Fraser Institute likely has that data.Be interesting, and easy enough for anybody to find I’m assuming, Canada’s national debt increase between the spring of 2015, & the announcement of Covid, before a penny was spent using that as justification.

Trudeau Is Going To Bury Us In Debt

- Thread starter Decapoda

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Federal government posts $6.5 billion deficit in April, May

Author of the article:Canadian Press

Canadian Press

Published Jul 25, 2025 • 1 minute read

The federal government posted a $6.5 billion deficit in the first two months of the fiscal year.

The result for the April-to-May period compared with a $3.8 billion deficit for the same stretch last year.

Revenues increased $26 million, virtually unchanged from the prior year, as increases in customs import duties and pollution pricing proceeds to be returned to Canadians were largely offset by a decrease in revenues from corporate income and goods and services taxes.

The Finance Department says program expenses excluding net actuarial losses rose $2.9 billion, or four per cent.

Public debt charges increased $400 million, or 3.8 per cent, due to an increase in the stock of marketable bonds and higher consumer price index adjustments on real return bonds.

Net actuarial losses fell $600 million, or 46.8 per cent.

torontosun.com

torontosun.com

Author of the article:Canadian Press

Canadian Press

Published Jul 25, 2025 • 1 minute read

The federal government posted a $6.5 billion deficit in the first two months of the fiscal year.

The result for the April-to-May period compared with a $3.8 billion deficit for the same stretch last year.

Revenues increased $26 million, virtually unchanged from the prior year, as increases in customs import duties and pollution pricing proceeds to be returned to Canadians were largely offset by a decrease in revenues from corporate income and goods and services taxes.

The Finance Department says program expenses excluding net actuarial losses rose $2.9 billion, or four per cent.

Public debt charges increased $400 million, or 3.8 per cent, due to an increase in the stock of marketable bonds and higher consumer price index adjustments on real return bonds.

Net actuarial losses fell $600 million, or 46.8 per cent.

Federal government posts $6.5 billion deficit in April, May

The federal government posted a $6.5 billion deficit in the first two months of the fiscal year.

It was only a matter of time.

ca.yahoo.com

ca.yahoo.com

Katy Perry Spotted Out For Dinner With Justin Trudeau And... Seriously, What?!

The Teenage Dream and former Canadian prime minister were pictured together on Monday night.

Canadians on hook for thousands in government debt costs: Study

Debt interest costs in Ontario, Quebec and Alberta are as much as those provinces spent on K-12 education in 2024-25

Author of the article:Bryan Passifiume

Published Aug 21, 2025 • Last updated 12 hours ago • 1 minute read

OTTAWA — Government debt will cost Ontarians $2,242 this year, according to a new Fraser Institute report.

This year’s edition of the institute’s Federal and Provincial Debt Interest Costs for Canadians report shows combined provincial and federal debt will cost Canadians between $1,937 and $3,432 depending on the province lived in.

“Governments across Canada continue to rack up large debts, which impose real costs on Canadians,” said study co-author Tegan Hill, who is also director of the institute’s Alberta policy studies.

“Interest payments across the country are substantial, and money that goes to creditors is money that is not available for other important priorities.”

Albertans will pay the lowest in 2025, at $1,937, while those from Newfoundland and Labrador will be on the hook for $3,432.

The study also points out that Ontario, Quebec and Alberta pay as much in combined debt interest costs as the provinces spent on kindergarten to Grade 12 education in the 2024-25 school year — while the $11.8-billion interest costs for British Columbia is more than what the province plans to spend on social services.

“Interest must be paid on government debt, and the more money governments spend on interest payments the less money is available for the programs and services that matter to Canadians,” said Jake Fuss, study co-author and the institute’s fiscal studies director.

The study says the federal government is expected to spend $92.5 billion on debt interest in 2024-25 and $53.8 billion to service that debt — more than the $52.1 billion spent on the Canada Health Transfer, and $35.1 billion set aside for childcare benefits.

bpassifiume@postmedia.com

X: @bryanpassifiume

fraserinstitute.org

fraserinstitute.org

torontosun.com

torontosun.com

Debt interest costs in Ontario, Quebec and Alberta are as much as those provinces spent on K-12 education in 2024-25

Author of the article:Bryan Passifiume

Published Aug 21, 2025 • Last updated 12 hours ago • 1 minute read

OTTAWA — Government debt will cost Ontarians $2,242 this year, according to a new Fraser Institute report.

This year’s edition of the institute’s Federal and Provincial Debt Interest Costs for Canadians report shows combined provincial and federal debt will cost Canadians between $1,937 and $3,432 depending on the province lived in.

“Governments across Canada continue to rack up large debts, which impose real costs on Canadians,” said study co-author Tegan Hill, who is also director of the institute’s Alberta policy studies.

“Interest payments across the country are substantial, and money that goes to creditors is money that is not available for other important priorities.”

Albertans will pay the lowest in 2025, at $1,937, while those from Newfoundland and Labrador will be on the hook for $3,432.

The study also points out that Ontario, Quebec and Alberta pay as much in combined debt interest costs as the provinces spent on kindergarten to Grade 12 education in the 2024-25 school year — while the $11.8-billion interest costs for British Columbia is more than what the province plans to spend on social services.

“Interest must be paid on government debt, and the more money governments spend on interest payments the less money is available for the programs and services that matter to Canadians,” said Jake Fuss, study co-author and the institute’s fiscal studies director.

