I just wish they'd forget about all the climate B.S. which does absolutely nothing for the climate & use those funds to perhaps stiffen up our electrical grid - you know, things that will actually BENEFIT us?? They're spending priorities SUCK BIG TIME and always have.The Trudeau government will launch a multimillion-dollar advertising campaign in the year ahead of the next election to promote its carbon pricing plan and the rebates it gives to Canadians, the Star has learned.

This of course, won’t be considered election campaigning for the liberals, so won’t come out of the parties pocket, and will be paid for by the taxpayer, maybe even from the carbon tax that’s 100% neutral-ish…death of a thousand cuts style.

'Too little, too late'? Trudeau government plans ad campaign to promote carbon pricing — and rebates — Toronto Star

Environment and Climate Change Canada is looking to run a $7-million "climate literacy and action" advertising campaign.apple.news

Environment and Climate Change Canada is planning a $7-million "climate literacy and action" advertising campaign that would focus on how "carbon pricing reduces emissions and benefits Canadians through the Canada Carbon Rebate," in addition to other actions to combat climate change, according to a copy of the department's advertising plan obtained by the Star through an Access to Information request.

It would mark the latest shift in the way the Trudeau Liberals communicate their flagship climate policy — which makes fossil-fuel products more expensive but encourages consumers to use less of them off with quarterly rebates — in the face of mounting Conservative attacks that label it as a driver of inflation.

The Liberals have long asserted that the rebates send more money to Canadians than the plan costs them. However, Conservative Leader Pierre Poilievre has vowed to "axe the tax" and has called for a "carbon tax election." Combined with the more significant industrial price on pollution, the Liberals' carbon pricing plan is expected to account for a third of Canada's greenhouse gas reductions by 2030, according to government estimates.

In an acknowledgment that the Conservatives have dominated the narrative, the Trudeau government this year rebranded the plan's rebates, forced banks to more clearly label payments and made a push to counter Conservative claims.

But the Liberal government had previously avoided calls urging it to use large paid advertising campaigns to make its case to Canadians.

Running advertisements would be one more way to raise awareness and boost support for the plan, a spokesperson for Environment Minister Steven Guilbeault said, etc…more at the link.

April Fools!! Here's your Carbon Tax F#ckers!!!

- Thread starter Ron in Regina

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Guess who’s become the most vocal critic of Prime Minister Justin Trudeau’s federal carbon tax? Brace yourselves: the NDP.

The first attack came from NDP leader Jagmeet Singh. He supported the Liberal carbon tax in the House of Commons, and sang its praises to the highest mountain top. Singh isn’t singing from the same political songbook any longer, however. He dropped his support for Trudeau’s pet project last week like a bad habit. The NDP leader now desires a policy that won’t “put the burden on the backs of working people, where big polluters have to pay their fair share.” His party will release its own plan in a few months’ time, etc…

apple.news

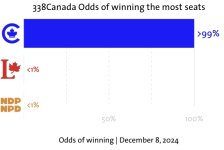

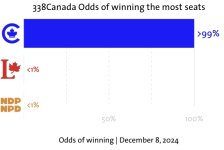

The NDP ended the controversial supply and confidence agreement it had with the Liberals earlier this month. Singh and his senior advisors privately know that Pierre Poilievre and the Conservatives would win a big majority if an election were held today. Hence, they’ll support the Liberal minority government on a case-by-case basis and start the process to leapfrog the Liberals and become the leading voice of progressive-leaning Canadians.

apple.news

The NDP ended the controversial supply and confidence agreement it had with the Liberals earlier this month. Singh and his senior advisors privately know that Pierre Poilievre and the Conservatives would win a big majority if an election were held today. Hence, they’ll support the Liberal minority government on a case-by-case basis and start the process to leapfrog the Liberals and become the leading voice of progressive-leaning Canadians.

The best way to do this is to strike out on your own, and not be dragged down by being associated with Trudeau’s mediocre and ineffective leadership. Taking ownership of the carbon tax is part of the NDP’s forthcoming election strategy, it seems.

From March 2022 until last week, Singh had kept the Liberal government — and with it, its unpopular carbon tax program — locked in with a confidence-and-supply agreement. In that time, the “price on pollution” doubled from $40 per tonne to today’s $80 per tonne; it’s set to somehow reach $170 per tonne in 2030. A painful price tag to pay in a country that would barely make a dent in global emissions if it were vaporized tomorrow.

apple.news

The Liberals and NDP have forked on how to manage this mess: the NDP are denouncing the present iteration of carbon pricing (sort of), invoking the disproportionate suffering workers are supposed to experience in a changed climate without openly opposing it. The Liberals, meanwhile, are trying out another hopeless rebrand while giving carve-outs to strategic provinces (Atlantic Canada).

apple.news

The Liberals and NDP have forked on how to manage this mess: the NDP are denouncing the present iteration of carbon pricing (sort of), invoking the disproportionate suffering workers are supposed to experience in a changed climate without openly opposing it. The Liberals, meanwhile, are trying out another hopeless rebrand while giving carve-outs to strategic provinces (Atlantic Canada).

