The info I read on it a while ago said to get the federal portion of the grants, one has to prove the existing fossil fuel heat source has been removed.Well, the “free” heat pump would work well for AC part of the year. Could you do it on a small scale as a supplement to your natural gas furnace in order to qualify for the “free” heat pump (?) and still not void your home owners insurance by not having a supplemental heat source beyond the heat pump itself (by still having your natural gas furnace & supply) when you get rid of the heating oil supplemental system?

April Fools!! Here's your Carbon Tax F#ckers!!!

- Thread starter Ron in Regina

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Goes by region and overall efficiency. If you dont have gas, youre just as fucked as you were before.The info I read on it a while ago said to get the federal portion of the grants, one has to prove the existing fossil fuel heat source has been removed.

I have propane, which I wouldn’t part with. Fortis told me it isn’t worth their while to give e gas. There is only about 600 houses along the way that would probably hook on.Goes by region and overall efficiency. If you dont have gas, youre just as fucked as you were before.

The Quebec problem was surprisingly silent during Harper’s tenure .

As a growing number of premiers urge the federal government to pause an upcoming increase to the federal carbon tax, Prime Minister Justin Trudeau pushed back on what he called "short-term thinker" politicians and defended his government's deeply divisive policy?

This is from the CBC even???

apple.news

apple.news

"My job is not to be popular, although it helps," Trudeau said during a news conference in Calgary Wednesday?

"My job is to do the right things for Canada now, and do the right things for Canadians a generation from now." (?????)

At the beginning of next month, the carbon price is scheduled to increase from $65 to $80 per tonne.

Trudeau showed no signs of bowing to pressure from the premiers…or Canadians?

So only Atlantic Canada gets a carve out. No relief from Trudeau’s ideology regardless of the economy or inflation.

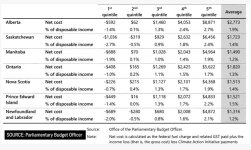

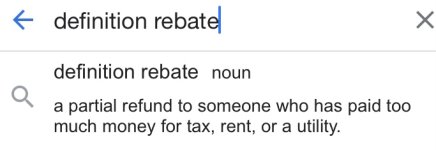

Canadians living in the eight provinces with the federal carbon tax receive quarterly rebate payments which vary depending on the province and the size of household, then you might get a portion of that back, which is the actual definition of a rebate due to overpayment…but in this case, it’s just wealth redistribution.

"Those are cheques that the conservative governments and Conservative Party want to take away from people," said Trudeau???

This is from the CBC even???

Trudeau calls out 'short-term thinker' politicians as some premiers urge him to drop carbon price hike — CBC News

As a growing number of premiers urge the federal government to pause an upcoming increase to the federal carbon tax, Prime Minister Justin Trudeau pushed back Wednesday on what he called "short-term thinker" politicians.

"My job is not to be popular, although it helps," Trudeau said during a news conference in Calgary Wednesday?

"My job is to do the right things for Canada now, and do the right things for Canadians a generation from now." (?????)

At the beginning of next month, the carbon price is scheduled to increase from $65 to $80 per tonne.

Trudeau showed no signs of bowing to pressure from the premiers…or Canadians?

So only Atlantic Canada gets a carve out. No relief from Trudeau’s ideology regardless of the economy or inflation.

Canadians living in the eight provinces with the federal carbon tax receive quarterly rebate payments which vary depending on the province and the size of household, then you might get a portion of that back, which is the actual definition of a rebate due to overpayment…but in this case, it’s just wealth redistribution.

"Those are cheques that the conservative governments and Conservative Party want to take away from people," said Trudeau???

Natural Resources Minister Jonathan Wilkinson says provincial premiers who are calling on the government to scrap a planned increase on the carbon tax have their facts wrong.

In an interview airing Sunday on Rosemary Barton Live, Wilkinson defended the federal government's landmark climate policy against a growing chorus of provincial leaders who hope to either delay or ditch altogether the impending April 1 increase.

"Based on the facts, the seven premiers are just wrong," Wilkinson told guest host David Common.

Wilkinson's comments are a continuation of a defence of the carbon tax by federal officials — including Prime Minister Justin Trudeau — on the grounds of affordability. Removing or pausing the carbon tax, they argue, would hurt more people than it helps, because of reduced rebates??

