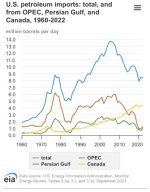

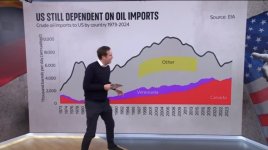

Well, they’re not seizing tankers bound for England, or America, etc…China is the biggest buyer of Venezuelan crude, which accounts for roughly 4% of its imports.

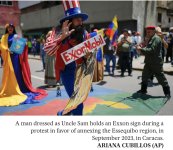

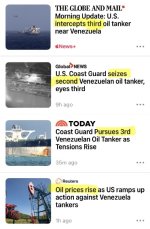

China's foreign ministry on Monday said the United States' seizure of another country's ships was a serious violation of international law, after the U.S. intercepted a China-bound oil tanker off the Venezuelan coast.

apple.news

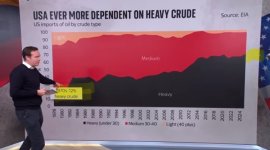

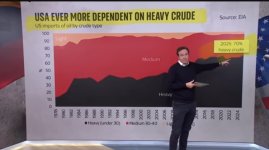

But…but maybe China is a secondary thing too (?) and the goal is to just increase the world price of oil?

View attachment 32337

View attachment 32338

Trump is reducing (from Venezuela anyway) some of the current world supply, so I wonder where he stands on a pipeline from Western Canada to the Pacific regardless of its route? I’m thinking we are gonna see huge pushback that ultimately can be tied back to the American government through NGO’s, American Billionaires, etc…

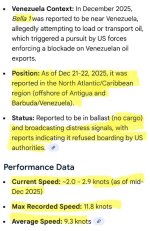

Anyway, back to the “third” empty oil tanker (Bella 1) approaching Venezuela, apparently at a maximum of about 10 kn, how long can America “pursue” this vessel without actually catching it?

View attachment 32339

View attachment 32340

Overview of Chinese Influence in Latin America

China's engagement with Latin America and the Caribbean (LAC) has expanded significantly over the past two decades, driven primarily by economic interests in resources, trade, and infrastructure. As of late 2025, China is South America's largest trading partner, with bilateral trade exceeding $500 billion annually in recent years (reaching $518 billion in 2024). This growth reflects China's demand for commodities like soybeans, copper, lithium, and oil, while providing LAC countries with investment and markets amid global uncertainties.

Economic Influence

Trade Dominance: China has surpassed the United States as the top trading partner for much of South America. Key exports from LAC to China include Brazilian soybeans (surging due to U.S.-China trade tensions), Peruvian copper, and Chilean lithium. In 2025, amid renewed U.S. tariffs under President Trump, LAC countries like Brazil and Argentina benefited from redirected Chinese demand.

Investments and Loans: Chinese state firms have invested heavily in energy, mining, infrastructure, and technology. Notable projects include the $3.5 billion Chancay megaport in Peru (operated by COSCO, inaugurated in 2024), which reduces shipping times to Asia and bypasses traditional routes. In May 2025, at the China-CELAC Forum in Beijing, President Xi Jinping announced a $9 billion credit line to boost infrastructure and promote yuan usage.

However, large-scale Belt and Road Initiative (BRI) projects have slowed, with LAC receiving only about 1% of global BRI investments in early 2025, shifting toward targeted sectors like renewables and electric vehicles.

BRI Participation: Over 20 LAC countries have joined the BRI, with Colombia signing on in 2025. This facilitates projects but has raised concerns about debt dependency.

Diplomatic and Cultural Influence

High-Level Engagement: China released its third policy paper on LAC in December 2025, emphasizing "shared future" cooperation in diplomacy, culture, security, and technology. Initiatives include scholarships, journalist exchanges, and visa-free travel for select countries (e.g., Argentina, Brazil, Peru since June 2025).

Taiwan Isolation: China has flipped several countries from recognizing Taiwan (e.g., Honduras, Nicaragua in recent years), leaving only seven LAC allies for Taipei.

Multilateral Forums: The China-CELAC mechanism has deepened ties, with the 2025-2027 Joint Action Plan focusing on solidarity, development, and people-to-people exchanges.

Military and Security Influence

China's military presence is growing but limited compared to economic ties. Activities include arms sales (e.g., to Venezuela), training programs for LAC officers (outpacing U.S. programs in some years), joint exercises (e.g., with Brazil in 2025), and humanitarian missions like hospital ship visits.

Security cooperation extends to cybersecurity, anti-corruption, and public safety equipment donations, appealing to high-crime regions.

U.S. Concerns and Counteractions

The United States views China's advances as a challenge to its traditional influence in the hemisphere. Concerns focus on:

Strategic infrastructure (e.g., Chancay port's potential dual-use for military purposes).

Debt traps and economic dependency.

Erosion of democratic norms through support for authoritarian regimes (e.g., Venezuela). In 2025, the Trump administration has pushed back aggressively: pressuring Panama on canal-related Chinese influence, warning allies against Huawei, and prioritizing regional security ties. Some sources argue this has reversed gains in countries like Argentina (canceling Chinese military deals) and strengthened U.S. alliances, while others note China's entrenched economic foothold makes full decoupling unlikely.

Overall, China's influence offers LAC economic opportunities but risks over-reliance and geopolitical tensions. Many countries hedge between Beijing and Washington, benefiting from competition while navigating U.S. pressures and China's "no-strings" approach. As of December 2025, ties remain robust, with China positioning itself as a reliable Global South partner amid shifting U.S. policies.

apple.news

Since the first seizure, Venezuelan crude exports have fallen sharply for some reason…except for the exports that haven’t stopped, but that’s something something, etc…

apple.news

Since the first seizure, Venezuelan crude exports have fallen sharply for some reason…except for the exports that haven’t stopped, but that’s something something, etc…