The first attack came from NDP leader Jagmeet Singh. He supported the Liberal carbon tax in the House of Commons, and sang its praises to the highest mountain top. Singh isn’t singing from the same political songbook any longer, however. He dropped his support for Trudeau’s pet project last week like a bad habit. The NDP leader now desires a policy that won’t “put the burden on the backs of working people, where big polluters have to pay their fair share.” His party will release its own plan in a few months’ time, etc…

Michael Taube: New Democrats haven't learned from their Liberal carbon tax mistake — National Post

The federal and provincial NDP are retreating away from Trudeau's imploding carbon pricing scheme, but not to the degree they need

The best way to do this is to strike out on your own, and not be dragged down by being associated with Trudeau’s mediocre and ineffective leadership. Taking ownership of the carbon tax is part of the NDP’s forthcoming election strategy, it seems.

From March 2022 until last week, Singh had kept the Liberal government — and with it, its unpopular carbon tax program — locked in with a confidence-and-supply agreement. In that time, the “price on pollution” doubled from $40 per tonne to today’s $80 per tonne; it’s set to somehow reach $170 per tonne in 2030. A painful price tag to pay in a country that would barely make a dent in global emissions if it were vaporized tomorrow.

Jamie Sarkonak: Jagmeet Singh targets carbon tax in a flaccid attempt to imitate Poilievre — National Post

The NDP, just like the Liberals, haven't a clue what working-class voters want

Ah hell, the NDP will continue to support the Liberals as they can't afford an election right now & besides, Singh still needs his pension LMAO!Guess who’s become the most vocal critic of Prime Minister Justin Trudeau’s federal carbon tax? Brace yourselves: the NDP.

The first attack came from NDP leader Jagmeet Singh. He supported the Liberal carbon tax in the House of Commons, and sang its praises to the highest mountain top. Singh isn’t singing from the same political songbook any longer, however. He dropped his support for Trudeau’s pet project last week like a bad habit. The NDP leader now desires a policy that won’t “put the burden on the backs of working people, where big polluters have to pay their fair share.” His party will release its own plan in a few months’ time, etc…

The NDP ended the controversial supply and confidence agreement it had with the Liberals earlier this month. Singh and his senior advisors privately know that Pierre Poilievre and the Conservatives would win a big majority if an election were held today. Hence, they’ll support the Liberal minority government on a case-by-case basis and start the process to leapfrog the Liberals and become the leading voice of progressive-leaning Canadians.

Michael Taube: New Democrats haven't learned from their Liberal carbon tax mistake — National Post

The federal and provincial NDP are retreating away from Trudeau's imploding carbon pricing scheme, but not to the degree they needapple.news

The best way to do this is to strike out on your own, and not be dragged down by being associated with Trudeau’s mediocre and ineffective leadership. Taking ownership of the carbon tax is part of the NDP’s forthcoming election strategy, it seems.

From March 2022 until last week, Singh had kept the Liberal government — and with it, its unpopular carbon tax program — locked in with a confidence-and-supply agreement. In that time, the “price on pollution” doubled from $40 per tonne to today’s $80 per tonne; it’s set to somehow reach $170 per tonne in 2030. A painful price tag to pay in a country that would barely make a dent in global emissions if it were vaporized tomorrow.

The Liberals and NDP have forked on how to manage this mess: the NDP are denouncing the present iteration of carbon pricing (sort of), invoking the disproportionate suffering workers are supposed to experience in a changed climate without openly opposing it. The Liberals, meanwhile, are trying out another hopeless rebrand while giving carve-outs to strategic provinces (Atlantic Canada).

Jamie Sarkonak: Jagmeet Singh targets carbon tax in a flaccid attempt to imitate Poilievre — National Post

The NDP, just like the Liberals, haven't a clue what working-class voters wantapple.news

The Liberals and NDP have forked on how to manage this mess: the NDP are denouncing the present iteration of carbon pricing (sort of), invoking the disproportionate suffering workers are supposed to experience in a changed climate without openly opposing it. The Liberals, meanwhile, are trying out another hopeless rebrand while giving carve-outs to strategic provinces (Atlantic Canada).

