelves.

“That’s some evidence alone, that you can have a big variation in the fuel prices without that much impact on the food,” he said. “So then you say, ‘Well, big jump to the fuel price, not that much of an impact on food, how can a very small increase in the fuel price due to a carbon tax have any impact?'”

Sylvain Charlebois, a professor at Dalhousie University who researches food distribution, safety and security, disputes the idea that a figure can be put on how much the carbon tax is affecting food prices, arguing that there hasn’t been significant research into its effects.

He said that because there are so many factors that influence food prices, it may be near impossible to actually calculate the effect of the carbon tax.

“It’s very difficult to assess how the carbon tax is impacting food prices,” Charlebois said. Consumers have a huge influence and everything from the weather to people’s moods and time of day can affect prices. “We just don’t know. The work that was actually published in Canada is mediocre at best so far. So, we need to do a better job.”

Charlebois said that for businesses, the carbon tax has made their expenses go up.

Throughout the food chain, he said, there’s a “compounding effect,” as links in the supply chain are exposed to increased costs due, in part, to the carbon tax.

“Calculations never account for compounding effects across the supply chain. That’s where the complexity lies,” Charlebois wrote in a follow-up email.

Vercammen also noted that even with sophisticated statistical models “we just don’t have enough data on the supply chain” to assess the effect of the carbon tax on food prices.

When it comes to food production, the bulk of carbon emissions from the agricultural sector are exempted from the carbon tax.

While farms are responsible for 75 megatonnes of carbon emissions — about 10 per cent of all of Canada’s greenhouse gases — only 13.6 megatonnes come from fossil fuels. The emissions from operating vehicles and equipment (10 megatonnes) are wholly or partially exempt from the carbon tax.

Biological emissions, such as gassy cows and fertilizer use, are responsible for the vast majority of emissions from the agricultural sector, and they’re also exempt from any carbon taxation.

Where farmers DO pay a tax on carbon is on the 3.1 megatonnes of emissions that come from crop drying and heating buildings, according to the Parliamentary Budget Officer.

All told, the carbon tax exemptions for the agriculture sector saved farmers $366 million in 2021, and will save them $1.6 billion by 2030, according to the Parliamentary Budget Officer.

A private member’s bill, which passed the House of Commons last spring, and is now with the Senate, “could” further expand those exemptions to propane and natural gas, which are used to dry crops for storage and transport after harvest.

Estimates provided by the PBO for the bill show that in 2023-24, were the bill already law, the government would lose out on about $70 million in carbon tax revenue. By 2030, farmers would be saving $162 million if exempted from the carbon tax on propane and natural gas.

My short answer would be, it’s not helping the cost of food, and I knew that something will come out eventually that I can copy and paste in….So here is….something.

While it’s clear that prices have spiked — Statistics Canada said there was an 11.4 per cent increase in food prices last year — when it comes to what’s actually causing food inflation, things are a bit more complicated. There are multiple factors at play. Everything from supply-chain disruptions to supply management and the war in Ukraine has contributed to an increase in costs.

The carbon tax has also played a role, but experts can’t agree on how much.

There is no clear figure for groceries. Nobody seems to know somehow, so here are some guesses:

What we know about how much the carbon tax is to blame for spiking food costs in Canada — National Post

While it's clear that grocery prices have spiked, when it comes to what's actually causing food inflation, things are a bit more complicatedapple.news

While it’s clear that prices have spiked — Statistics Canada said there was an 11.4 per cent increase in food prices last year — when it comes to what’s actually causing food inflation, things are a bit more complicated. There are multiple factors at play. Everything from supply-chain disruptions to supply management and the war in Ukraine has contributed to an increase in costs. The carbon tax has also played a role, but experts can’t agree on how much.

The Bank of Canada said this month the carbon price contributes about 0.15 percentage points to inflation overall. That amount was the same whether inflation was at its peak of 8.1 per cent in June 2022 or 3.3 per cent in July. There is no clear figure for groceries. While the tax is not applied directly to food, and the bulk of carbon emissions from the agricultural sector are exempted, it can still indirectly raise costs of production and transportation of food.

University of Calgary economist Trevor Tombe estimates that the carbon tax is responsible for less than one per cent of grocery price increases.

