April Fools!! Here's your Carbon Tax F#ckers!!!

- Thread starter Ron in Regina

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Yeah. Two years after you pay the tax. Last 2021 payment was January.Does that mean the rebate cheques will get bigger Lol

2022 rebates come out April 5th

The federal carbon tax jumps by 23% to $80 per tonne on April 1.

“The giant hike in carbon taxes further highlights how unfair this tax is for small businesses,” CFIB president Dan Kelly said in a statement.

He is calling on the federal government to freeze the upcoming hike.

“The whole carbon tax system has become a shell game, and sadly, small firms are unfairly punished by it,” he said.

According to the Canadian Federation of Independent Business, 56% of small businesses will be forced to raise prices to accommodate the increase while 45% report they will need to freeze or reduce wages. One third say it will reduce their ability to invest in environmental initiatives.

Kelly said the Liberal government has not kept its promise to return some revenues from the carbon tax to small businesses.

“Ottawa is sitting on $2.5 billion in carbon tax rebates intended for small firms, calling into question the government’s claim that the tax is revenue neutral,” Kelly said.

apple.news

According to CFIB estimates, businesses in Ontario, Manitoba, Saskatchewan and Alberta — provinces under the federal carbon tax system — that qualify for a rebate could receive a one-time payment between $2,600 and nearly $7,000.

apple.news

According to CFIB estimates, businesses in Ontario, Manitoba, Saskatchewan and Alberta — provinces under the federal carbon tax system — that qualify for a rebate could receive a one-time payment between $2,600 and nearly $7,000.

I don’t live in a 6000 square-foot home, & I don’t have a hummer in my driveway, and I don’t have a boat in my backyard, & I am not further ahead with the carbon tax rebates that I don’t receive… but I should be according to the liberal government and the CBC?

When you factor in its negative impact on the economy, Giroux (independent, non-partisan Parliamentary Budget Officer Yves Giroux) estimated 60% of households paying the federal carbon tax are already worse off today, rising to 80% in Nova Scotia in 2025, in Ontario in 2026, in Manitoba in 2029 and in Alberta and P.E.I. in 2030.

Giroux reported that the carbon tax would lower Canada’s GDP and reduce business investment and labour income for skilled and unskilled workers. He also noted the government doesn’t remit the GST paid on top of the carbon tax back to those paying it.

apple.news

A reduction of possibly 8-9% on 1.5% of global emissions that Canada is supposedly responsible for not factoring in the forests in Canada sequestering several times more annually than our total output? Seriously, what’s the point?

apple.news

A reduction of possibly 8-9% on 1.5% of global emissions that Canada is supposedly responsible for not factoring in the forests in Canada sequestering several times more annually than our total output? Seriously, what’s the point?

“The giant hike in carbon taxes further highlights how unfair this tax is for small businesses,” CFIB president Dan Kelly said in a statement.

“The whole carbon tax system has become a shell game, and sadly, small firms are unfairly punished by it,” he said.

Kelly said the Liberal government has not kept its promise to return some revenues from the carbon tax to small businesses.

“Ottawa is sitting on $2.5 billion in carbon tax rebates intended for small firms, calling into question the government’s claim that the tax is revenue neutral,” Kelly said.

Small businesses 'unfairly punished' by upcoming carbon tax hike: CFIB — Toronto Sun

Many small business owners are not looking forward to the upcoming carbon tax hike next week. According to the Canadian Federation of Independent Business, 56% of small businesses will be forced to raise prices to accommodate the increase while 45% report they will need to freeze or reduce...

Giroux reported that the carbon tax would lower Canada’s GDP and reduce business investment and labour income for skilled and unskilled workers. He also noted the government doesn’t remit the GST paid on top of the carbon tax back to those paying it.

GOLDSTEIN: How the Liberals blew their credibility on the carbon tax — Toronto Sun

Once a government loses its credibility on an issue, it’s hard to recover it. That’s what has happened to the Trudeau Liberals on their carbon tax. Their loss of credibility began when they claimed they had come up with a tax that, because of rebates, would leave 80% of Canadian households...