Ah hell, the NDP will continue to support the Liberals as they can't afford an election right now & besides, Singh still needs his pension LMAO!

'It's a complex issue': Why Steven Guilbeault thinks the Liberals' climate plan isn't resonating — National Post

The environment minister tried to make the case that the plan is working and ruled out slowing down scheduled increases to the carbon tax

“I don’t know about you,” the minister said, “but (Poilievre’s) scare mongering about ludicrous nuclear winter makes absolutely no sense to anyone but him,” referring to the dire warning the Conservative leader delivered to his caucus about the scheduled increases to the plan before they returned for the fall sitting,

(Looks like it makes sense the more than just the one guy, looking at the scoreboard)

Guilbeault continued: “He should ask a family of four in his (Ontario) riding if the $1,120 this year that they will be receiving is helping them.”

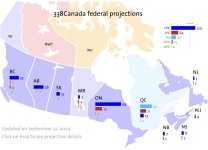

(Ontario is the province with projection violating the US)

EDITORIAL: Liberals and their carbon tax follies — Toronto Sun

American author and social activist Upton Sinclair famously said, “It is difficult to get a man to understand something when his salary depends upon his not understanding it.” This describes Prime Minister Justin Trudeau and the Liberals when it comes to their carbon tax. Their salaries, indeed...

JAY GOLDBERG: Ontario must take Trudeau to court — again — Toronto Sun

Prime Minister Justin Trudeau’s carbon tax has never been more vulnerable. It’s time for Ontario Premier Doug Ford to step up to the plate and take the federal government to court — again. Ford, along with his colleagues in Alberta and Saskatchewan, took Trudeau to court several years ago after...

PBO report clearly shows Trudeau's carbon tax costs you more

No, you don't get more in rebates than what the carbon tax costs you.

Author of the article:Brian Lilley

Published Oct 10, 2024 • Last updated 2 days ago • 3 minute read

Justin Trudeau’s carbon tax will cost most Canadians more, it will lower your income and it will shrink our economy.

Those are the conclusions of the Parliamentary Budget Officer (PBO), an independent officer of Parliament, after looking at the fiscal and total economic impact of the carbon tax.

The PBO found that by 2030, those in the bottom 40% of income earners will see a net benefit from the carbon tax and the government’s rebate programs – but everyone else will pay more.

In Ontario, the estimate is between paying an extra $588 a year and $3,467. For Alberta, the range was $130 to $3,122. And in Manitoba, it’s between $218 and $3,295.

Ever since the Trudeau government announced their carbon tax plan, they have claimed that eight out of 10 families will get back more in rebates than they pay in tax. While the PBO finds that generally accurate when just looking at the direct tax paid versus the rebates, the total economic impact is negative.

This is the second report by the PBO to find this.

The office previously issued a report in March 2023 showing a similar problem, that most were paying more. Earlier this year, the PBO said there was an error in the report and they would be correcting it.

The Trudeau Liberals had never really acknowledged the report showing most paid more than they received in rebates. They just kept repeating the line that eight out of 10 got more in rebates than they paid in “carbon pricing,” even refusing to acknowledge it was a tax.

“When the economic impact of the federal fuel charge is combined with the fiscal impact, the net cost increases for the average household across all income quintiles, reflecting the overall negative economic impact of the fuel charge,” the PBO’s revised report states.

“In 2030-31, taking into consideration both fiscal and economic impacts, we estimate that the average household in each of the backstop provinces will see a net cost, paying more in the federal fuel charge and GST, as well as receiving lower incomes (due to the fuel charge), compared to the Canada Carbon Rebate they receive.”

Not to sound like Chandler from Friends but, “Could they be any clearer?”

Trudeau’s Environment Minister Steven Guilbeault tried to skate past the report’s clear findings several times. In both statements to social media and in a brief interaction with the media, Guilbeault claimed it was clear most people were better off due to the carbon tax.

That is clearly not what the report said.

“Now’s the time to clear the air on Pierre Poilievre’s big lie to Canadians,” Guilbeault said to reporters before Question Period on Thursday.

“He’s been misleading Canadians, the PBO is very clear. More Canadians get money back from the Canada Carbon Rebate than what they pay.”

That’s not what the PBO said, and once again the Liberals are lying to the public and will be aided and abetted by a media that won’t tell the full truth. This tax is clearly costing more for the average family than they will get back in rebates.

Even the way the rebates are calculated should give people pause for concern.

Whether it is the cost to heat your home or fill your gas tank, everything is calculated on StatsCan averages. That means the rebate is calculated on the average Canadian driving 15,000 km per year or less.