“The best estimates we have show very clearly that carbon taxes do increase food prices, but do so modestly. Certainly not by an amount that’s in any way comparable to the magnitude, just the truly dramatic increase, in food prices that we’ve seen over the last few years,” he said.

Tombe used a Statistics Canada modelling program that analyzes the relationship between taxation and personal finances and takes into account, for example, increased costs of heating on a corner store, when figuring out how much grocery prices have been affected by the tax.

In Alberta, the carbon tax has increased prices by about 0.3 per cent, Tombe said. That’s just 30 cents on a $100 bill. In Manitoba it’s 0.9 per cent and in Ontario it’s 0.4 per cent.

“That doesn’t mean that we should or shouldn’t be concerned about small amounts. A variety of small contributing factors can add up,” Tombe said.

At present, Canada’s carbon tax is set at $65 per tonne of greenhouse-gas emissions. But it is set to increase to $170 by 2030, which would amplify its effects.

There could also be outlier products that are more expensive than other products.

“Especially in winter months, two-thirds of our fruits and vegetables in Canada are imported, and so have greater trucking distances or a little more fuel intensity. Different crops have different fuel intensities as well,” said Tombe.

Currently, the carbon tax works out to about 14 cents per litre of gasoline and 17 cents per litre of diesel.

High fuel prices have previously shown up in grocery prices, but it’s not a sure thing, said James Vercammen, a professor at the Saunder School of Business at the University of British Columbia. He said that there have been a number of periods in the last couple of decades where oil prices were extremely high, but it didn’t necessarily translate into high prices on store shelves.

“That’s some evidence alone, that you can have a big variation in the fuel prices without that much impact on the food,” he said. “So then you say, ‘Well, big jump to the fuel price, not that much of an impact on food, how can a very small increase in the fuel price due to a carbon tax have any impact?'”

Sylvain Charlebois, a professor at Dalhousie University who researches food distribution, safety and security, disputes the idea that a figure can be put on how much the carbon tax is affecting food prices, arguing that there hasn’t been significant research into its effects.

He said that because there are so many factors that influence food prices, it may be near impossible to actually calculate the effect of the carbon tax.

“It’s very difficult to assess how the carbon tax is impacting food prices,” Charlebois said. Consumers have a huge influence and everything from the weather to people’s moods and time of day can affect prices. “We just don’t know. The work that was actually published in Canada is mediocre at best so far. So, we need to do a better job.”

Charlebois said that for businesses, the carbon tax has made their expenses go up.

Throughout the food chain, he said, there’s a “compounding effect,” as links in the supply chain are exposed to increased costs due, in part, to the carbon tax.

“Calculations never account for compounding effects across the supply chain. That’s where the complexity lies,” Charlebois wrote in a follow-up email.

Vercammen also noted that even with sophisticated statistical models “we just don’t have enough data on the supply chain” to assess the effect of the carbon tax on food prices.

When it comes to food production, the bulk of carbon emissions from the agricultural sector are exempted from the carbon tax.

While farms are responsible for 75 megatonnes of carbon emissions — about 10 per cent of all of Canada’s greenhouse gases — only 13.6 megatonnes come from fossil fuels. The emissions from operating vehicles and equipment (10 megatonnes) are wholly or partially exempt from the carbon tax.

Biological emissions, such as gassy cows and fertilizer use, are responsible for the vast majority of emissions from the agricultural sector, and they’re also exempt from any carbon taxation.

Where farmers DO pay a tax on carbon is on the 3.1 megatonnes of emissions that come from crop drying and heating buildings, according to the Parliamentary Budget Officer.

All told, the carbon tax exemptions for the agriculture sector saved farmers $366 million in 2021, and will save them $1.6 billion by 2030, according to the Parliamentary Budget Officer.

A private member’s bill, which passed the House of Commons last spring, and is now with the Senate, “could” further expand those exemptions to propane and natural gas, which are used to dry crops for storage and transport after harvest.

Estimates provided by the PBO for the bill show that in 2023-24, were the bill already law, the government would lose out on about $70 million in carbon tax revenue. By 2030, farmers would be saving $162 million if exempted from the carbon tax on propane and natural gas.