It's time for Justin and Steve to come out of the carbon closet to face their peers.The federal carbon tax jumps by 23% to $80 per tonne on April 1.

“The giant hike in carbon taxes further highlights how unfair this tax is for small businesses,” CFIB president Dan Kelly said in a statement.

He is calling on the federal government to freeze the upcoming hike.

“The whole carbon tax system has become a shell game, and sadly, small firms are unfairly punished by it,” he said.

According to the Canadian Federation of Independent Business, 56% of small businesses will be forced to raise prices to accommodate the increase while 45% report they will need to freeze or reduce wages. One third say it will reduce their ability to invest in environmental initiatives.

View attachment 21586

Kelly said the Liberal government has not kept its promise to return some revenues from the carbon tax to small businesses.

“Ottawa is sitting on $2.5 billion in carbon tax rebates intended for small firms, calling into question the government’s claim that the tax is revenue neutral,” Kelly said.

According to CFIB estimates, businesses in Ontario, Manitoba, Saskatchewan and Alberta — provinces under the federal carbon tax system — that qualify for a rebate could receive a one-time payment between $2,600 and nearly $7,000.

Small businesses 'unfairly punished' by upcoming carbon tax hike: CFIB — Toronto Sun

Many small business owners are not looking forward to the upcoming carbon tax hike next week. According to the Canadian Federation of Independent Business, 56% of small businesses will be forced to raise prices to accommodate the increase while 45% report they will need to freeze or reduce...apple.news

I don’t live in a 6000 square-foot home, & I don’t have a hummer in my driveway, and I don’t have a boat in my backyard, & I am not further ahead with the carbon tax rebates that I don’t receive… but I should be according to the liberal government and the CBC?

When you factor in its negative impact on the economy, Giroux (independent, non-partisan Parliamentary Budget Officer Yves Giroux) estimated 60% of households paying the federal carbon tax are already worse off today, rising to 80% in Nova Scotia in 2025, in Ontario in 2026, in Manitoba in 2029 and in Alberta and P.E.I. in 2030.

Giroux reported that the carbon tax would lower Canada’s GDP and reduce business investment and labour income for skilled and unskilled workers. He also noted the government doesn’t remit the GST paid on top of the carbon tax back to those paying it.

GOLDSTEIN: How the Liberals blew their credibility on the carbon tax — Toronto Sun

Once a government loses its credibility on an issue, it’s hard to recover it. That’s what has happened to the Trudeau Liberals on their carbon tax. Their loss of credibility began when they claimed they had come up with a tax that, because of rebates, would leave 80% of Canadian households...apple.news

A reduction of possibly 8-9% on 1.5% of global emissions that Canada is supposedly responsible for not factoring in the forests in Canada sequestering several times more annually than our total output? Seriously, what’s the point?

View attachment 21587

Small businesses 'unfairly punished' by upcoming carbon tax hike: CFIB

Author of the article ostmedia News

ostmedia News

Published Mar 28, 2024 • Last updated 1 day ago • 2 minute read

Many small business owners are not looking forward to the upcoming carbon tax hike next week.

According to the Canadian Federation of Independent Business, 56% of small businesses will be forced to raise prices to accommodate the increase while 45% report they will need to freeze or reduce wages. One third say it will reduce their ability to invest in environmental initiatives.

The federal carbon tax jumps by 23% to $80 per tonne on April 1.

“The giant hike in carbon taxes further highlights how unfair this tax is for small businesses,” CFIB president Dan Kelly said in a statement.

He is calling on the federal government to freeze the upcoming hike.

“The whole carbon tax system has become a shell game, and sadly, small firms are unfairly punished by it,” he said.

Kelly said the Liberal government has not kept its promise to return some revenues from the carbon tax to small businesses.

“Ottawa is sitting on $2.5 billion in carbon tax rebates intended for small firms, calling into question the government’s claim that the tax is revenue neutral,” Kelly said.

According to CFIB estimates, businesses in Ontario, Manitoba, Saskatchewan and Alberta — provinces under the federal carbon tax system — that qualify for a rebate could receive a one-time payment between $2,600 and nearly $7,000.