The study says the federal government is expected to spend $92.5 billion on debt interest in 2024-25 and $53.8 billion to service that debt — more than the $52.1 billion spent on the Canada Health Transfer, and $35.1 billion set aside for childcare benefits.

bpassifiume@postmedia.com

X: @bryanpassifiume

Federal and Provincial Debt-Interest Costs for Canadians, 2025 Edition

Canadians on hook for thousands in government debt costs: Study

Debt interest costs in Ontario, Quebec and Alberta are as much as those provinces spent on K-12 education in 2024-25

Budget’s aren’t important , what is , is finding the right liberal to take on the bad Orangeman to our south . Elbows up .Not like we didn’t see this coming a decade ago….& the budget will balance itself. Ugh…

Canadians on hook for thousands in government debt costs: Study

Debt interest costs in Ontario, Quebec and Alberta are as much as those provinces spent on K-12 education in 2024-25

Author of the article:Bryan Passifiume

Published Aug 21, 2025 • Last updated 12 hours ago • 1 minute read

OTTAWA — Government debt will cost Ontarians $2,242 this year, according to a new Fraser Institute report.

This year’s edition of the institute’s Federal and Provincial Debt Interest Costs for Canadians report shows combined provincial and federal debt will cost Canadians between $1,937 and $3,432 depending on the province lived in.

“Governments across Canada continue to rack up large debts, which impose real costs on Canadians,” said study co-author Tegan Hill, who is also director of the institute’s Alberta policy studies.

“Interest payments across the country are substantial, and money that goes to creditors is money that is not available for other important priorities.”

Albertans will pay the lowest in 2025, at $1,937, while those from Newfoundland and Labrador will be on the hook for $3,432.

The study also points out that Ontario, Quebec and Alberta pay as much in combined debt interest costs as the provinces spent on kindergarten to Grade 12 education in the 2024-25 school year — while the $11.8-billion interest costs for British Columbia is more than what the province plans to spend on social services.

“Interest must be paid on government debt, and the more money governments spend on interest payments the less money is available for the programs and services that matter to Canadians,” said Jake Fuss, study co-author and the institute’s fiscal studies director.

The study says the federal government is expected to spend $92.5 billion on debt interest in 2024-25 and $53.8 billion to service that debt — more than the $52.1 billion spent on the Canada Health Transfer, and $35.1 billion set aside for childcare benefits.

bpassifiume@postmedia.com

X: @bryanpassifiume

Federal and Provincial Debt-Interest Costs for Canadians, 2025 Edition

fraserinstitute.org

Canadians on hook for thousands in government debt costs: Study

Debt interest costs in Ontario, Quebec and Alberta are as much as those provinces spent on K-12 education in 2024-25torontosun.com

Not like we didn’t see this coming a decade ago….& the budget will balance itself. Ugh…

It's time to start selling water. We have 10% of global supply.Budget’s aren’t important , what is , is finding the right liberal to take on the bad Orangeman to our south . Elbows up .

Feds to spend $71 billion on public servants' salaries, other costs this fiscal: PBO

The increase in personnel spending came despite a shrinking federal public service.

Author of the article:Matteo Cimellaro

Published Aug 28, 2025 • Last updated 21 hours ago • 2 minute read

Parliamentary Budget Officer Yves Giroux reports that personnel spending is set to increase this fiscal.

Parliamentary Budget Officer Yves Giroux reports that personnel spending is set to increase this fiscal. Photo by Adrian Wyld /The Canadian Press

The federal government is set to spend an estimated $71.1 billion on salaries, bonuses and other personnel costs in 2024-25 despite having shaved off around 10,000 workers from the public service last fiscal year, according to Canada’s parliamentary budget officer.

This was an increase from last year’s $69.6 billion spent on personnel, according to a new PBO report published on Aug. 28. Personnel costs are the largest part of operational spending and will present a challenge to the government of Prime Minister Mark Carney, which has promised to balance the operating budget all while capping and not cutting the size of the federal public service.

Last fiscal year, the size of the federal public service shrunk by 9,807 jobs, according to Treasury Board data. However, in July, the PBO released an analysis that showed the number of full-time equivalents in the public service has continued to grow.

A full-time equivalent is the labour of one full-time employee, or multiple part-time employees whose work adds to the work of one full-time employee.

In an interview, Giroux said the government can reduce the headcount of the public service but still increase the number of full-time equivalents if the jobs cut are those of students, part-time employees and temporary contract workers.

“So you can reduce the number of employees by thousands, but still increase your wage bill,” he said.

The PBO projected that the average cost per full-time equivalent when it comes to salaries, wages and other standard compensation will increase to $139,000 by 2029-30, growing in line with inflation. But the average projected cost balloons to more than $172,000 when benefits and other payments are factored in.

In the new report, the PBO also projected that federal personnel spending could reach $76.2 billion per year by 2029-30 if left unchecked. However, this projection did not include planned increases in defence spending, nor the potential savings in the government’s upcoming spending review.

Carney’s target is to increase defence spending to two per cent of Canada’s gross domestic product by the end of March 2025, which will require more than $9 billion in additional annual spending. The prime minister is eyeing subsequent increases in future years as part of commitments he’s made to NATO.

Meanwhile, his ministers have been asked to find up to 15 per cent savings in most departments and agencies over three years, culminating in 2028-29.