As an urban dweller, I drive less than that, but any suburban family raising kids is driving much more than that and they don’t get a bigger rebate.

“That’s why we need a carbon tax election where Canadians can choose between a 61 cents a litre carbon tax or axing the carbon tax altogether,” Poilievre said Thursday.

The PBO report shows the Liberals are lying to you, they want to claim it shows Poilievre is the one fudging the truth. On this file, as with many, Trudeau and his gang can’t be trusted.

blilley@postmedia.com

torontosun.com

torontosun.com

No, you don't get more in rebates than what the carbon tax costs you.

Author of the article:Brian Lilley

Published Oct 10, 2024 • Last updated 2 days ago • 3 minute read

Justin Trudeau’s carbon tax will cost most Canadians more, it will lower your income and it will shrink our economy.

Those are the conclusions of the Parliamentary Budget Officer (PBO), an independent officer of Parliament, after looking at the fiscal and total economic impact of the carbon tax.

The PBO found that by 2030, those in the bottom 40% of income earners will see a net benefit from the carbon tax and the government’s rebate programs – but everyone else will pay more.

In Ontario, the estimate is between paying an extra $588 a year and $3,467. For Alberta, the range was $130 to $3,122. And in Manitoba, it’s between $218 and $3,295.

Ever since the Trudeau government announced their carbon tax plan, they have claimed that eight out of 10 families will get back more in rebates than they pay in tax. While the PBO finds that generally accurate when just looking at the direct tax paid versus the rebates, the total economic impact is negative.

This is the second report by the PBO to find this.

The office previously issued a report in March 2023 showing a similar problem, that most were paying more. Earlier this year, the PBO said there was an error in the report and they would be correcting it.

The Trudeau Liberals had never really acknowledged the report showing most paid more than they received in rebates. They just kept repeating the line that eight out of 10 got more in rebates than they paid in “carbon pricing,” even refusing to acknowledge it was a tax.

“When the economic impact of the federal fuel charge is combined with the fiscal impact, the net cost increases for the average household across all income quintiles, reflecting the overall negative economic impact of the fuel charge,” the PBO’s revised report states.

“In 2030-31, taking into consideration both fiscal and economic impacts, we estimate that the average household in each of the backstop provinces will see a net cost, paying more in the federal fuel charge and GST, as well as receiving lower incomes (due to the fuel charge), compared to the Canada Carbon Rebate they receive.”

Not to sound like Chandler from Friends but, “Could they be any clearer?”

Trudeau’s Environment Minister Steven Guilbeault tried to skate past the report’s clear findings several times. In both statements to social media and in a brief interaction with the media, Guilbeault claimed it was clear most people were better off due to the carbon tax.

That is clearly not what the report said.

“Now’s the time to clear the air on Pierre Poilievre’s big lie to Canadians,” Guilbeault said to reporters before Question Period on Thursday.

“He’s been misleading Canadians, the PBO is very clear. More Canadians get money back from the Canada Carbon Rebate than what they pay.”

That’s not what the PBO said, and once again the Liberals are lying to the public and will be aided and abetted by a media that won’t tell the full truth. This tax is clearly costing more for the average family than they will get back in rebates.

Even the way the rebates are calculated should give people pause for concern.

Whether it is the cost to heat your home or fill your gas tank, everything is calculated on StatsCan averages. That means the rebate is calculated on the average Canadian driving 15,000 km per year or less.

As an urban dweller, I drive less than that, but any suburban family raising kids is driving much more than that and they don’t get a bigger rebate.

“That’s why we need a carbon tax election where Canadians can choose between a 61 cents a litre carbon tax or axing the carbon tax altogether,” Poilievre said Thursday.

The PBO report shows the Liberals are lying to you, they want to claim it shows Poilievre is the one fudging the truth. On this file, as with many, Trudeau and his gang can’t be trusted.

blilley@postmedia.com

LILLEY: PBO report clearly shows Trudeau's carbon tax costs you more

Report from the Parliamentary Budget Officer shows the claim by the Trudeau Liberals that most get more money back is a lie.

EDITORIAL: Is the carbon tax the next flip-flop? — Toronto Sun

The turbulent events on Parliament Hill this week culminated in a spectacular policy flip-flop on the part of Prime Minister Justin Trudeau. Acknowledging they made mistakes, Trudeau backed off from his wide-open immigration policy that has allowed millions of foreign students, refugees and new...

I don't have a liberal membership card, so not eligible.

So the big question is" if most families are getting a rebate, many more than they paid in carbon scam taxes, why charge a tax in the first place? The only purpose I see is wealth redistribution.