Description organic Jersey

Approximate hanging weight 500lbs. $5.50/lb cut and wrapped. Butchering end of October beginning of November.Beef sides and individual cuts for sale in Other in Regina

Description

Save $$ on beef

1/4 - $5.50 /Lb h.w.

Individual cuts - please contact for price list

Delivery to Regina, Weyburn and surrounding communities available

So. . . your point is that the government shouldn't ban. . . say, meth. . . cuz Adam n'Eve?

OK, your opinion is noted.

Meth came from the apple.So. . . your point is that the government shouldn't ban. . . say, meth. . . cuz Adam n'Eve?

OK, your opinion is noted.

Been going on since before you were born. For example, ANY grocery store that is within easy walking distance of senior's housing will have higher prices for almost everything than anywhere else in town. Even in large cities. I've even seen instances in those locations where a 500ml bottle of ketchup cost more than the 1L bottle, because generally old people don't buy food in large amounts or large size formats.Sure, there's more to the reason groceries are high in price than just the chain owners wanting it to be that way....

Oops, maybe not so much.

In my town for example, there is a 'captured shopper'. University students who can't leave town, or seniors who can't leave due to no car access, or low income people who might not have car access or who only use their car for long distance trips occasionally. Whatever the reason is, they can't leave town. Some things are high cost regardless (fresh produce for example), but if I can go to a freakin GAS station and pay 20 cents less for a pack of instant ramen, there's something wrong with the prices in grocery store chains.

Or if you do have access to a vehicle, and can get to the bigger centers (15 or 30 minutes away respectively) there is a change in a lot of the prices for things. Used to be we could claim tax as a difference, but now NB and NS have the same tax rate so that's not a factor anymore.

Locally, it's just sheer greed, that's it. And it has always been this way through the entirety of my life here.

But with that captured shopper, they always have people who don't have a choice but to pay the price they demand for things.

So I think the question is a lot more complex than just blaming Carbon Tax shit or Inflation for it.

What I found interesting was how morons boycotted Loblaws because of their "insane" 3.4% profit margin and Singh egged it on. Meanwhile his brother or something works for a lobbying firm that lobbies on behalf of Metro. Which by the way had a profit margin exceeding 4%.

Like it or not, the problem lays with the govt. Not Trudeau specifically but govts in general. THEY let these grocers get away with the shit they do. Lobbying pays off but not for the consumer. There's also some weird allergy to competition in this country. You see, govts also have a vested interest in higher prices because higher prices mean higher tax revenues without having to actually increase taxes. Big corps get the blame and the govt laughs at your pathetic gullibility.

Similarly to those who get right fucked off about CEO's with $20 million salaries laying off a few hundred workers but didn't bat an eye when the taxpayer force-funded CBC laid off hundreds of workers while handing out a round of taxpayer force-funded bonuses to the CBC execs.

Yup every few years governments get on the high price of gas issue . They yak and yak create a commission of inquiry provide a healthy package to trusted insiders . And laugh as they do everything possible to keep prices high .Been going on since before you were born. For example, ANY grocery store that is within easy walking distance of senior's housing will have higher prices for almost everything than anywhere else in town. Even in large cities. I've even seen instances in those locations where a 500ml bottle of ketchup cost more than the 1L bottle, because generally old people don't buy food in large amounts or large size formats.

What I found interesting was how morons boycotted Loblaws because of their "insane" 3.4% profit margin and Singh egged it on. Meanwhile his brother or something works for a lobbying firm that lobbies on behalf of Metro. Which by the way had a profit margin exceeding 4%.

Like it or not, the problem lays with the govt. Not Trudeau specifically but govts in general. THEY let these grocers get away with the shit they do. Lobbying pays off but not for the consumer. There's also some weird allergy to competition in this country. You see, govts also have a vested interest in higher prices because higher prices mean higher tax revenues without having to actually increase taxes. Big corps get the blame and the govt laughs at your pathetic gullibility.

Similarly to those who get right fucked off about CEO's with $20 million salaries laying off a few hundred workers but didn't bat an eye when the taxpayer force-funded CBC laid off hundreds of workers while handing out a round of taxpayer force-funded bonuses to the CBC execs.