The spending review will start in earnest in 2026-27 with a 7.5 per cent cut across most departments, followed by another 2.5 per cent the next year, and an additional 5 per cent in 2028-29.

“As personnel expenses constitute the single largest component of federal operating spending, amore granular understanding is essential for effective parliamentary scrutiny,” the PBO wrote in the report.

The PBO’s report noted that the projected spending on personnel “provides a baseline for the anticipated policy changes to be announced in Budget 2025,” which is expected this fall.

torontosun.com

torontosun.com

The increase in personnel spending came despite a shrinking federal public service.

Author of the article:Matteo Cimellaro

Published Aug 28, 2025 • Last updated 21 hours ago • 2 minute read

Parliamentary Budget Officer Yves Giroux reports that personnel spending is set to increase this fiscal.

Parliamentary Budget Officer Yves Giroux reports that personnel spending is set to increase this fiscal. Photo by Adrian Wyld /The Canadian Press

The federal government is set to spend an estimated $71.1 billion on salaries, bonuses and other personnel costs in 2024-25 despite having shaved off around 10,000 workers from the public service last fiscal year, according to Canada’s parliamentary budget officer.

This was an increase from last year’s $69.6 billion spent on personnel, according to a new PBO report published on Aug. 28. Personnel costs are the largest part of operational spending and will present a challenge to the government of Prime Minister Mark Carney, which has promised to balance the operating budget all while capping and not cutting the size of the federal public service.

Last fiscal year, the size of the federal public service shrunk by 9,807 jobs, according to Treasury Board data. However, in July, the PBO released an analysis that showed the number of full-time equivalents in the public service has continued to grow.

A full-time equivalent is the labour of one full-time employee, or multiple part-time employees whose work adds to the work of one full-time employee.

In an interview, Giroux said the government can reduce the headcount of the public service but still increase the number of full-time equivalents if the jobs cut are those of students, part-time employees and temporary contract workers.

“So you can reduce the number of employees by thousands, but still increase your wage bill,” he said.

The PBO projected that the average cost per full-time equivalent when it comes to salaries, wages and other standard compensation will increase to $139,000 by 2029-30, growing in line with inflation. But the average projected cost balloons to more than $172,000 when benefits and other payments are factored in.

In the new report, the PBO also projected that federal personnel spending could reach $76.2 billion per year by 2029-30 if left unchecked. However, this projection did not include planned increases in defence spending, nor the potential savings in the government’s upcoming spending review.

Carney’s target is to increase defence spending to two per cent of Canada’s gross domestic product by the end of March 2025, which will require more than $9 billion in additional annual spending. The prime minister is eyeing subsequent increases in future years as part of commitments he’s made to NATO.

Meanwhile, his ministers have been asked to find up to 15 per cent savings in most departments and agencies over three years, culminating in 2028-29.

The spending review will start in earnest in 2026-27 with a 7.5 per cent cut across most departments, followed by another 2.5 per cent the next year, and an additional 5 per cent in 2028-29.

“As personnel expenses constitute the single largest component of federal operating spending, amore granular understanding is essential for effective parliamentary scrutiny,” the PBO wrote in the report.

The PBO’s report noted that the projected spending on personnel “provides a baseline for the anticipated policy changes to be announced in Budget 2025,” which is expected this fall.

Feds to spend $71 billion on public servants' salaries, other costs this fiscal: PBO

The increase in personnel spending came despite a shrinking federal public service.

Canada sending $2.6M in humanitarian, refugee aid after Pakistan floods

Author of the article:Canadian Press

Canadian Press

Dylan Robertson

Published Sep 09, 2025 • 1 minute read

A train leaves a flooded railway station.

A commuter train leaves a railway station through flooded tracks caused by heavy rains, in Hyderabad, Pakistan, Tuesday, Sept. 9, 2025. Photo by Pervez Masih /AP Photo

OTTAWA — Canada is providing $2.6 million in humanitarian aid for people in Pakistan displaced by flooding, and for Afghan refugees.

Pakistan has been grappling since June with floods and heavy monsoon rains that have affected roughly four million people and killed more than 900.

Randeep Sarai, secretary of state for international development, says Canada is sending $2 million to the UN Refugee Agency in Pakistan, which primarily supports Afghan refugees but has also been providing emergency relief.

He says $350,000 will be sent to Save the Children Canada to provide emergency shelter, water and hygiene services.

The remaining $250,000 will support the Pakistan Red Crescent Society’s relief work.

Pakistan has experienced a rise in large-scale natural disasters that environmental experts have linked to climate change, including floods in 2022 that led Canada to announce $58 million in aid.

torontosun.com

torontosun.com

Author of the article:Canadian Press

Canadian Press

Dylan Robertson

Published Sep 09, 2025 • 1 minute read

A train leaves a flooded railway station.

A commuter train leaves a railway station through flooded tracks caused by heavy rains, in Hyderabad, Pakistan, Tuesday, Sept. 9, 2025. Photo by Pervez Masih /AP Photo

OTTAWA — Canada is providing $2.6 million in humanitarian aid for people in Pakistan displaced by flooding, and for Afghan refugees.

Pakistan has been grappling since June with floods and heavy monsoon rains that have affected roughly four million people and killed more than 900.

Randeep Sarai, secretary of state for international development, says Canada is sending $2 million to the UN Refugee Agency in Pakistan, which primarily supports Afghan refugees but has also been providing emergency relief.

