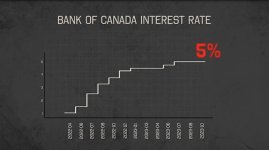

Taxpayers should brace for impact based on the finance minister’s latest projections.

Interest charges on the federal debt will go from $47 billion this year to $61 billion in 2028-29, according to the budget update.

But what does $61 billion mean to you?

Sixty-one billion is the same amount the government plans to collect with the GST in 2028-29.

So, in a few short years, when you pay the GST on a hockey stick, a tank of gas or a bar of soap, every penny will go to interest charges on the federal debt.

In fact, interest charges will surpass federal health-care transfers next year.

Let the shock sink in just a little deeper. What could we do if it weren’t for the federal debt?

We could virtually double federal health spending.

Or we could completely eliminate the GST in a couple of years.

Somehow the government is communicating these perplexing projections with considerable calmness.

Finance Minister Chrystia Freeland claims “the foundation of our Fall Economic Statement is our responsible fiscal plan.”

But last year the government spent $474 billion. And this year the feds plan on spending $489 billion. By 2029, the government will be spending $595 billion a year.

Pro-tip for Freeland: when you spend billions of dollars more every year, you’re saving money wrong.

Taxpayers should brace for impact based on the finance minister’s latest projections. Interest charges on the federal debt will go from $47 billion this year to $61 billion in 2028-29, according to the budget update. But what does $61 billion mean to you? Sixty-one billion is the same amount the...

apple.news