So you are a racist or a science denier , which is worse ?That would be racist.

April Fools!! Here's your Carbon Tax F#ckers!!!

- Thread starter Ron in Regina

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

NP View: Danielle Smith's warning signal to Trudeau a welcome act of leadership — National Post

In the face of expensive new federal energy regulations creeping over the horizon compounded with an ever-rising cost of living, Alberta has confirmed its choice for a defender: Danielle Smith. Smith has already drawn her lines in the sand and put the Trudeau Liberals on notice. Her warning...

Smith has already drawn her lines in the sand and put the Trudeau Liberals on notice. Her warning: Don’t make life more expensive for us, or we’ll fight. Because she’s early into her mandate, the move might appear brash (a “declaration of war”) for some — but it’s merely an act of defence.

Accordingly, Smith vowed in her election night victory speech to push back against anticipated new regulations on restricting electricity generation through natural gas, which would “not only massively increase your power bills, but will also endanger the integrity and reliability of our power grid.”

She went on: “I cannot under any circumstances allow these contemplated federal policies to be inflicted upon Albertans. I simply can’t, and I won’t.” Sounds familiar somehow. Meanwhile, Canada’s emissions only amount to 1.5 per cent of what is produced globally — a rounding error. Penalties to energy production are a form of unfair, collective punishment for Albertans (as well as those in Saskatchewan and Newfoundland and Labrador).

Already in place is the federal carbon price, which currently sits at $65 per tonne and will more than double to $170 by 2030. The rest at the above link.

Conservatives of course . Those Luddite’s.Well, liberals are both, so I guess it depends on which is scarier at the moment.

There’s a “Dropping Disney+” comment that fits with this…

apple.news

apple.news

Canada's national food policy is at risk of enshrining a two-tiered food system — The Conversation Canada

Canada’s National Food Policy is slated for renewal later this year. Employment and Social Development Canada must be involved to develop income supports that reduce food insecurity.

Over the last few months, Moe has put a focus on the province’s future in energy, deciding to go against the federal mandate of net-zero emissions by 2035.

“We will not sacrifice the reliability and affordability of Saskatchewan’s power grid to meet some notional target that isn’t achievable,” Moe said in a recent interview, where he outlined the future of Saskatchewan energy sector.

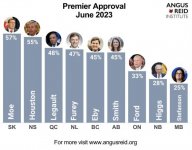

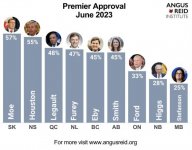

And while Moe’s premier approval remains at the top nationwide, the ratings fall well short of his highest approval rates which came in 2019 and 2020 when it was 65 per cent.

apple.news

apple.news

“We will not sacrifice the reliability and affordability of Saskatchewan’s power grid to meet some notional target that isn’t achievable,” Moe said in a recent interview, where he outlined the future of Saskatchewan energy sector.

And while Moe’s premier approval remains at the top nationwide, the ratings fall well short of his highest approval rates which came in 2019 and 2020 when it was 65 per cent.

Scott Moe ranks at the top of premier approval rates across Canada: Angus Reid poll — Global News

Approximately three in five people in Saskatchewan have a positive view of Moe’s performance, giving him a 57 per cent approval rate.

Canadian Taxpayers Federation

A citizens advocacy group dedicated to lower taxes, less waste and accountable government.

Jack Mintz: Stacked carbon taxes are unfair and inefficient. It's time for an overhaul — Financial Post

Counting carbon, excise and sales taxes, as well as new fuel standards, we have at least six taxes on gasoline

Prime Minister Justin Trudeau has a summer special for taxpayers: A second carbon tax.

On July 1, the Trudeau government’s second carbon tax will take effect. Trudeau buried the tax in fuel regulations that require producers to reduce the carbon content of their fuels. If companies can’t meet the requirements, they’ll be forced to buy credits. Those costs will be passed on to consumers through higher pump prices.

The Parliamentary Budget Officer, the government’s independent budget watchdog, recently released analysis of Trudeau’s second carbon tax. In 2030, when the regulations are fully implemented, it will cost the average family up to $1,157 and will increase the price of gas by up to 17 cents per litre.

The government’s own analysis shows the second carbon tax will “disproportionately impact lower- and middle-income households, as well as households currently experiencing energy poverty.” That will especially harm “single mothers” and “seniors living on fixed incomes.”

The second carbon tax will also lead to 24,000 fewer jobs in 2030, according to a report commissioned by Canadians for Affordable Energy.

Taxpayers will need to pay an extra $85 million to fuel the bureaucracy administering this regulatory quagmire, according to the government. Canadians will have the pleasure of paying higher taxes so more federal paper-pushers can increase our fuel prices and force our neighbours out of a job.

To make matters worse, there are no rebates with the second carbon tax, and it’s being layered on top of Trudeau’s current tax.

Trudeau’s current carbon tax is already costing the average family up to $710 more per year than they get back in rebates, according to the PBO.