He says $350,000 will be sent to Save the Children Canada to provide emergency shelter, water and hygiene services.

The remaining $250,000 will support the Pakistan Red Crescent Society’s relief work.

Pakistan has experienced a rise in large-scale natural disasters that environmental experts have linked to climate change, including floods in 2022 that led Canada to announce $58 million in aid.

Canada sending $2.6M in humanitarian, refugee aid after Pakistan floods

Canada is providing $2.6 million in humanitarian aid for people in Pakistan displaced by flooding, and for Afghan refugees.

Taxpayers stuck with growing bill from equity-obsessed city charity

Emails show that despite efforts by the non-profit to reach people digitally, an end-of-year call for donations drew just 11 clicks.

Author of the article:Justin Holmes

Published Sep 21, 2025 • Last updated 3 days ago • 5 minute read

Conrad the Raccoon plaque on Yonge St.

Heritage Toronto’s Conrad the Raccoon plaque at 819 Yonge St. has a couple of admirers on Wednesday September 10, 2025. The city charity, which is responsible for historical plaques, put up the tribute to the internet sensation in July, intended as something it could make that would be “quick and fun.” Photo by Jack Boland/Toronto Sun

Heritage Toronto, the City of Toronto charity responsible for historical plaques and walking tours, has struggled with public engagement even as its government funding has soared, documents show.

Emails, released to the Toronto Sun after a freedom-of-information request, show the non-profit is holding fewer public plaque unveilings and working instead to reach people digitally – however, an end-of-year call for donations in a 2024 email drew just 11 clicks.

The emails suggest the city charity’s spending tied to “equity” exceeds six figures annually. One email boasted 40% of tours and 47% of plaques in 2023 “featured equity-deserving people and communities.”

Executive director Allison Bain declined the Toronto Sun’s request for an interview but agreed to have her communications manager, Lucy Di Pietro, reply to questions via a written statement.

The Sun asked for the emails after Heritage Toronto’s 2025 operating budget, published during City Hall’s regular budget process, flagged sponsorship revenues – money from corporations and groups like city BIAs – as well below target for 2024. While Bain attributed that to a “deferral of funds” in an email exchange with the Sun, she conceded that private donations, which also fell short, were a challenge in the “current economic climate.”

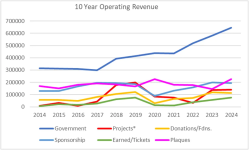

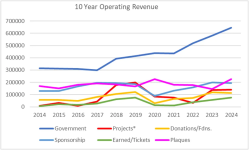

In a chart of Heritage Toronto’s funding from 2014-24, most forms of revenue appear largely flat over a decade. However, government funding more than doubled, from $312,000 in 2014 to $639,000 in 2024.

Heritage Toronto operational revenue

This chart depicting operating revenue over 10 years at Heritage Toronto was included in an email to staff at the city charity. Photo by Heritage Toronto

Di Pietro said that line graph was meant to show funding “trends” and lacks context. It was created for Heritage Toronto staff, who are privy to crucial details “not explicitly stated in the email.”

“In fact, all areas of revenue have experienced growth since 2014,” she wrote. “For example, our earned and ticket revenue has risen from $4,914 to $74,730, and donations and foundations have doubled from $57,529 to $113,946.” Government funding as a percentage of the operations budget “has ranged from 44% to 57%. Last year, it was 52%,” she wrote.

The sponsorship funding flagged in the budget is expected to grow 19% this year, Di Pietro said, adding that it’s too early to make predictions about individual donations, which largely come in the fall.

One of the documents supplied to the Sun, however, shows the average donation for the non-profit’s walking and bus tours plummeted to a paltry $1.81 per attendee in 2023, far below expectations and short of the $4.05 average in 2022. Heritage went into 2024 budgeting for drops in both private donations and corporate sponsorships.

Di Pietro said that difference is “offset by the move to a paid ticket model and a focus on ticket revenues.” Ticket sales are up by half this year and donations per tour attendee were up by a quarter in 2024, she added.

Key to Heritage Toronto’s finances is TD Bank, which sponsors its tours program and what it calls its “equity heritage initiative.” While TD has provided five years of funding for the equity initiative, a “development notes” document warned Heritage Toronto potentially faces “the loss or massive reduction in TD funding in 2026.”

(Di Pietro said the charity is “optimistic about continuing to work with TD.” The bank did not respond to a request for comment.)

Jackie Shane plaque

This Heritage Toronto plaque featuring Jackie Shane, a transgender musician, is mentioned in emails from the charity released to the Toronto Sun. A live event was held for its unveiling, which is less common for Heritage Toronto now than before 2020. Photo by Jack Boland/Toronto Sun

Di Pietro said managing the large pool of “project-directed” money requires “a constant balance … We can’t undertake project work that leads to either an operational surplus or deficit.” But in a June 2024 email to three staffers, Bain said the charity had a $100,000 operational deficit on its equity work – a big chunk for an organization with a total budget not far above $1 million.

“I do have to note that we are running a $100K deficit in our equity work, so we could cancel some things but expenses would have to rise in other areas in order to avoid generating an operational surplus,” Bain wrote, adding that she was “committed to leveraging as much of our resources as possible to address equity work which can be sustained once the TD grant expires.”

And in an email about digital ads in February that year, Bain told Di Pietro “the only way we could afford this (is) if we charged to equity.”

