Blow up the bridge between Ottawa and Hull .Could we consider some sort of wall or the like? It worked for the chinese and for hadrian, for a while at least. IF we give it a french name they might even think it was their idea - like Mur de Poutine or Les Anglais sont de la merde Barrière

April Fools!! Here's your Carbon Tax F#ckers!!!

- Thread starter Ron in Regina

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

A wall didn't work for Montcalm did it? I doubt we can wall them in can we? Its not like we need them to pick happles or haccumulate detritus in Banff or do slave labour (ecofascism) through Katimavik. We have Australians for that now.Could we consider some sort of wall or the like? It worked for the chinese and for hadrian, for a while at least. IF we give it a french name they might even think it was their idea - like Mur de Poutine or Les Anglais sont de la merde Barrière

The times they are a changin..... fucking hippies....

Sorry, I thought I had clicked on the post where wages were being discussed. Don't know what happened there!Ahhhhh - the story you tagged in your reply was the carbon tax one.Sorry for the confusion.

I do agreee that Virtually all of the studies for the 'gender wage gap' have been disproven, there's craptonnes of info on that.

He had crappy engineers.A wall didn't work for Montcalm did it?

You raise a valid point.I doubt we can wall them in can we? Its not like we need them to pick happles or haccumulate detritus in Banff or do slave labour (ecofascism) through Katimavik. We have Australians for that now.

The times they are a changin..... fucking hippies....

"i hear you traveled here from the past. Take my advice - go back. The future isn't what it used to be."

-Babylon 5

In 2023, Canadians will be paying not one, but two federally imposed carbon taxes as they struggle to cope with inflation and higher interest rates.

On April 1, Prime Minister Justin Trudeau’s national minimum carbon price will increase by 30% to $65 per tonne of greenhouse gas emissions, up from the current $50 per tonne.

Starting in 2023, the carbon price will increase by $15 per year, instead of the previous $10 per year, reaching $170 per tonne in 2030.

Even with carbon tax rebates in the four provinces that receive them — Ontario, Alberta, Saskatchewan and Manitoba — 60% of families will pay hundreds of dollars more in carbon taxes than they receive in rebates in 2023, according to the parliamentary budget officer.

Starting in 2023, for the first time, Canadians will pay a SECOND carbon tax called the clean fuel standard to lower the carbon intensity of oil and diesel fuel.

apple.news

apple.news

The government also says this will increase energy poverty and disproportionately impact low-and-middle income earners, seniors on fixed incomes, single mothers, Canadians in rural Canada and Atlantic Canada, as well as oil and gas sector workers.

The Trudeau government, which failed to meet its 2020 target for reducing emissions, says this new carbon tax is needed to help meet its 2030 target.

On April 1, Prime Minister Justin Trudeau’s national minimum carbon price will increase by 30% to $65 per tonne of greenhouse gas emissions, up from the current $50 per tonne.

Starting in 2023, the carbon price will increase by $15 per year, instead of the previous $10 per year, reaching $170 per tonne in 2030.

Even with carbon tax rebates in the four provinces that receive them — Ontario, Alberta, Saskatchewan and Manitoba — 60% of families will pay hundreds of dollars more in carbon taxes than they receive in rebates in 2023, according to the parliamentary budget officer.

Starting in 2023, for the first time, Canadians will pay a SECOND carbon tax called the clean fuel standard to lower the carbon intensity of oil and diesel fuel.

EDITORIAL: New Year brings a new carbon tax — Toronto Sun

In 2023, Canadians will be paying not one, but two federally imposed carbon taxes as they struggle to cope with inflation and higher interest rates. On April 1, Prime Minister Justin Trudeau’s national minimum carbon price will increase by 30% to $65 per tonne of greenhouse gas emissions, up...

The government also says this will increase energy poverty and disproportionately impact low-and-middle income earners, seniors on fixed incomes, single mothers, Canadians in rural Canada and Atlantic Canada, as well as oil and gas sector workers.