Higher fuel prices also mean higher sales taxes, which the federal government applies on top of gas taxes. Canadians will pay $429 million more this year in GST because of this tax-on-tax.

Trudeau is cranking up his current carbon tax until it reaches more than 37 cents per litre of gas by 2030. By the end of the decade, Trudeau’s two carbon taxes will increase the price of gas by about 55 cents per litre and cost the average family more than $2,000 annually.

All this pain is for nothing.

Making it more expensive for Canadians to gas up their car or keep the natural gas running during winter will have a negligible impact on the environment.

apple.news

apple.news

With Canada making up just 1.5% of global emissions, the PBO notes that “Canada’s own emissions are not large enough to materially impact climate change.” In 2018, Trudeau himself acknowledged that “even if Canada stopped everything tomorrow, and the other countries didn’t have any solutions, it wouldn’t make a big difference.”

Trudeau’s tax is especially self-defeating when more than three-quarters of countries don’t have a national carbon tax, as highlighted by the World Bank. Meanwhile, Canada will soon have two.

Ottawa increased gas taxes while other countries cut them. Australia cut its gas tax in half. South Korea reduced gas taxes by 30%. The United Kingdom provided billions of dollars in gas tax relief. New Zealand, the Netherlands, Germany, Italy, Israel and Portugal also cut fuel taxes, along with provinces like Alberta, Ontario and Newfoundland and Labrador.

Canadians need another carbon tax like we need a kick in the head. A government that was even remotely serious about making life more affordable would immediately back away from carbon taxes.

On July 1, the Trudeau government’s second carbon tax will take effect. Trudeau buried the tax in fuel regulations that require producers to reduce the carbon content of their fuels. If companies can’t meet the requirements, they’ll be forced to buy credits. Those costs will be passed on to consumers through higher pump prices.

The Parliamentary Budget Officer, the government’s independent budget watchdog, recently released analysis of Trudeau’s second carbon tax. In 2030, when the regulations are fully implemented, it will cost the average family up to $1,157 and will increase the price of gas by up to 17 cents per litre.

The government’s own analysis shows the second carbon tax will “disproportionately impact lower- and middle-income households, as well as households currently experiencing energy poverty.” That will especially harm “single mothers” and “seniors living on fixed incomes.”

The second carbon tax will also lead to 24,000 fewer jobs in 2030, according to a report commissioned by Canadians for Affordable Energy.

Taxpayers will need to pay an extra $85 million to fuel the bureaucracy administering this regulatory quagmire, according to the government. Canadians will have the pleasure of paying higher taxes so more federal paper-pushers can increase our fuel prices and force our neighbours out of a job.

To make matters worse, there are no rebates with the second carbon tax, and it’s being layered on top of Trudeau’s current tax.

Trudeau’s current carbon tax is already costing the average family up to $710 more per year than they get back in rebates, according to the PBO.

Higher fuel prices also mean higher sales taxes, which the federal government applies on top of gas taxes. Canadians will pay $429 million more this year in GST because of this tax-on-tax.

Trudeau is cranking up his current carbon tax until it reaches more than 37 cents per litre of gas by 2030. By the end of the decade, Trudeau’s two carbon taxes will increase the price of gas by about 55 cents per litre and cost the average family more than $2,000 annually.

All this pain is for nothing.

Making it more expensive for Canadians to gas up their car or keep the natural gas running during winter will have a negligible impact on the environment.

TERRAZZANO: Taxpayers better brace for Trudeau’s two carbon taxes — Toronto Sun

Making it more expensive for Canadians will have a negligible impact on the environment

With Canada making up just 1.5% of global emissions, the PBO notes that “Canada’s own emissions are not large enough to materially impact climate change.” In 2018, Trudeau himself acknowledged that “even if Canada stopped everything tomorrow, and the other countries didn’t have any solutions, it wouldn’t make a big difference.”

Trudeau’s tax is especially self-defeating when more than three-quarters of countries don’t have a national carbon tax, as highlighted by the World Bank. Meanwhile, Canada will soon have two.

Ottawa increased gas taxes while other countries cut them. Australia cut its gas tax in half. South Korea reduced gas taxes by 30%. The United Kingdom provided billions of dollars in gas tax relief. New Zealand, the Netherlands, Germany, Italy, Israel and Portugal also cut fuel taxes, along with provinces like Alberta, Ontario and Newfoundland and Labrador.

Canadians need another carbon tax like we need a kick in the head. A government that was even remotely serious about making life more affordable would immediately back away from carbon taxes.

The answers are disingenuous at best. Apparently, he is claiming that the clean fuel B.S. isn't a tax. What a bloody fool!

Trudeau is an idiot!

The Trudeau government will mark Canada Day on Saturday by imposing what amounts to a second carbon tax on Canadians called the Clean Fuel Regulations.

By 2030, Prime Minister Justin Trudeau’s carbon tax plus the CFR will increase the cost of a litre of gasoline by up to 54.57¢, according to Parliamentary Budget Officer Yves Giroux.