And ensuring that the Public Service members increase so that taxpayers have to pay even more. AFter all, increasing regulations means hiring more people to implement said regulation.So the big question is" if most families are getting a rebate, many more than they paid in carbon scam taxes, why charge a tax in the first place? The only purpose I see is wealth redistribution.

…& the public sector increased under Trudeau by a about 40%…let that sink in.And ensuring that the Public Service members increase so that taxpayers have to pay even more. AFter all, increasing regulations means hiring more people to implement said regulation.

Bad vibes man, bad vibes.…& the public sector increased under Trudeau by a about 40%…let that sink in.

“’It’s really, really easy’ when people are in short-term survival mode worried about being ‘able to pay the rent this month’ and ‘buy groceries for my kids to say ‘okay: let’s put climate change as a slightly lower priority,’” Trudeau said.

EDITORIAL: Trudeau doubles down defending his carbon tax

Trudeau appears ready to die on that hill.

Trudeau also implied he introduced his carbon tax as the best way to lower greenhouse gas emissions as opposed to government regulations and subsidies, when the reality is his plan includes all three at a cost of more than $200 billion.

He opened by insisting it is morally selfish to put food and lodging concerns above contributions to the carbon tax. Seriously.

Terry Newman: Trudeau to Canada — starve your kids for climate change

Forgive us if we put feeding and housing our families above Trudeau's plans to save the entire planet

If only somebody could’ve seen this coming five years ago…& tried to start a conversation about it. Oh well…..

(Ralph Goodale was my Liberal MP for my riding for years)

For years , explains it all .View attachment 25880

Speaking at a Global Citizen conference in Rio de Janeiro leading up to this year’s G20 meeting, Trudeau said his job in the next election will be to convince Canadians that “they have to pay more in taxes, or they have to accept that some of their tax dollars are going to the most vulnerable in the world” to fight climate change, even as they face an affordability crisis at home.

“’It’s really, really easy’ when people are in short-term survival mode worried about being ‘able to pay the rent this month’ and ‘buy groceries for my kids to say ‘okay: let’s put climate change as a slightly lower priority,’” Trudeau said.

Trudeau hopped on a plane to fly 8,280 km to take the stage at the Global Citizen Now Event at the G20 Leaders’ Summit Rio de Janeiro, Brazil to lecture the audience and Canadians about our country’s role in saving the entire planet.

EDITORIAL: Trudeau doubles down defending his carbon tax

Trudeau appears ready to die on that hill.torontosun.com

Trudeau also implied he introduced his carbon tax as the best way to lower greenhouse gas emissions as opposed to government regulations and subsidies, when the reality is his plan includes all three at a cost of more than $200 billion.

He opened by insisting it is morally selfish to put food and lodging concerns above contributions to the carbon tax. Seriously.

View attachment 25881

Terry Newman: Trudeau to Canada — starve your kids for climate change

Forgive us if we put feeding and housing our families above Trudeau's plans to save the entire planetnationalpost.com

View attachment 25882

If only somebody could’ve seen this coming five years ago…& tried to start a conversation about it. Oh well…..

View attachment 25883

View attachment 25884

(Ralph Goodale was my Liberal MP for my riding for years)

Prime Minister Justin Trudeau’s carbon tax has become such a stink bomb to Liberal fortunes everywhere that even Ontario Liberal leader Bonnie Crombie is now denouncing it.

As she put it at a Liberal fundraiser on Tuesday night, as reported by the Toronto Star: “I’m not here to tell the prime minister how to do his job. But I promise you, I will tell him when he’s wrong. Like on the carbon tax.”

That was in response to months of Ontario Premier Doug Ford and the Progressive Conservatives labelling her as “the Queen of the Carbon Tax” because, they said, of her previous support for it when she was a Liberal MP, plus describing her “as one of the only provincial Liberal leaders in Canada who won’t speak out against the carbon tax.”

Crombie had previously pledged not to introduce a provincial carbon tax if she becomes premier.

apple.news

While taking her at her word, her problem in terms of credibility is the history of Ontario and federal Liberals saying one thing and doing another when it comes to carbon taxes.

apple.news

While taking her at her word, her problem in terms of credibility is the history of Ontario and federal Liberals saying one thing and doing another when it comes to carbon taxes.

For example, to the 2019 federal election, then Liberal environment minister Catherine McKenna said the Liberals wouldn’t raise their carbon tax beyond $50 per tonne of emissions in 2022.

After the 2019 election, in which the Liberals were reduced from a majority to a minority government, Trudeau announced he would raise the federal carbon tax every year after 2022 until it reached $170 per tonne of emissions in 2030.