This focus has been no secret. Equity is the central theme in the charity’s latest State of Heritage report, which features images of a drag brunch, a lesbian bathhouse and vulgar graffiti at the former Ryerson University.

While plaques manager Chris Bateman said in a May 2024 email that a new online focus means the charity reaches “far more people overall with plaque programming” than pre-COVID, when it held more in-person events, other emails show the digital shift has been challenging.

Di Pietro told Bain in a November 2024 email that while they “barely use” YouTube, “anyone can see that” a Heritage Toronto video “has had 146 views with 0 comments and 5 likes.”

That followed an email in which Bain fretted that other than a Heritage Toronto staffer and two people with City Hall, “only 11 people clicked on the link” calling for end-of-year donations.

“That is not good news for us finding new donors,” Bain wrote. (Di Pietro told the Sun the soft response to one “wide communication” was not a concern.)

The non-profit has worked to widen its audience.

A plaque memorializing a dead raccoon — dubbed Conrad — was placed on Yonge St. in July. Meg Sutton, Heritage Toronto’s plaques co-ordinator, told The Canadian Press that community engagement was the goal of the plaque.

A year before, in July 2024, Bain got an email from Bateman that brought up Conrad – and floated an alternative critter candidate for a new plaque.

“I’m looking for something quick and fun that wouldn’t require extensive research, consultation or stakeholder review. We did a serious subject last year (the Chinese Exclusion Act), so I’m seriously considering Ikea Monkey or the raccoon that people built a shrine for,” Bateman wrote. (Di Pietro said there is no current plan for an Ikea Monkey plaque.)

jholmes@postmedia.com

torontosun.com

torontosun.com

Emails show that despite efforts by the non-profit to reach people digitally, an end-of-year call for donations drew just 11 clicks.

Author of the article:Justin Holmes

Published Sep 21, 2025 • Last updated 3 days ago • 5 minute read

Conrad the Raccoon plaque on Yonge St.

Heritage Toronto’s Conrad the Raccoon plaque at 819 Yonge St. has a couple of admirers on Wednesday September 10, 2025. The city charity, which is responsible for historical plaques, put up the tribute to the internet sensation in July, intended as something it could make that would be “quick and fun.” Photo by Jack Boland/Toronto Sun

Heritage Toronto, the City of Toronto charity responsible for historical plaques and walking tours, has struggled with public engagement even as its government funding has soared, documents show.

Emails, released to the Toronto Sun after a freedom-of-information request, show the non-profit is holding fewer public plaque unveilings and working instead to reach people digitally – however, an end-of-year call for donations in a 2024 email drew just 11 clicks.

The emails suggest the city charity’s spending tied to “equity” exceeds six figures annually. One email boasted 40% of tours and 47% of plaques in 2023 “featured equity-deserving people and communities.”

Executive director Allison Bain declined the Toronto Sun’s request for an interview but agreed to have her communications manager, Lucy Di Pietro, reply to questions via a written statement.

The Sun asked for the emails after Heritage Toronto’s 2025 operating budget, published during City Hall’s regular budget process, flagged sponsorship revenues – money from corporations and groups like city BIAs – as well below target for 2024. While Bain attributed that to a “deferral of funds” in an email exchange with the Sun, she conceded that private donations, which also fell short, were a challenge in the “current economic climate.”

In a chart of Heritage Toronto’s funding from 2014-24, most forms of revenue appear largely flat over a decade. However, government funding more than doubled, from $312,000 in 2014 to $639,000 in 2024.

Heritage Toronto operational revenue

This chart depicting operating revenue over 10 years at Heritage Toronto was included in an email to staff at the city charity. Photo by Heritage Toronto

Di Pietro said that line graph was meant to show funding “trends” and lacks context. It was created for Heritage Toronto staff, who are privy to crucial details “not explicitly stated in the email.”

“In fact, all areas of revenue have experienced growth since 2014,” she wrote. “For example, our earned and ticket revenue has risen from $4,914 to $74,730, and donations and foundations have doubled from $57,529 to $113,946.” Government funding as a percentage of the operations budget “has ranged from 44% to 57%. Last year, it was 52%,” she wrote.

The sponsorship funding flagged in the budget is expected to grow 19% this year, Di Pietro said, adding that it’s too early to make predictions about individual donations, which largely come in the fall.

One of the documents supplied to the Sun, however, shows the average donation for the non-profit’s walking and bus tours plummeted to a paltry $1.81 per attendee in 2023, far below expectations and short of the $4.05 average in 2022. Heritage went into 2024 budgeting for drops in both private donations and corporate sponsorships.

Di Pietro said that difference is “offset by the move to a paid ticket model and a focus on ticket revenues.” Ticket sales are up by half this year and donations per tour attendee were up by a quarter in 2024, she added.

Key to Heritage Toronto’s finances is TD Bank, which sponsors its tours program and what it calls its “equity heritage initiative.” While TD has provided five years of funding for the equity initiative, a “development notes” document warned Heritage Toronto potentially faces “the loss or massive reduction in TD funding in 2026.”

(Di Pietro said the charity is “optimistic about continuing to work with TD.” The bank did not respond to a request for comment.)