In the four Atlantic provinces that came under the federal carbon tax last July, rebates would be between $630 and $1,060.

British Columbia, Quebec and Northwest Territories have their own carbon tax for all sources of emissions.

Kelly said he was happy to hear Deputy Prime Minister Chrystia Freeland’s comments to a recent committee meeting that small businesses will soon have some good news on the billions owed to them since 2019.

“This can’t come soon enough,” Kelly added.

The CFIB is calling on Ottawa to drop the planned carbon tax hike and immediately return the billions owed to all small businesses.

“Ottawa has an opportunity to right the wrong and announce concrete plans to return the promised $2.5 billion to all small businesses, not just certain sectors,” said Jasmin Guenette, CFIB’s vice-president of national affairs.

“We hope the government listens to small business concerns and will announce details of a plan to keep its promise in the upcoming budget.”

torontosun.com

torontosun.com

Author of the article

Published Mar 28, 2024 • Last updated 1 day ago • 2 minute read

Many small business owners are not looking forward to the upcoming carbon tax hike next week.

According to the Canadian Federation of Independent Business, 56% of small businesses will be forced to raise prices to accommodate the increase while 45% report they will need to freeze or reduce wages. One third say it will reduce their ability to invest in environmental initiatives.

The federal carbon tax jumps by 23% to $80 per tonne on April 1.

“The giant hike in carbon taxes further highlights how unfair this tax is for small businesses,” CFIB president Dan Kelly said in a statement.

He is calling on the federal government to freeze the upcoming hike.

“The whole carbon tax system has become a shell game, and sadly, small firms are unfairly punished by it,” he said.

Kelly said the Liberal government has not kept its promise to return some revenues from the carbon tax to small businesses.

“Ottawa is sitting on $2.5 billion in carbon tax rebates intended for small firms, calling into question the government’s claim that the tax is revenue neutral,” Kelly said.

According to CFIB estimates, businesses in Ontario, Manitoba, Saskatchewan and Alberta — provinces under the federal carbon tax system — that qualify for a rebate could receive a one-time payment between $2,600 and nearly $7,000.

In the four Atlantic provinces that came under the federal carbon tax last July, rebates would be between $630 and $1,060.

British Columbia, Quebec and Northwest Territories have their own carbon tax for all sources of emissions.

Kelly said he was happy to hear Deputy Prime Minister Chrystia Freeland’s comments to a recent committee meeting that small businesses will soon have some good news on the billions owed to them since 2019.

“This can’t come soon enough,” Kelly added.

The CFIB is calling on Ottawa to drop the planned carbon tax hike and immediately return the billions owed to all small businesses.

“Ottawa has an opportunity to right the wrong and announce concrete plans to return the promised $2.5 billion to all small businesses, not just certain sectors,” said Jasmin Guenette, CFIB’s vice-president of national affairs.

“We hope the government listens to small business concerns and will announce details of a plan to keep its promise in the upcoming budget.”

Small businesses 'unfairly punished' by upcoming carbon tax hike: CFIB

Many small business owners are not looking forward to the upcoming carbon tax hike next week.

Being April Fools Day, is there going to be some kind of Canada wide celebration of the Carbon Tax(s) or anything?

“A province or territory can decide to voluntarily adopt the federal pricing system,” the federal government (= Justin Trudeau) said on its website.

“A province or territory can decide to voluntarily adopt the federal pricing system,” the federal government (= Justin Trudeau) said on its website.

Voluntarily? LOL it went to the Supreme Court to force the provinces to join.Being April Fools Day, is there going to be some kind of Canada wide celebration of the Carbon Tax(s) or anything?

“A province or territory can decide to voluntarily adopt the federal pricing system,” the federal government (= Justin Trudeau) said on its website.

Call it the Easter Tax. That lines up with Christmas, when Caesar decreed that all the world would be taxed.Being April Fools Day, is there going to be some kind of Canada wide celebration of the Carbon Tax(s) or anything?

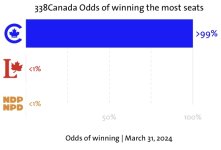

Did anyone call an election yet to boot this Woke Doomsday Cult to the curb? Bueller? Bueller?