The Trudeau government, which failed to meet its 2020 target for reducing emissions, says this new carbon tax is needed to help meet its 2030 target.

Yup let’s bring in 500,000 more carbon emitters every year , that should help get our emissions on target .In 2023, Canadians will be paying not one, but two federally imposed carbon taxes as they struggle to cope with inflation and higher interest rates.

On April 1, Prime Minister Justin Trudeau’s national minimum carbon price will increase by 30% to $65 per tonne of greenhouse gas emissions, up from the current $50 per tonne.

Starting in 2023, the carbon price will increase by $15 per year, instead of the previous $10 per year, reaching $170 per tonne in 2030.

Even with carbon tax rebates in the four provinces that receive them — Ontario, Alberta, Saskatchewan and Manitoba — 60% of families will pay hundreds of dollars more in carbon taxes than they receive in rebates in 2023, according to the parliamentary budget officer.

Starting in 2023, for the first time, Canadians will pay a SECOND carbon tax called the clean fuel standard to lower the carbon intensity of oil and diesel fuel.

EDITORIAL: New Year brings a new carbon tax — Toronto Sun

In 2023, Canadians will be paying not one, but two federally imposed carbon taxes as they struggle to cope with inflation and higher interest rates. On April 1, Prime Minister Justin Trudeau’s national minimum carbon price will increase by 30% to $65 per tonne of greenhouse gas emissions, up...apple.news

The government also says this will increase energy poverty and disproportionately impact low-and-middle income earners, seniors on fixed incomes, single mothers, Canadians in rural Canada and Atlantic Canada, as well as oil and gas sector workers.

The Trudeau government, which failed to meet its 2020 target for reducing emissions, says this new carbon tax is needed to help meet its 2030 target.

Of course they don't. BC has had carbon taxes for well over a decade and it didn't even come close. THe best estimates suggest it may have slowed carbon emissions growth y about 5-10 percent (maybe) but it didn't cut a damn thing.I want to see the how and why and if this tax actually cuts emissions.

And there's been research on this. The original models which suggested it would be effective GROSSLY overestimated how 'elistic' energy costs were - in other words they believed people would be able to choose to spend less on energy such as fuel which would reduce carbon. But they can't - and it turns out what they do is spend less on everything else. They still have to drive to work, they still have to pick up the kids, they still need to heat their homes in the winter. There's very little they can do to save. They might buy a slightly more fuel efficient car, or get a more efficient furnace, but those changes only make a small difference and not everyone can afford a new car or to redo their home heating. (especially if you rent).

So all it does is put a drag on the economy. There is no chance it will help the environment.

But what it DOES do is create a massive tax windfall for the gov't. Remember - they still charge GST on that carbon tax! So every time the carbon tax goes up it's a gst bump! And they don't return all the money so it's a tax grab for the gov't. And over time as they did in bc the feds will just pocket more and more of that money and return less and less.

It drove many people across the border for gas .Of course they don't. BC has had carbon taxes for well over a decade and it didn't even come close. THe best estimates suggest it may have slowed carbon emissions growth y about 5-10 percent (maybe) but it didn't cut a damn thing.

And there's been research on this. The original models which suggested it would be effective GROSSLY overestimated how 'elistic' energy costs were - in other words they believed people would be able to choose to spend less on energy such as fuel which would reduce carbon. But they can't - and it turns out what they do is spend less on everything else. They still have to drive to work, they still have to pick up the kids, they still need to heat their homes in the winter. There's very little they can do to save. They might buy a slightly more fuel efficient car, or get a more efficient furnace, but those changes only make a small difference and not everyone can afford a new car or to redo their home heating. (especially if you rent).

So all it does is put a drag on the economy. There is no chance it will help the environment.

But what it DOES do is create a massive tax windfall for the gov't. Remember - they still charge GST on that carbon tax! So every time the carbon tax goes up it's a gst bump! And they don't return all the money so it's a tax grab for the gov't. And over time as they did in bc the feds will just pocket more and more of that money and return less and less.