Jackie Shane plaque

This Heritage Toronto plaque featuring Jackie Shane, a transgender musician, is mentioned in emails from the charity released to the Toronto Sun. A live event was held for its unveiling, which is less common for Heritage Toronto now than before 2020. Photo by Jack Boland/Toronto Sun

Di Pietro said managing the large pool of “project-directed” money requires “a constant balance … We can’t undertake project work that leads to either an operational surplus or deficit.” But in a June 2024 email to three staffers, Bain said the charity had a $100,000 operational deficit on its equity work – a big chunk for an organization with a total budget not far above $1 million.

“I do have to note that we are running a $100K deficit in our equity work, so we could cancel some things but expenses would have to rise in other areas in order to avoid generating an operational surplus,” Bain wrote, adding that she was “committed to leveraging as much of our resources as possible to address equity work which can be sustained once the TD grant expires.”

And in an email about digital ads in February that year, Bain told Di Pietro “the only way we could afford this (is) if we charged to equity.”

This focus has been no secret. Equity is the central theme in the charity’s latest State of Heritage report, which features images of a drag brunch, a lesbian bathhouse and vulgar graffiti at the former Ryerson University.

While plaques manager Chris Bateman said in a May 2024 email that a new online focus means the charity reaches “far more people overall with plaque programming” than pre-COVID, when it held more in-person events, other emails show the digital shift has been challenging.

Di Pietro told Bain in a November 2024 email that while they “barely use” YouTube, “anyone can see that” a Heritage Toronto video “has had 146 views with 0 comments and 5 likes.”

That followed an email in which Bain fretted that other than a Heritage Toronto staffer and two people with City Hall, “only 11 people clicked on the link” calling for end-of-year donations.

“That is not good news for us finding new donors,” Bain wrote. (Di Pietro told the Sun the soft response to one “wide communication” was not a concern.)

The non-profit has worked to widen its audience.

A plaque memorializing a dead raccoon — dubbed Conrad — was placed on Yonge St. in July. Meg Sutton, Heritage Toronto’s plaques co-ordinator, told The Canadian Press that community engagement was the goal of the plaque.

A year before, in July 2024, Bain got an email from Bateman that brought up Conrad – and floated an alternative critter candidate for a new plaque.

“I’m looking for something quick and fun that wouldn’t require extensive research, consultation or stakeholder review. We did a serious subject last year (the Chinese Exclusion Act), so I’m seriously considering Ikea Monkey or the raccoon that people built a shrine for,” Bateman wrote. (Di Pietro said there is no current plan for an Ikea Monkey plaque.)

jholmes@postmedia.com

Taxpayers stuck with growing bill from equity-obsessed city charity

Historical plaque maker Heritage Toronto has struggled with public engagement even as its government funding has soared, documents show.

Canada's deficit to surge to $100 billion, National Bank chief economist says

National Bank of Canada's Stefane Marion says shortfall will reach $100 billion this fiscal year.

Author of the article:Bloomberg News

Bloomberg News

Erik Hertzberg

Published Oct 07, 2025 • Last updated 1 day ago • 2 minute read

Prime Minister Mark Carney meets with U.S. President Donald Trump in the Oval Office of the White House in Washington, D.C., Tuesday, Oct. 7, 2025.

Prime Minister Mark Carney meets with U.S. President Donald Trump in the Oval Office of the White House in Washington, D.C., Tuesday, Oct. 7, 2025.

One of Canada’s major lenders says Prime Minister Mark Carney will push the country’s deficit to about 3% of its gross domestic product as his government pursues major projects and tries to attract more investment.

Stefane Marion, National Bank of Canada’s chief economist, said he expects Ottawa’s fiscal shortfall will reach $100 billion this fiscal year, more than double the $42 billion the government forecast in December.

Speaking at Bloomberg’s Canadian Finance Conference on Tuesday, Marion called Carney’s upcoming fiscal update on Nov. 4 the “most consequential budget in a generation” after a decade of “suboptimal” economic policy.

Canada’s deficits are in a relatively good position compared to other Group of Seven countries, he said.

“We do have some fiscal room when you compare Canada to the rest to the world,” Marion said. “We should not waste it.”

Marion is among a growing chorus of economists and business leaders who are optimistic about the government’s plans to invest in infrastructure, defence and housing to help boost Canada’s sagging productivity.

Investment in Canada has stagnated since 2015, a major contrast with the U.S., where business outlays have flourished. That’s due in part to limited capital spending in Canada’s energy sector, which has contended with lower oil prices and growing regulatory burdens.

Carney’s plan to review federal regulations that may be stunting Canada’s potential to become an energy and industrial superpower is another step in the right direction, Marion said.

“We’ve been stranding these assets by not knowing whether or not we could exploit them down the road,” he said. “If you’re going to re-industrialize and the U.S. wants to re-industrialize, I can find no better partner than Canada.”

He also pointed to Canada’s relatively clean electricity sector as a major opportunity for foreign investment.

“I’m optimistic that Ottawa is serious about improving the outlook,” he said.

Marion sees the Bank of Canada cutting the policy rate by a quarter-point to 2.25% at its next meeting on Oct. 29, but says the central bank will likely pause as policymakers parse the details of the federal government’s budget.

“It will be a stimulative budget,” Marion said.

torontosun.com

torontosun.com

National Bank of Canada's Stefane Marion says shortfall will reach $100 billion this fiscal year.