For another example, Trudeau Liberals have claimed for years that the rebate system under their carbon tax leaves 80% of families paying it with more money in their pockets than they pay in carbon taxes.

Independent, non-partisan Parliamentary Budget Officer Yves Giroux subsequently pointed out that this was true if one considered only the fiscal impact of the carbon tax.

But if you added in its drag on the Canadian economy, plus the fact the Liberal rebate system doesn’t return revenue generated by their imposition of the GST on top of the carbon tax to Canadians, 60% of families ended up with less money in their pockets every year.

For another another example, Trudeau says he introduced his carbon tax as an alternative to less efficient and more expensive ways to reduce emissions such as government regulations and government subsidies.

But in addition to his carbon tax, Trudeau has introduced costly clean fuel, clean electricity and methane regulations, along with a cap on oil and gas emissions, in addition to multi-billion subsidies to the private sector to create a supply chain for electric vehicles in Canada.

(In reality, there are 149 government programs aimed at reducing emissions to which the Trudeau Liberals have earmarked more than $200 billion)

For another another another example, during the 2014 Ontario election that brought her predecessor as Ontario Liberal leader, Kathleen Wynne, to power, Wynne said nothing about imposing a provincial carbon tax on Ontarians. Shortly after her victory, she said she had no plans to introduce a carbon tax.

Then she introduced cap-and-trade, another form of a carbon tax, etc…’cuz?

For another another another another example, the Trudeau Liberals said no political considerations went into the creation of their carbon tax.

But Gudie Hutchings, Trudeau’s minister for rural economic development and the Atlantic Canada Opportunities Agency, said last year that if provinces like Alberta wanted special deals to defray the costs of carbon pricing as they had just announced for Atlantic Canada, “Perhaps they need to elect more Liberals on the Prairies so that we can have that conversation, as well.”

(Here’s the quote from Jabba the Libb)

apple.news

apple.news

As she put it at a Liberal fundraiser on Tuesday night, as reported by the Toronto Star: “I’m not here to tell the prime minister how to do his job. But I promise you, I will tell him when he’s wrong. Like on the carbon tax.”

That was in response to months of Ontario Premier Doug Ford and the Progressive Conservatives labelling her as “the Queen of the Carbon Tax” because, they said, of her previous support for it when she was a Liberal MP, plus describing her “as one of the only provincial Liberal leaders in Canada who won’t speak out against the carbon tax.”

Crombie had previously pledged not to introduce a provincial carbon tax if she becomes premier.

GOLDSTEIN: Even Liberals are running away from Trudeau’s carbon tax — Toronto Sun

Prime Minister Justin Trudeau’s carbon tax has become such a stink bomb to Liberal fortunes everywhere that even Ontario Liberal leader Bonnie Crombie is now denouncing it. As she put it at a Liberal fundraiser on Tuesday night, as reported by the Toronto Star: “I’m not here to tell the prime...

For example, to the 2019 federal election, then Liberal environment minister Catherine McKenna said the Liberals wouldn’t raise their carbon tax beyond $50 per tonne of emissions in 2022.

After the 2019 election, in which the Liberals were reduced from a majority to a minority government, Trudeau announced he would raise the federal carbon tax every year after 2022 until it reached $170 per tonne of emissions in 2030.

For another example, Trudeau Liberals have claimed for years that the rebate system under their carbon tax leaves 80% of families paying it with more money in their pockets than they pay in carbon taxes.

Independent, non-partisan Parliamentary Budget Officer Yves Giroux subsequently pointed out that this was true if one considered only the fiscal impact of the carbon tax.

But if you added in its drag on the Canadian economy, plus the fact the Liberal rebate system doesn’t return revenue generated by their imposition of the GST on top of the carbon tax to Canadians, 60% of families ended up with less money in their pockets every year.

For another another example, Trudeau says he introduced his carbon tax as an alternative to less efficient and more expensive ways to reduce emissions such as government regulations and government subsidies.

But in addition to his carbon tax, Trudeau has introduced costly clean fuel, clean electricity and methane regulations, along with a cap on oil and gas emissions, in addition to multi-billion subsidies to the private sector to create a supply chain for electric vehicles in Canada.

(In reality, there are 149 government programs aimed at reducing emissions to which the Trudeau Liberals have earmarked more than $200 billion)

For another another another example, during the 2014 Ontario election that brought her predecessor as Ontario Liberal leader, Kathleen Wynne, to power, Wynne said nothing about imposing a provincial carbon tax on Ontarians. Shortly after her victory, she said she had no plans to introduce a carbon tax.