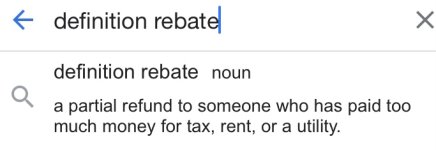

Have these fools seriously not ever looked up the definition of the term “rebate”???

apple.news

apple.news

A “partial” refund to someone who has paid “too much” for tax, rent, or a utility.

Stop paying the tax, and we’ll stop refunding a portion of that back? That’s the threat & sales pitch rolled up into one???

In an interview airing Sunday on Rosemary Barton Live, Wilkinson defended the federal government's landmark climate policy against a growing chorus of provincial leaders who hope to either delay or ditch altogether the impending April 1 increase.

"Based on the facts, the seven premiers are just wrong," Wilkinson told guest host David Common.

Wilkinson's comments are a continuation of a defence of the carbon tax by federal officials — including Prime Minister Justin Trudeau — on the grounds of affordability. Removing or pausing the carbon tax, they argue, would hurt more people than it helps, because of reduced rebates??

Have these fools seriously not ever looked up the definition of the term “rebate”???

Natural resources minister defends carbon tax as provinces pile on — CBC News

Jonathan Wilkinson says provincial premiers who are calling on the government to scrap a planned increase on the carbon tax have their facts wrong.

A “partial” refund to someone who has paid “too much” for tax, rent, or a utility.

Stop paying the tax, and we’ll stop refunding a portion of that back? That’s the threat & sales pitch rolled up into one???

Saskatchewan has been at the forefront of the provincial fight against the tax, going so far as to refuse to remit the carbon tax collected on natural gas used for home heating, in defiance of the federal law.

"Our view is that if the prime minister thought that a reduction in the carbon tax and a reduction in the rebate for Atlantic Canadians meant that would be a net positive in terms of affordability for those residents, surely the economics should hold true for Saskatchewan," said Dustin Duncan, the minister responsible for SaskEnergy.

"Clearly, there have to be consequences," Wilkinson said Sunday.

What those consequences may be is something that is "actively under discussion," he added.

"Our view is that if the prime minister thought that a reduction in the carbon tax and a reduction in the rebate for Atlantic Canadians meant that would be a net positive in terms of affordability for those residents, surely the economics should hold true for Saskatchewan," said Dustin Duncan, the minister responsible for SaskEnergy.

"Clearly, there have to be consequences," Wilkinson said Sunday.

What those consequences may be is something that is "actively under discussion," he added.

OK, I admit. . . I never, ever expected to hear those words.Saskatchewan has been at the forefront

Why?OK, I admit. . . I never, ever expected to hear those words.

Given their full-throated defence of the federal carbon tax, why can’t the Trudeau government tell us how much it’s reducing Canada’s energy-related greenhouse gas emissions?

After all, Prime Minister Justin Trudeau and his cabinet ministers keep telling us, that’s the whole point of the carbon tax.

It’s primary purpose is not to make Canadians richer or poorer.

This depending on whether you believe Trudeau that 80% of households paying the federal carbon tax end up better off because of rebates, or Parliamentary Budget Officer Yves Giroux, who says when you factor in the tax’s negative impact on the economy, 60% of households end up worse off, despite the rebates.

The carbon tax is supposed to be the most economically efficient way we have to lower emissions linked to climate change.

In response to an order paper question by Conservative MP Dan Mazier last month, Environment Minister Steven Guilbeault said:

“The government does not measure the annual amount of emissions that are directly reduced by federal carbon pricing. Retroactively attributing specific GHG reductions to a specific action, such as carbon pricing, a discrete regulation, or a specific incentive, is difficult given the multiple interacting factors that influence emissions, including carbon pricing, tax incentives, funding programs, investor preferences and consumer demand. The National Inventory Report, which reports annually on historical GHG emissions, does not include this information.” (Huh????)

EDITORIAL: Carbon tax defence full of hot air — Toronto Sun

Given their full-throated defence of the federal carbon tax, why can’t the Trudeau government tell us how much it’s reducing Canada’s energy-related greenhouse gas emissions? After all, Prime Minister Justin Trudeau and his cabinet ministers keep telling us, that’s the whole point of the carbon...

The closest we’ve gotten to an answer from the Trudeau government was a Dec. 1, 2023 news release on, “How pollution pricing reduces emissions,” that simultaneously estimated reductions from the federal carbon tax at “roughly one-third” and “as much as one-third” of Canada’s emission reductions in 2030.

