check that....You know, Tee, I only live for your approval. lol

right

I'll be paying extra attention to your spelling and syntax henceforth.

;?)

damn voice-to-text!

I live for your reproval. heh heh

take that!

:?P

check that....You know, Tee, I only live for your approval. lol

right

I'll be paying extra attention to your spelling and syntax henceforth.

;?)

In your experience do local carriers pass on the tax ?Well, we have to remain competitive in our pricing with American Haulers. 90% of the population of Canada lives within 100 miles of the US border. Remember, you asked…

We are an international carrier, competing with other international carriers from America. Passing on the April Fools Carbon Tax to our customers is not a luxury we can partake in, so that means it just comes out of our very narrow bottom line directly. If you can’t deliver your load on the US Fuel in your tanks and then get back to the US to refill, you eat the loss that the Carbon Tax is.

Our only defence against the carbon tax is that we try to buy as little fuel as possible in Canada, though with IFTA (International Fuel Tax Agreement) we will still pay the road tax for every kilometre driven in Canada to each jurisdiction….Currently it doesn’t force international carriers to pay the carbon tax on fuel, brought into the country in OEM fuel cells or the first 200L in an aftermarket not OEM Slip Tanks.

International Fuel Tax Agreement - Wikipedia

en.wikipedia.org

So, unless you live within a return trip of a single tank of fuel, carried by a vehicle, bringing whatever it is you’re purchasing, that’s coming from another country, you’re paying the Carbon Tax on pretty much everything you purchase!!! Everything. You. Purchase. So…. The further away from the American border, the smaller the profit margin becomes.

How else can a Canadian International Carrier compete with American International Carriers when American doesn’t have this April Fools Tax? It is what it is. Play the system within the boundaries of the law.

They’d have to. Nobody can afford to just eat it or they’d just go broke & be defunct. Once the loophole of non-Carbon Taxed fuel gets closed, it’ll be beyond bad for all of us.In your experience do local carriers pass on the tax ?

www.cjme.com

www.cjme.com

It seems costs for all carriers are rising big time out here .They’d have to. Nobody can afford to just eat it or they’d just go broke & be defunct. Once the loophole of non-Carbon Taxed fuel gets closed, it’ll be beyond bad for all of us.

Everywhere!! Even the girl guides are jumping the cost of cookies by 20% due to inflation.It seems costs for all carriers are rising big time out here .

For crop producers the carbon tax gets passed on to buyers like India and vegan types the world over. Can Bangladesh, Myanmar, Sri Lanka etc afford the carbon tax on Canadian peas, lentils, soy and durum wheat like India?Everywhere!! Even the girl guides are jumping the cost of cookies by 20% due to inflation.

The hourly labour rate in a heavy duty, mechanical shop now averages about $185/hour plus the Vig of 8% to 10% of labor, charged as shop supplies, even though separately, your charge for every nut, bolt, and zip tie. One of the big players (Peterbilt) even charge us a 2% carbon tax fee on top of the total bill before tax.

It would be less painful initially, and accumulatively.They should probably eliminate the carbon tax and institute thumb tax.

Its 6 months until theyll get it. They wont get for July either.Call it another example of government know-how. Or more accurately, know-not.

That’s because if you live in Ontario, Alberta, Manitoba or Saskatchewan and your 2022 income tax return wasn’t filed and assessed by the Canada Revenue Agency by March 24, you will not receive your quarterly climate action incentive payment this month, under Prime Minister Justin Trudeau’s carbon tax system.

Canadians paying the carbon tax don’t have to apply for the tax-free rebates intended to defray the higher cost of living imposed by the carbon tax, but they must file an annual income tax return to receive the benefit.

Except this year, anyone who didn’t file their income taxes prior to March 24 — as opposed to the CRA deadline of May 1 —didn’t receive the rebate sent out on April 14 by direct deposit or cheque to those aware of the little-publicized early deadline, etc….

GOLDSTEIN: Carbon tax rebates delayed for all but early tax filers — Toronto Sun

Call it another example of government know-how. Or more accurately, know-not. That’s because if you live in Ontario, Alberta, Manitoba or Saskatchewan and your 2022 income tax return wasn’t filed and assessed by the Canada Revenue Agency by March 24, you will not receive your quarterly climate...apple.news

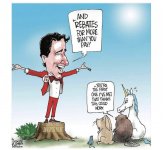

Prime Minister Justin Trudeau, promoting the rebates in a tweet April 14, didn’t mention anyone who hadn’t filed their taxes well before March 24 wouldn’t be getting it now.

“With the Climate Action Incentive rebate, which goes out today, we’re putting more money in the pockets of millions of Canadians – and fighting climate change,” Trudeau tweeted, etc…

In an accompanying video he said:

“If you live in Ontario, Manitoba, Saskatchewan or Alberta, you probably noticed a deposit in your bank account today. It’s called the climate action incentive. It’s how we make sure that we put money in your pockets while we put a price on pollution. It actually puts more money back in the pockets of millions of Canadians and it’s a small part of our big plan to fight climate change, keep our air clean, make life more affordable and grow the economy for everyone.” Etc…

View attachment 17937

Of course, many people didn’t notice the deposit because it wasn’t there because they didn’t know they had to file their tax return very early to get the rebate on April 14.

Indeed, the Trudeau government doesn’t appear to have gone out of its way to inform people that to get the April 14 climate action incentive payment, they had to have their income tax return filed early enough so that the CRA (whose workers are now on strike) could process it on or before March 24, as opposed to the tax filing deadline of May 1.

The rest of this at the above link.

Had they said they were going to raise the GST to 15% incrementally Ottawa would have been in ashes 8 years ago but if they blame the eco-boogeyman people will fight for it instead of against it.If the carbon scam tax is refunded to some people, without proof they paid that much in carbon scam tax, then the carbon scam tax is not a tax on carbon, but an income tax disguised as a user tax.

Politicians should only be allowed to speak in the house under oath. turdOWE and Feedland would effectively be muzzled.

All they’d be able to do is plead the Fifth, which isn’t even a Canadian thing, but American Bogiemen get pointed out when it’s convenient, so why not?Politicians should only be allowed to speak in the house under oath. turdOWE and Feedland would effectively be muzzled.

Politics would be much more civil if they did . Nobody seems to want that though .They could try the rather novel approach of telling the truth.