Then she introduced cap-and-trade, another form of a carbon tax, etc…’cuz?

For another another another another example, the Trudeau Liberals said no political considerations went into the creation of their carbon tax.

But Gudie Hutchings, Trudeau’s minister for rural economic development and the Atlantic Canada Opportunities Agency, said last year that if provinces like Alberta wanted special deals to defray the costs of carbon pricing as they had just announced for Atlantic Canada, “Perhaps they need to elect more Liberals on the Prairies so that we can have that conversation, as well.”

(Here’s the quote from Jabba the Libb)

GOLDSTEIN: Even Liberals are running away from Trudeau’s carbon tax — Toronto Sun

Prime Minister Justin Trudeau’s carbon tax has become such a stink bomb to Liberal fortunes everywhere that even Ontario Liberal leader Bonnie Crombie is now denouncing it. As she put it at a Liberal fundraiser on Tuesday night, as reported by the Toronto Star: “I’m not here to tell the prime...

The federal government argues that given the financial aid it is giving to the provinces to make the transition to green energy in the electricity sector, they should be able to reach the federal targets without putting any onerous burden on electricity ratepayers.

The underlying point, however, is that Trudeau’s climate change plan has a lot more moving parts to it than his carbon tax.

In fact, Trudeau imposed his carbon tax on top of government regulations and subsidies — part of 149 different government programs on which the Liberal government says it is spending more than $200 billion to implement.

apple.news

apple.news

The underlying point, however, is that Trudeau’s climate change plan has a lot more moving parts to it than his carbon tax.

In fact, Trudeau imposed his carbon tax on top of government regulations and subsidies — part of 149 different government programs on which the Liberal government says it is spending more than $200 billion to implement.

EDITORIAL: The astronomical cost of 'clean' electricity — Toronto Sun

Every time Prime Minister Justin Trudeau says he chose a carbon tax as the most efficient way to reduce greenhouse gas emissions as opposed to government regulations and expensive subsidies, he’s spouting nonsense. In fact, Trudeau imposed his carbon tax on top of government regulations and...

Ontario Liberal Leader Bonnie Crombie had an epiphany: Carbon taxes are bad and Prime Minister Justin Trudeau should scrap his.

After pledging last month to remove the provincial portion of the HST from home heating and hydro bills if elected, Crombie faced further pressure from taxpayers to call on Trudeau to scrap his carbon tax.

Crombie’s promise to remove the HST from heating and hydro bills could save Ontarians about $150 a year. But the carbon tax is costing the typical Ontario family $399 this year, even after the rebates, according to the Parliamentary Budget Officer. And that’ll go up to $903 by 2030 if Trudeau has his way.

In the past, Crombie pledged not to introduce a provincial carbon tax of her own if elected and the federal carbon tax is removed. But she hadn’t flatly said that Trudeau’s carbon tax was bad policy and should be repealed.

Until now.

apple.news

Crombie finally took aim at Trudeau’s costly carbon tax at a donor dinner earlier this month.

apple.news

Crombie finally took aim at Trudeau’s costly carbon tax at a donor dinner earlier this month.

“I’m not here to tell the prime minister how to do his job,” Crombie said. “But I promise you, I will tell him when he’s wrong. Like on the carbon tax.”

Crombie’s move is big news. She was one of the last provincial Liberal leaders refusing to call on Trudeau to scrap his carbon tax.

Federal Environment Minister Steven Guilbeault said fighting climate change is “politically tough,” which is why he understands that Ontario Liberal leader Bonnie Crombie is distancing herself from the carbon levy.

Crombie criticized the federal price on carbon on Tuesday night during a party fundraising dinner. She said the federal carbon levy is “wrong.”

Guilbeault said he wasn’t surprised by Crombie’s remarks, but he stands behind the levy.

The federal carbon levy (=TAX) only applies in provinces that don’t impose their own climate change plans that meet federal standards for emissions reductions. Only British Columbia and Quebec have provincially made plans, with ALL the other provinces taking the federal program.

The Liberal plan includes a levy on gasoline and heating fuels and rises every April Fools Day. It also includes regular rebates paid to some consumers.

apple.news

apple.news

After pledging last month to remove the provincial portion of the HST from home heating and hydro bills if elected, Crombie faced further pressure from taxpayers to call on Trudeau to scrap his carbon tax.

Crombie’s promise to remove the HST from heating and hydro bills could save Ontarians about $150 a year. But the carbon tax is costing the typical Ontario family $399 this year, even after the rebates, according to the Parliamentary Budget Officer. And that’ll go up to $903 by 2030 if Trudeau has his way.