Being April Fools Day, is there going to be some kind of Canada wide celebration of the Carbon Tax(s) or anything?

“A province or territory can decide to voluntarily adopt the federal pricing system,” the federal government (= Justin Trudeau) said on its website.

Celebrating has started:Voluntarily? LOL it went to the Supreme Court to force the provinces to join.

N.L.'s Liberal premier calls for emergency meeting with PM as anti-carbon tax protests snarl highways — CBC News

Protests erupted across the country against the federal carbon tax on Monday — the same day it rose by 23 per cent — while Canada’s only Liberal provincial leader pressed for an emergency meeting to discuss alternative ways to cut emissions.

The suggestion that hundreds of economists could put out a letter endorsing the federal government’s signature climate policy, the carbon tax, without it being perceived as political is incredibly precious. Although Pierre Poilievre’s Conservatives are not directly named, they are the clear targets of the letter, which was released last week. Hardly apolitical, the stunt, and the 340-plus economists who have so far signed on to it, are deserving of nothing more than a massive eye roll.

Where the letter falls down is that beyond a few nods to the fact that a carbon tax is a preferred policy to subsidies and regulations, the letter mostly assumes that the carbon tax exists in isolation. There is no mention of the fact there are, as economist Jack Mintz has written in the Post, stacked carbon taxes. On top of the consumer carbon tax, there are clean fuel regulations, federal and provincial fuel excise taxes and “federal and provincial sales taxes that apply to gasoline prices inclusive of carbon and excise taxes.”

Nor does the letter mention the swath of new tax credits announced last year geared towards “clean electricity” investment or credits to “manufacture or process key clean technologies.” And the letter certainly doesn’t mention emissions caps for the oil and gas industry or millions in subsidies for electric vehicle battery manufacturing plants. That’s before we even get to the de facto ban on the export of natural gas, or the throttling of oil pipeline construction — the Trans Mountain expansion, approved only after several other pipeline projects were killed, notwithstanding.

Instead, the letter flaunts its obliviousness to these other policies, stating: “In a world of scarce resources, it seems imprudent to abandon carbon pricing, only to replace it with more costly methods of reducing emissions.”

However, carbon pricing isn’t being implemented as an alternative to other policies intended to lower carbon emissions, it is being used on top of, and in addition to, the “more costly methods of reducing emissions.”

apple.news

apple.news

Nor does the letter mention the swath of new tax credits announced last year geared towards “clean electricity” investment or credits to “manufacture or process key clean technologies.” And the letter certainly doesn’t mention emissions caps for the oil and gas industry or millions in subsidies for electric vehicle battery manufacturing plants. That’s before we even get to the de facto ban on the export of natural gas, or the throttling of oil pipeline construction — the Trans Mountain expansion, approved only after several other pipeline projects were killed, notwithstanding.

Instead, the letter flaunts its obliviousness to these other policies, stating: “In a world of scarce resources, it seems imprudent to abandon carbon pricing, only to replace it with more costly methods of reducing emissions.”

However, carbon pricing isn’t being implemented as an alternative to other policies intended to lower carbon emissions, it is being used on top of, and in addition to, the “more costly methods of reducing emissions.”

Carson Jerema: Economists' open letter oblivious to carbon tax realities — National Post

Liberal policy is on top of massive subsidies and regulations, which the letter ignores

I bet all those "economists" either work for the federal government, are university perfessers, or work for one of turdOWE's bought news agencies.The suggestion that hundreds of economists could put out a letter endorsing the federal government’s signature climate policy, the carbon tax, without it being perceived as political is incredibly precious. Although Pierre Poilievre’s Conservatives are not directly named, they are the clear targets of the letter, which was released last week. Hardly apolitical, the stunt, and the 340-plus economists who have so far signed on to it, are deserving of nothing more than a massive eye roll.

