Relations between the Prime Minister’s Office and Finance Minister Chrystia Freeland have chilled as tensions grow over the push for politically strategic spending measures such as the GST holiday, multiple sources say, risking the minister missing her pledge to keep the deficit at or below $40.1-billion???

View attachment 26111

Damn, I thought that $40,100,000,000.00 deficit pledge wasn’t even a spec in the rearview mirror anymore….

View attachment 26112

The sources say the idea for a sales-tax break on items such as toys, video games, Christmas trees and alcohol was driven by the Prime Minister’s Office (PMO), as was the pledge to send $250 benefit cheques to working Canadians who earned an income of up to $150,000 last year.

View attachment 26110

Opposition MPs seized on a Globe report about tensions between the Prime Minister’s Office and Chrystia Freeland, the same day Ms. Freeland indicated the Liberals will not meet their deficit target

apple.news

The Finance Department viewed the $6.28-billion plan as fiscally unwise, with one source saying Finance officials described the GST holiday as making little economic sense. The sales-tax break has passed in the House of Commons, but the future of the $250 rebate remains unclear, with opposition parties making support for it contingent on it going to more people.

The Globe and Mail spoke to 10 government insiders, high-ranking Liberals and former senior Finance Department officials. The Globe is not identifying the sources who were not authorized to speak publicly about the tensions between Prime Minister Justin Trudeau’s office and Ms. Freeland and her department.

Worse is the impact another broken deficit promise will have on Canada’s fiscal reputation

apple.news

Finance officials see GST break, $250 cheque pledge as fiscally unwise, sources say, with minister at risk of missing goal to keep the deficit at or below $40.1-billion

apple.news

Deputy Prime Minister and Finance Minister Chrystia Freeland will release the Liberal government’s fall fiscal update next Monday. Many financial observers are hopeful Freeland will (finally) come clean on the size of last year’s federal deficit.

Government to issue fall economic statement on Monday, less than week before official arrival of winter

apple.news

Not this year’s deficit, last year’s. (This year’s deficit is going to be even larger, but we’ll be lucky to see it before next fall’s federal election.)

The problem with the Trudeau government when it comes to the nation’s finances is that you can’t rely on anything it says. The reason is that it keeps moving the goalposts — goalposts that it itself set — to the point where taking this government at its word is a bad idea. In her April 2024...

apple.news

The 2023-24 deficit figure is already several months late. Not that that’s unusual for the Liberals. The Trudeau government once went two years and one month between federal budgets, the longest gap in Canada’s history.

They’re just not serious fiscal managers.

Revived talk of tensions between Prime Minister Justin Trudeau and Deputy Prime Minister and Finance Minister Chrystia Freeland prompted new questions Tuesday, about how big the federal deficit will be in next week's economic update.

apple.news

It’s clear Freeland is sitting on bad news, which explains her reluctance to give up the figures.

In her 2023 budget, Freeland promised last year’s deficit would be no bigger than $40.1 billion, which is staggering enough. Back in October, though, parliamentary budget officer (PBO) Yves Giroux put the 2023-24 deficit at $46.4 billion – 16% higher than Freeland’s pledge.

The bigger point is: This government quite simply cannot control spending. It piles billions in expenditures on top of billions more, then sheepishly tries to avoid admitting it hasn’t a clue how much of your money it’s thrown away.

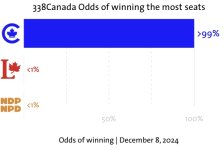

View attachment 26115

And 2024-25 (the fiscal year that will end next March) is going to be much worse.

Deputy Prime Minister and Finance Minister Chrystia Freeland will release the Liberal government’s fall fiscal update next Monday. Many financial observers are hopeful Freeland will (finally) come clean on the size of last year’s federal deficit. Not this year’s deficit, last year’s. (This...

apple.news

The PBO believes the Liberals have spent more money than they had at this time last year. Freeland pledged the 2024-25 deficit would be “only” $39.8 billion, but already several leading Canadian banks are projecting closer to $50 billion.

The National Bank of Canada said in a newsletter in late November, “Barring any yet-to-be announced revenue measures … the current year’s deficit could exceed $50 billion,” particularly if the Liberals send out all those $250 bribes … uh, er … “affordability cheques” to working Canadians before the end of the fiscal year next March 31.

The Liberals have even botched the calculations of the cost of their GST holiday, which is further proof of how incompetent they are.

All along they have claimed the amount of lost revenue from their two-month GST holiday would be $1.6 billion. However, the federal Finance department genuinely seems to have forgotten that Ottawa has harmonized sales tax (HST) agreements with five provinces (Ontario and the four Atlantic provinces). If Ottawa makes changes to the GST that reduce the provincial portion of HST, then the feds are required to make up the difference.

The GST holiday will likely end up costing the Trudeau government $2.9 billion instead of $1.6 billion because no one in the federal government thought to consult any of the provinces before announcing the holiday.

And while the $250 cheques are slated to cost a further $5 billion, that sum could go much higher if the NDP succeeds in pressuring the Liberals to send the payments to an even broader range of Canadians.

It is not unrealistic to think the 2024-25 deficit could come in closer to $60 billion, simply because the Trudeau government can’t stop spending.

Unbelievably, Freeland said Monday at the Commons industry committee that it was very important for opposition MPs to stop questioning cabinet’s ability to manage government debt and deficits???!!

Apparently, she believes their critiques are harming Canada’s reputation in international markets. Really?