In the past, Crombie pledged not to introduce a provincial carbon tax of her own if elected and the federal carbon tax is removed. But she hadn’t flatly said that Trudeau’s carbon tax was bad policy and should be repealed.

Until now.

JAY GOLDBERG: Another provincial Liberal leader defects on Trudeau’s carbon tax — Toronto Sun

Ontario Liberal Leader Bonnie Crombie had an epiphany: Carbon taxes are bad and Prime Minister Justin Trudeau should scrap his. After pledging last month to remove the provincial portion of the HST from home heating and hydro bills if elected, Crombie faced further pressure from taxpayers to...

“I’m not here to tell the prime minister how to do his job,” Crombie said. “But I promise you, I will tell him when he’s wrong. Like on the carbon tax.”

Crombie’s move is big news. She was one of the last provincial Liberal leaders refusing to call on Trudeau to scrap his carbon tax.

Federal Environment Minister Steven Guilbeault said fighting climate change is “politically tough,” which is why he understands that Ontario Liberal leader Bonnie Crombie is distancing herself from the carbon levy.

Crombie criticized the federal price on carbon on Tuesday night during a party fundraising dinner. She said the federal carbon levy is “wrong.”

Guilbeault said he wasn’t surprised by Crombie’s remarks, but he stands behind the levy.

The federal carbon levy (=TAX) only applies in provinces that don’t impose their own climate change plans that meet federal standards for emissions reductions. Only British Columbia and Quebec have provincially made plans, with ALL the other provinces taking the federal program.

The Liberal plan includes a levy on gasoline and heating fuels and rises every April Fools Day. It also includes regular rebates paid to some consumers.

Trudeau's environment minister says he understands why Ontario Liberal leader is distancing herself from 'carbon tax' — Toronto Star

Bonnie Crombie criticized the federal tax on Tuesday night during a party fundraising dinner. She said the federal carbon levy is “wrong.”

Notice it is now a levy .Ontario Liberal Leader Bonnie Crombie had an epiphany: Carbon taxes are bad and Prime Minister Justin Trudeau should scrap his.

View attachment 26134

After pledging last month to remove the provincial portion of the HST from home heating and hydro bills if elected, Crombie faced further pressure from taxpayers to call on Trudeau to scrap his carbon tax.

Crombie’s promise to remove the HST from heating and hydro bills could save Ontarians about $150 a year. But the carbon tax is costing the typical Ontario family $399 this year, even after the rebates, according to the Parliamentary Budget Officer. And that’ll go up to $903 by 2030 if Trudeau has his way.

In the past, Crombie pledged not to introduce a provincial carbon tax of her own if elected and the federal carbon tax is removed. But she hadn’t flatly said that Trudeau’s carbon tax was bad policy and should be repealed.

Until now.

Crombie finally took aim at Trudeau’s costly carbon tax at a donor dinner earlier this month.

JAY GOLDBERG: Another provincial Liberal leader defects on Trudeau’s carbon tax — Toronto Sun

Ontario Liberal Leader Bonnie Crombie had an epiphany: Carbon taxes are bad and Prime Minister Justin Trudeau should scrap his. After pledging last month to remove the provincial portion of the HST from home heating and hydro bills if elected, Crombie faced further pressure from taxpayers to...apple.news

“I’m not here to tell the prime minister how to do his job,” Crombie said. “But I promise you, I will tell him when he’s wrong. Like on the carbon tax.”

Crombie’s move is big news. She was one of the last provincial Liberal leaders refusing to call on Trudeau to scrap his carbon tax.

View attachment 26135

Federal Environment Minister Steven Guilbeault said fighting climate change is “politically tough,” which is why he understands that Ontario Liberal leader Bonnie Crombie is distancing herself from the carbon levy.

View attachment 26136

Crombie criticized the federal price on carbon on Tuesday night during a party fundraising dinner. She said the federal carbon levy is “wrong.”

View attachment 26137

Guilbeault said he wasn’t surprised by Crombie’s remarks, but he stands behind the levy.

View attachment 26138

The federal carbon levy (=TAX) only applies in provinces that don’t impose their own climate change plans that meet federal standards for emissions reductions. Only British Columbia and Quebec have provincially made plans, with ALL the other provinces taking the federal program.

View attachment 26139

The Liberal plan includes a levy on gasoline and heating fuels and rises every April Fools Day. It also includes regular rebates paid to some consumers.

Trudeau's environment minister says he understands why Ontario Liberal leader is distancing herself from 'carbon tax' — Toronto Star

Bonnie Crombie criticized the federal tax on Tuesday night during a party fundraising dinner. She said the federal carbon levy is “wrong.”apple.news