Where the letter falls down is that beyond a few nods to the fact that a carbon tax is a preferred policy to subsidies and regulations, the letter mostly assumes that the carbon tax exists in isolation. There is no mention of the fact there are, as economist Jack Mintz has written in the Post, stacked carbon taxes. On top of the consumer carbon tax, there are clean fuel regulations, federal and provincial fuel excise taxes and “federal and provincial sales taxes that apply to gasoline prices inclusive of carbon and excise taxes.”

View attachment 21622

Nor does the letter mention the swath of new tax credits announced last year geared towards “clean electricity” investment or credits to “manufacture or process key clean technologies.” And the letter certainly doesn’t mention emissions caps for the oil and gas industry or millions in subsidies for electric vehicle battery manufacturing plants. That’s before we even get to the de facto ban on the export of natural gas, or the throttling of oil pipeline construction — the Trans Mountain expansion, approved only after several other pipeline projects were killed, notwithstanding.

Instead, the letter flaunts its obliviousness to these other policies, stating: “In a world of scarce resources, it seems imprudent to abandon carbon pricing, only to replace it with more costly methods of reducing emissions.”

However, carbon pricing isn’t being implemented as an alternative to other policies intended to lower carbon emissions, it is being used on top of, and in addition to, the “more costly methods of reducing emissions.”

Carson Jerema: Economists' open letter oblivious to carbon tax realities — National Post

Liberal policy is on top of massive subsidies and regulations, which the letter ignoresapple.news

Of course , I know which side of the toast is buttered .I bet all those "economists" either work for the federal government, are university perfessers, or work for one of turdOWE's bought news agencies.

The argument favouring a carbon tax in Canada is losing strength. The combination of carbon tax and populist carbon rebates has shifted the policy towards wealth redistribution, straying from its (claim initially of?) environmental goals.

A detailed and transparent discussion on the carbon tax policy is overdue. Since its introduction in 2015, the policy has shown minimal impact on climate change.

The Trudeau government’s development of a powerful intellectual lobby, including the Climate Change Institute and the Smart Prosperity Institute, has made the policy landscape even more complex. These institutions tend to promote the carbon tax without adequately assessing the policy’s true effectiveness and consequences.

apple.news

apple.news

A detailed and transparent discussion on the carbon tax policy is overdue. Since its introduction in 2015, the policy has shown minimal impact on climate change.

The Trudeau government’s development of a powerful intellectual lobby, including the Climate Change Institute and the Smart Prosperity Institute, has made the policy landscape even more complex. These institutions tend to promote the carbon tax without adequately assessing the policy’s true effectiveness and consequences.

CHARLEBOIS: Debating the path to carbon pricing — Toronto Sun

Over 340 economists have penned an open letter in support of Canada’s prevailing carbon tax policy. Despite the misleading information noted in the letter regarding the carbon tax’s impact on our climate and its effect on our cost of living – specifically referencing the Bank of Canada’s...

They didn't get their basic income scheme.The argument favouring a carbon tax in Canada is losing strength. The combination of carbon tax and populist carbon rebates has shifted the policy towards wealth redistribution, straying from its (claim initially of?) environmental goals.

A detailed and transparent discussion on the carbon tax policy is overdue. Since its introduction in 2015, the policy has shown minimal impact on climate change.

The Trudeau government’s development of a powerful intellectual lobby, including the Climate Change Institute and the Smart Prosperity Institute, has made the policy landscape even more complex. These institutions tend to promote the carbon tax without adequately assessing the policy’s true effectiveness and consequences.

CHARLEBOIS: Debating the path to carbon pricing — Toronto Sun

Over 340 economists have penned an open letter in support of Canada’s prevailing carbon tax policy. Despite the misleading information noted in the letter regarding the carbon tax’s impact on our climate and its effect on our cost of living – specifically referencing the Bank of Canada’s...apple.news

They didn't get their basic income scheme.

I more than notice the carbon tax, & I don’t live in a mansion with an indoor swimming pool and three personal motor vehicles, etc…this dude is clueless, but then here is a quote from his former Climate Barbie:

![p158052-youtube-thumbnail[1].jpg p158052-youtube-thumbnail[1].jpg](https://forums.canadiancontent.net/data/attachments/19/19879-49de9cd1a0c5334fd0b41d82b7ff5e53.jpg)