That’s 37.57¢ more per litre due to the carbon tax and an additional maximum increase of 17¢ per litre because of the CFR, which is intended to reduce the carbon content of liquid fossil fuels. I feel greener (around the gills) already!!!

(The federal government says the CFR will raise the cost of gasoline by a maximum of 13¢ per litre.)

When the cost of gasoline rises, the cost of almost everything rises because of the need to transport most goods and services.

Unlike the carbon tax, the CFR has no rebate system to help families defray costs. Good times.

On that issue, Giroux and the federal government agree the CFR will hit lower-income Canadians hardest, as the PBO reported in May.

The rest of this at the below link:

apple.news

apple.news

By 2030, Prime Minister Justin Trudeau’s carbon tax plus the CFR will increase the cost of a litre of gasoline by up to 54.57¢, according to Parliamentary Budget Officer Yves Giroux.

That’s 37.57¢ more per litre due to the carbon tax and an additional maximum increase of 17¢ per litre because of the CFR, which is intended to reduce the carbon content of liquid fossil fuels. I feel greener (around the gills) already!!!

(The federal government says the CFR will raise the cost of gasoline by a maximum of 13¢ per litre.)

When the cost of gasoline rises, the cost of almost everything rises because of the need to transport most goods and services.

Unlike the carbon tax, the CFR has no rebate system to help families defray costs. Good times.

On that issue, Giroux and the federal government agree the CFR will hit lower-income Canadians hardest, as the PBO reported in May.

The rest of this at the below link:

EDITORIAL: Second carbon fee arrives on July 1 — Toronto Sun

The Trudeau government will mark Canada Day on Saturday by imposing what amounts to a second carbon tax on Canadians called the Clean Fuel Regulations. By 2030, Prime Minister Justin Trudeau’s carbon tax plus the CFR will increase the cost of a litre of gasoline by up to 54.57¢, according to...

Following on the heels of the latest carbon tax (the other other carbon tax) from two days ago on July 1st, 2023:

apple.news

In a bid to reduce food waste, a parliamentary committee is recommending the federal government look into the impacts of eliminating “best-before” dates on groceries.

apple.news

In a bid to reduce food waste, a parliamentary committee is recommending the federal government look into the impacts of eliminating “best-before” dates on groceries.

The House of Commons agriculture committee — which undertook a four-month look at rising food prices in Canada and how to address the issue — is recommending the government work with the provinces and territories to investigate the impacts of scrapping best-before dates.

The suggestion is one of 13 recommendations in a new non-binding report by the committee, which comes amid heightened political attention on the rising cost of groceries. Food prices have been increasing at their fastest rate in more than 40 years.

Could scrapping best-before dates reduce food waste? Committee says government should look at impacts — CTV News

In a bid to reduce food waste, a parliamentary committee is recommending the federal government look into the impacts of eliminating 'best-before' dates on groceries.

The House of Commons agriculture committee — which undertook a four-month look at rising food prices in Canada and how to address the issue — is recommending the government work with the provinces and territories to investigate the impacts of scrapping best-before dates.

The suggestion is one of 13 recommendations in a new non-binding report by the committee, which comes amid heightened political attention on the rising cost of groceries. Food prices have been increasing at their fastest rate in more than 40 years.

Depends on who is paying for the science.So you are a racist or a science denier , which is worse ?

Anyways, I can't be a racist because I hate everyone equally.Depends on who is paying for the science.

I don't get the rebate thingy. Why charge it in the first place, when all it does is pay a bunch of bureaucraps to administer the money theft, and then administering rebates to people that may not even own a vehicle, as long as they have a low enough income.The Trudeau government will mark Canada Day on Saturday by imposing what amounts to a second carbon tax on Canadians called the Clean Fuel Regulations.

By 2030, Prime Minister Justin Trudeau’s carbon tax plus the CFR will increase the cost of a litre of gasoline by up to 54.57¢, according to Parliamentary Budget Officer Yves Giroux.

That’s 37.57¢ more per litre due to the carbon tax and an additional maximum increase of 17¢ per litre because of the CFR, which is intended to reduce the carbon content of liquid fossil fuels. I feel greener (around the gills) already!!!

(The federal government says the CFR will raise the cost of gasoline by a maximum of 13¢ per litre.)

When the cost of gasoline rises, the cost of almost everything rises because of the need to transport most goods and services.

Unlike the carbon tax, the CFR has no rebate system to help families defray costs. Good times.

On that issue, Giroux and the federal government agree the CFR will hit lower-income Canadians hardest, as the PBO reported in May.

The rest of this at the below link:

EDITORIAL: Second carbon fee arrives on July 1 — Toronto Sun

The Trudeau government will mark Canada Day on Saturday by imposing what amounts to a second carbon tax on Canadians called the Clean Fuel Regulations. By 2030, Prime Minister Justin Trudeau’s carbon tax plus the CFR will increase the cost of a litre of gasoline by up to 54.57¢, according to...apple.news