When we get rid of the current idot, "blue hydrogen" from hydrocarbons will change everything. Oil and gas isnt going away. How we use it will change.Of course they don't. BC has had carbon taxes for well over a decade and it didn't even come close. THe best estimates suggest it may have slowed carbon emissions growth y about 5-10 percent (maybe) but it didn't cut a damn thing.

And there's been research on this. The original models which suggested it would be effective GROSSLY overestimated how 'elistic' energy costs were - in other words they believed people would be able to choose to spend less on energy such as fuel which would reduce carbon. But they can't - and it turns out what they do is spend less on everything else. They still have to drive to work, they still have to pick up the kids, they still need to heat their homes in the winter. There's very little they can do to save. They might buy a slightly more fuel efficient car, or get a more efficient furnace, but those changes only make a small difference and not everyone can afford a new car or to redo their home heating. (especially if you rent).

So all it does is put a drag on the economy. There is no chance it will help the environment.

But what it DOES do is create a massive tax windfall for the gov't. Remember - they still charge GST on that carbon tax! So every time the carbon tax goes up it's a gst bump! And they don't return all the money so it's a tax grab for the gov't. And over time as they did in bc the feds will just pocket more and more of that money and return less and less.

Yeah, those that were fortunate enough to live within driving distance. The rest of us got hosed.It drove many people across the border for gas .

The only difference between then and now, is that under the Liberals the carbon scam tax was offset by lowering of other taxes, making it revenue neutral. Some people probably even came out slightly ahead, depending on their driving habits. The NDP, never seeing a tax they didn't like simply added it into general revenue and gave us 27 new and improved taxes to make up the revenue shortfall.

The federal tax has never really been neutral. First off, the budget watchdog notes they didn't calculate it properly and the vast majority of Canadians will pay more in the tax than they save. Secondly, you pay tax on the tax. For example, if there's 10 dollars of carbon tax on your fuel when you fill up, then gst gets charged on that 10 dollars. A tax on the tax if you will.Yeah, those that were fortunate enough to live within driving distance. The rest of us got hosed.

The only difference between then and now, is that under the Liberals the carbon scam tax was offset by lowering of other taxes, making it revenue neutral. Some people probably even came out slightly ahead, depending on their driving habits. The NDP, never seeing a tax they didn't like simply added it into general revenue and gave us 27 new and improved taxes to make up the revenue shortfall.

BC's carbon tax started off 'revenue neutral' as well and pretty soon as you say it was just general revenue. The fed tax will be no different in the end.

Nope. No GST unless done by provincial design.