An accompanying chart estimated the carbon tax will reduce Canada’s emissions (670 million tonnes in 2021, according to the latest available government data) by 19 million tonnes in 2022, 24 million tonnes in 2023, 32 million tonnes in 2024, 43 million tonnes in 2025, 49 million tonnes in 2026, 56 million tonnes in 2027, 62 million tonnes in 2028, 70 million tonnes in 2029 and 79 million tonnes in 2030.

But if they’re not measuring it, how do they know?

Considering that the Trudeau government says it’s spending more than $200 billion on more than 100 climate change programs, it’s time for some answers.

Where's the beef? I see gravy but no beef.View attachment 21478

Given their full-throated defence of the federal carbon tax, why can’t the Trudeau government tell us how much it’s reducing Canada’s energy-related greenhouse gas emissions?

After all, Prime Minister Justin Trudeau and his cabinet ministers keep telling us, that’s the whole point of the carbon tax.

It’s primary purpose is not to make Canadians richer or poorer.

This depending on whether you believe Trudeau that 80% of households paying the federal carbon tax end up better off because of rebates, or Parliamentary Budget Officer Yves Giroux, who says when you factor in the tax’s negative impact on the economy, 60% of households end up worse off, despite the rebates.

The carbon tax is supposed to be the most economically efficient way we have to lower emissions linked to climate change.

In response to an order paper question by Conservative MP Dan Mazier last month, Environment Minister Steven Guilbeault said:

“The government does not measure the annual amount of emissions that are directly reduced by federal carbon pricing. Retroactively attributing specific GHG reductions to a specific action, such as carbon pricing, a discrete regulation, or a specific incentive, is difficult given the multiple interacting factors that influence emissions, including carbon pricing, tax incentives, funding programs, investor preferences and consumer demand. The National Inventory Report, which reports annually on historical GHG emissions, does not include this information.” (Huh????)

EDITORIAL: Carbon tax defence full of hot air — Toronto Sun

Given their full-throated defence of the federal carbon tax, why can’t the Trudeau government tell us how much it’s reducing Canada’s energy-related greenhouse gas emissions? After all, Prime Minister Justin Trudeau and his cabinet ministers keep telling us, that’s the whole point of the carbon...apple.news

The closest we’ve gotten to an answer from the Trudeau government was a Dec. 1, 2023 news release on, “How pollution pricing reduces emissions,” that simultaneously estimated reductions from the federal carbon tax at “roughly one-third” and “as much as one-third” of Canada’s emission reductions in 2030.

An accompanying chart estimated the carbon tax will reduce Canada’s emissions (670 million tonnes in 2021, according to the latest available government data) by 19 million tonnes in 2022, 24 million tonnes in 2023, 32 million tonnes in 2024, 43 million tonnes in 2025, 49 million tonnes in 2026, 56 million tonnes in 2027, 62 million tonnes in 2028, 70 million tonnes in 2029 and 79 million tonnes in 2030.

But if they’re not measuring it, how do they know?

Considering that the Trudeau government says it’s spending more than $200 billion on more than 100 climate change programs, it’s time for some answers.

Trudeau needs to fall out of a window.

Arkanscide?Trudeau needs to fall out of a window.

Unfortunately for BC, we have our very own carbon scam tax grab that the current leadership uses for vote buying from uninformed voters.

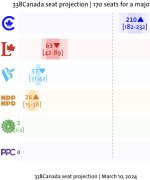

Chek news poll yesterday showed 49% support for NDP. For those of you outside lalaland, CHEK is a Victoria station, so the bulk of viewers are government employees or rich socialists. But I repeat myself.

We have an election due in October so the BS is flowing like a fleet of manure spreaders on a farm.

Chek news poll yesterday showed 49% support for NDP. For those of you outside lalaland, CHEK is a Victoria station, so the bulk of viewers are government employees or rich socialists. But I repeat myself.

We have an election due in October so the BS is flowing like a fleet of manure spreaders on a farm.

CHEK goes beyond Victoria. It's CTV2 on the south coast.Unfortunately for BC, we have our very own carbon scam tax grab that the current leadership uses for vote buying from uninformed voters.

Chek news poll yesterday showed 49% support for NDP. For those of you outside lalaland, CHEK is a Victoria station, so the bulk of viewers are government employees or rich socialists. But I repeat myself.

We have an election due in October so the BS is flowing like a fleet of manure spreaders on a farm.

LILLEY: Trudeau Liberals double down on hiking carbon tax even higher — Toronto Sun

Trudeau government won't rule out raising carbon tax in perpetuity.