Author of the article:Bloomberg News

Bloomberg News

Erik Hertzberg

Published Oct 07, 2025 • Last updated 1 day ago • 2 minute read

Prime Minister Mark Carney meets with U.S. President Donald Trump in the Oval Office of the White House in Washington, D.C., Tuesday, Oct. 7, 2025.

Prime Minister Mark Carney meets with U.S. President Donald Trump in the Oval Office of the White House in Washington, D.C., Tuesday, Oct. 7, 2025.

One of Canada’s major lenders says Prime Minister Mark Carney will push the country’s deficit to about 3% of its gross domestic product as his government pursues major projects and tries to attract more investment.

Stefane Marion, National Bank of Canada’s chief economist, said he expects Ottawa’s fiscal shortfall will reach $100 billion this fiscal year, more than double the $42 billion the government forecast in December.

Speaking at Bloomberg’s Canadian Finance Conference on Tuesday, Marion called Carney’s upcoming fiscal update on Nov. 4 the “most consequential budget in a generation” after a decade of “suboptimal” economic policy.

Canada’s deficits are in a relatively good position compared to other Group of Seven countries, he said.

“We do have some fiscal room when you compare Canada to the rest to the world,” Marion said. “We should not waste it.”

Marion is among a growing chorus of economists and business leaders who are optimistic about the government’s plans to invest in infrastructure, defence and housing to help boost Canada’s sagging productivity.

Investment in Canada has stagnated since 2015, a major contrast with the U.S., where business outlays have flourished. That’s due in part to limited capital spending in Canada’s energy sector, which has contended with lower oil prices and growing regulatory burdens.

Carney’s plan to review federal regulations that may be stunting Canada’s potential to become an energy and industrial superpower is another step in the right direction, Marion said.

“We’ve been stranding these assets by not knowing whether or not we could exploit them down the road,” he said. “If you’re going to re-industrialize and the U.S. wants to re-industrialize, I can find no better partner than Canada.”

He also pointed to Canada’s relatively clean electricity sector as a major opportunity for foreign investment.

“I’m optimistic that Ottawa is serious about improving the outlook,” he said.

Marion sees the Bank of Canada cutting the policy rate by a quarter-point to 2.25% at its next meeting on Oct. 29, but says the central bank will likely pause as policymakers parse the details of the federal government’s budget.

“It will be a stimulative budget,” Marion said.

Canada's deficit to surge to $100 billion, National Bank chief economist says

One of Canada’s major lenders says Prime Minister Mark Carney will push the country’s deficit to about 3% of its gross domestic product.

What are they borrowing against? Same old same old or new schemes? With gold hitting $4K inflation isn't going away.Canada's deficit to surge to $100 billion, National Bank chief economist says

National Bank of Canada's Stefane Marion says shortfall will reach $100 billion this fiscal year.

Author of the article:Bloomberg News

Bloomberg News

Erik Hertzberg

Published Oct 07, 2025 • Last updated 1 day ago • 2 minute read

Prime Minister Mark Carney meets with U.S. President Donald Trump in the Oval Office of the White House in Washington, D.C., Tuesday, Oct. 7, 2025.

Prime Minister Mark Carney meets with U.S. President Donald Trump in the Oval Office of the White House in Washington, D.C., Tuesday, Oct. 7, 2025.

One of Canada’s major lenders says Prime Minister Mark Carney will push the country’s deficit to about 3% of its gross domestic product as his government pursues major projects and tries to attract more investment.

Stefane Marion, National Bank of Canada’s chief economist, said he expects Ottawa’s fiscal shortfall will reach $100 billion this fiscal year, more than double the $42 billion the government forecast in December.

Speaking at Bloomberg’s Canadian Finance Conference on Tuesday, Marion called Carney’s upcoming fiscal update on Nov. 4 the “most consequential budget in a generation” after a decade of “suboptimal” economic policy.

Canada’s deficits are in a relatively good position compared to other Group of Seven countries, he said.

“We do have some fiscal room when you compare Canada to the rest to the world,” Marion said. “We should not waste it.”

Marion is among a growing chorus of economists and business leaders who are optimistic about the government’s plans to invest in infrastructure, defence and housing to help boost Canada’s sagging productivity.

Investment in Canada has stagnated since 2015, a major contrast with the U.S., where business outlays have flourished. That’s due in part to limited capital spending in Canada’s energy sector, which has contended with lower oil prices and growing regulatory burdens.

Carney’s plan to review federal regulations that may be stunting Canada’s potential to become an energy and industrial superpower is another step in the right direction, Marion said.

“We’ve been stranding these assets by not knowing whether or not we could exploit them down the road,” he said. “If you’re going to re-industrialize and the U.S. wants to re-industrialize, I can find no better partner than Canada.”

He also pointed to Canada’s relatively clean electricity sector as a major opportunity for foreign investment.

“I’m optimistic that Ottawa is serious about improving the outlook,” he said.

Marion sees the Bank of Canada cutting the policy rate by a quarter-point to 2.25% at its next meeting on Oct. 29, but says the central bank will likely pause as policymakers parse the details of the federal government’s budget.

“It will be a stimulative budget,” Marion said.

Canada's deficit to surge to $100 billion, National Bank chief economist says

One of Canada’s major lenders says Prime Minister Mark Carney will push the country’s deficit to about 3% of its gross domestic product.torontosun.com

Good thing Canada sold all their gold at $850 / oz.What are they borrowing against? Same old same old or new schemes? With gold hitting $4K inflation isn't going away.