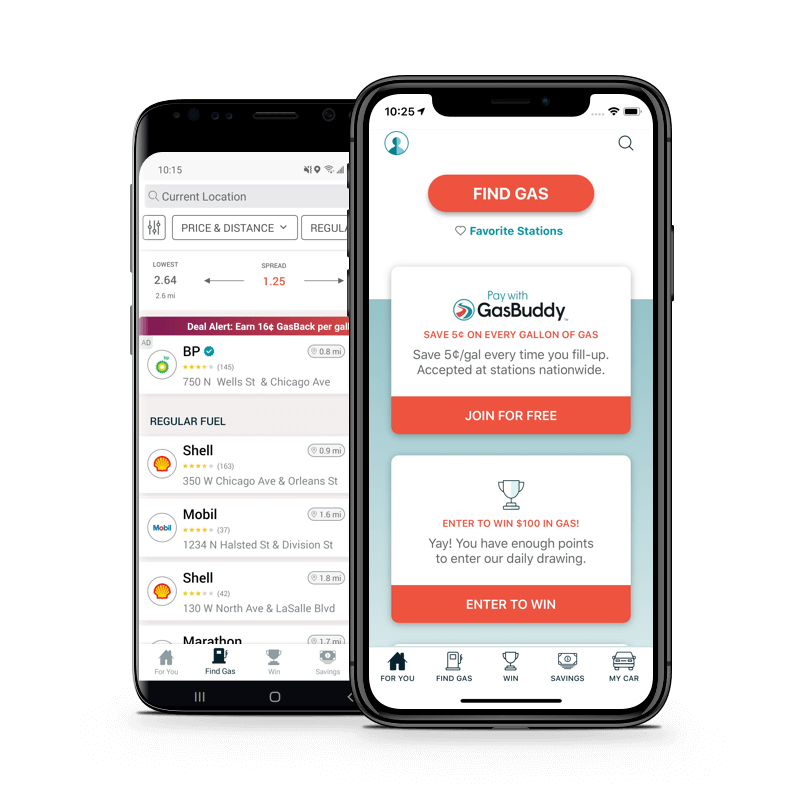

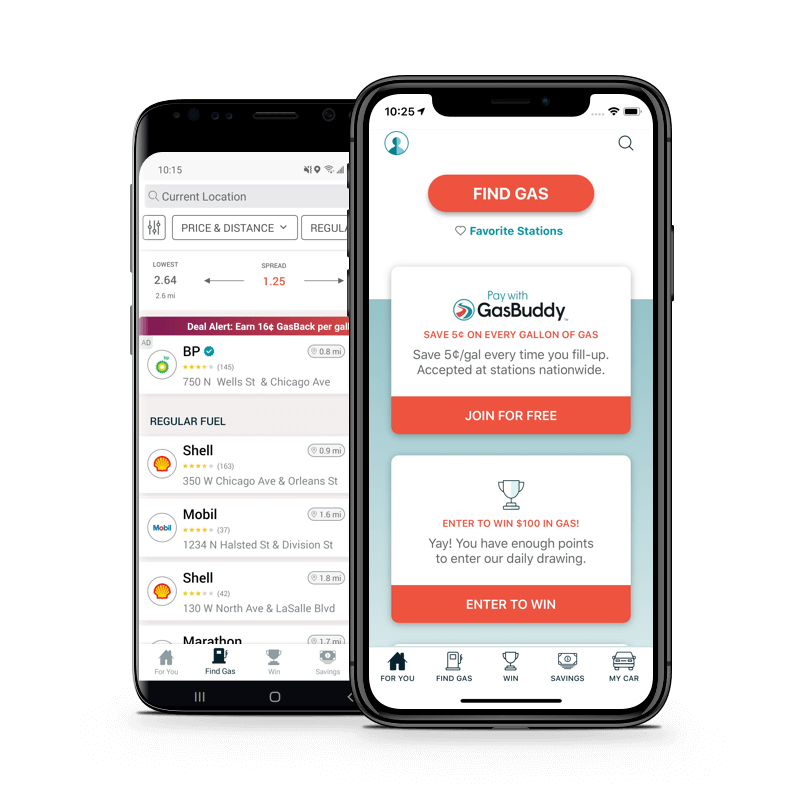

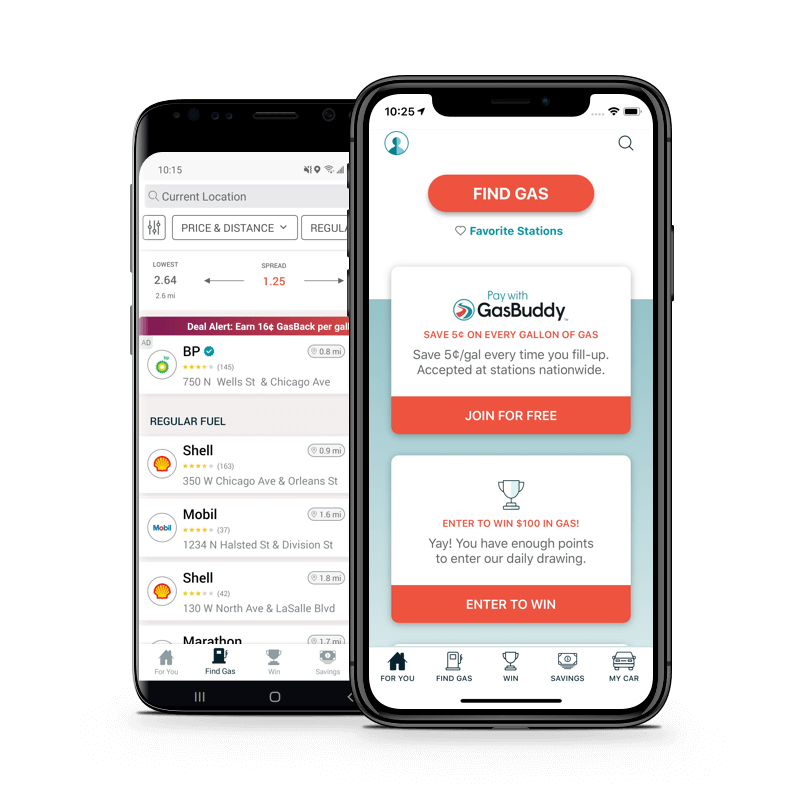

www.gasbuddy.com

www.gasbuddy.com

Canadian Fuel Tax Information

GasBuddy lets you search for Gas Prices by city, state, zip code, with listings for all cities in the USA and Canada. Updated in real-time, with national average price for gasoline, current trends, and mapping tools.

That's pretty old i think. There's no mention of federal carbon tax in there at all, or whether or not gst applies to the fed tax rate.Nope. No GST unless done by provincial design.

Canadian Fuel Tax Information

GasBuddy lets you search for Gas Prices by city, state, zip code, with listings for all cities in the USA and Canada. Updated in real-time, with national average price for gasoline, current trends, and mapping tools.www.gasbuddy.com

But GST has been charged on the fed tax since the beginning in most provinces (i have no idea what's going on in quebec). Here's an article first discussing it:

Yes there is mention of carbon taxvin there. Check the tables.That's pretty old i think. There's no mention of federal carbon tax in there at all, or whether or not gst applies to the fed tax rate.

But GST has been charged on the fed tax since the beginning in most provinces (i have no idea what's going on in quebec). Here's an article first discussing it:

Sigh. Did you read the article i posted? The feds confirmed that gst will be applied to carbon tax. And no, there's nothing in the tables that you posted about a federal carbon tax, just the handful of provincial ones that have been in place prior like bc's.Yes there is mention of carbon taxvin there. Check the tables.

So. When carbon taxes are placed on fuel currently we pay GST on that tax. Which is extra revenue for the gov't. We pay again because of course it drives inflation so other goods we buy ALSO cost more because of the tax and we pay more gst on many of those items as well.

So even if the feds gave back every penny in carbon tax - WHICH THEY DO NOT - they would still make a buttload from the extra GST.

The federal tax was never even pushed as revenue neutral. I was referring to the BC Liberals carbon scam tax, which was implemented to try and buy the green vote. And it worked. For the record, I opposed it at the party meetings.The federal tax has never really been neutral. First off, the budget watchdog notes they didn't calculate it properly and the vast majority of Canadians will pay more in the tax than they save. Secondly, you pay tax on the tax. For example, if there's 10 dollars of carbon tax on your fuel when you fill up, then gst gets charged on that 10 dollars. A tax on the tax if you will.

BC's carbon tax started off 'revenue neutral' as well and pretty soon as you say it was just general revenue. The fed tax will be no different in the end.

The poor don't pay GST either. As best I can tell some of them make money off the GST rebate.Sigh. Did you read the article i posted? The feds confirmed that gst will be applied to carbon tax. And no, there's nothing in the tables that you posted about a federal carbon tax, just the handful of provincial ones that have been in place prior like bc's.

So. When carbon taxes are placed on fuel currently we pay GST on that tax. Which is extra revenue for the gov't. We pay again because of course it drives inflation so other goods we buy ALSO cost more because of the tax and we pay more gst on many of those items as well.

So even if the feds gave back every penny in carbon tax - WHICH THEY DO NOT - they would still make a buttload from the extra GST.