Sadly managed when you consider the gold resources in the country.

Its now viable to extract our vast but mostly remote gold resources.Good thing Canada sold all their gold at $850 / oz.

Sadly managed when you consider the gold resources in the country.

federal government spends millions on promo merch

Government departments spent $207,000 on hats, $607,000 on bags and $52,000 on socks since 2022

Author of the article:Bryan Passifiume

Published Oct 28, 2025 • Last updated 1 day ago • 2 minute read

Canadian dollars, Counting on smartphone calculator, CAD money, notes in notebook. Financial settlement, Household budget, Taxes, Canada currency exchange rate, Business Financial Analysis Concept

Canada's bureaucracy spent over $13 million on branded merchandise since 2022.

OTTAWA — Hats and bags were in high demand among government bureaucrats, as federal departments spent nearly $1 million on just those two pieces of highly-priced tat.

In government documents uncovered via an enormous 900-page response to an order paper question filed by Conservative MP Michelle Rempel Garner, Canada’s bureaucracy spent over $13 million on branded merchandise since 2022 — consisting of all manner of promotional tchotchkes, including socks, pricey Yeti and Stanley tumblers, air fresheners and pens.

“It’s like the government had a contest to see which department could come up with the dumbest way to spend taxpayers’ money and they all won,” said Franco Terrazzano, federal director of the Canadian Taxpayers Federation, who uncovered the documents.

“This is what happens when you have too many bureaucrats with too many tax dollars.”

RCMP biggest spender, but refused to disclose details

Across all departments, $207,000 was spent on hats, $607,000 on bags and $52,000 on socks.

The biggest spender was the RCMP, with the federal police service spending over $4 million on merchandise — but claimed no records existed detailing what was spent on what.

Canadian Heritage was the second-biggest spender on promotional trinkets, spending more than $2 million.

That number included spending $1.7 million on three-foot by six-foot Canadian flags, $143,000 on Canadian flag lapel pins, $14,000 on Canadian flags for desks and $16,000 for pins and cards with words of encouragement for Canadian athletes competing in the 2024 Paris Olympics.

CBC-Radio Canada also declined to provide details on what they spent on branded kickshaws.

Mint spends a mint on leather notepads

The Department of National Defence spent $1.4 million on promotional knickknacks, while Farm Credit Canada spent $871,000 — including $32,600 on tractor-shaped air fresheners.

Trendy Yeti and Stanley drinkware were also hot items, with $40,000 spent on the tumblers.

Public Safety Canada alone spent nearly $16,000 on branded YETI water bottles for their Young Women in Public Safety program, an initiative that also saw the department spend $5,715 on Whitney water bottles, $1,205 on T-shirts, $804 on wine tumblers.

Natural Resources Canada spent $256,061 on promotional items, including $7,000 for environmentally-friendly notebooks, and $8,000 on Geological Survey of Canada notebooks.

Nearly $42,000 was spent by the Royal Canadian Mint on leather journals with laser-engraved pens, while VIA Rail spent $262,000 on merch — including $5,000 on air fresheners promoting the national railway’s new rolling stock.

Questionable spending not isolated

Thousands more were spent across all departments on temporary tattoos, sunglasses, branded charcuterie boards and coffee mugs.

“Government bureaucrats dropping thousands of dollars on stress balls really stresses taxpayers out,” Terrazzano said.

“Unless the temporary tattoos show the national debt to remind bureaucrats to cut spending, it’s a waste of money.”

This isn’t the only instance of questionable government spending.

Last year, Canadian bureaucrats spent nearly $8 million renting art from the government-run federal art bank, while the Trudeau Liberals shelled out nearly $2 million to produce government podcasts that few Canadians bothered listening to — including $155,736 by Canadian Heritage to produce seven episodes of a podcast on the care and conservation of cultural artifacts.

bpassifiume@postmedia.com

X: @bryanpassifiume

torontosun.com

torontosun.com

Government departments spent $207,000 on hats, $607,000 on bags and $52,000 on socks since 2022

Author of the article:Bryan Passifiume

Published Oct 28, 2025 • Last updated 1 day ago • 2 minute read

Canadian dollars, Counting on smartphone calculator, CAD money, notes in notebook. Financial settlement, Household budget, Taxes, Canada currency exchange rate, Business Financial Analysis Concept

Canada's bureaucracy spent over $13 million on branded merchandise since 2022.

OTTAWA — Hats and bags were in high demand among government bureaucrats, as federal departments spent nearly $1 million on just those two pieces of highly-priced tat.

In government documents uncovered via an enormous 900-page response to an order paper question filed by Conservative MP Michelle Rempel Garner, Canada’s bureaucracy spent over $13 million on branded merchandise since 2022 — consisting of all manner of promotional tchotchkes, including socks, pricey Yeti and Stanley tumblers, air fresheners and pens.

“It’s like the government had a contest to see which department could come up with the dumbest way to spend taxpayers’ money and they all won,” said Franco Terrazzano, federal director of the Canadian Taxpayers Federation, who uncovered the documents.

“This is what happens when you have too many bureaucrats with too many tax dollars.”

RCMP biggest spender, but refused to disclose details

Across all departments, $207,000 was spent on hats, $607,000 on bags and $52,000 on socks.

The biggest spender was the RCMP, with the federal police service spending over $4 million on merchandise — but claimed no records existed detailing what was spent on what.

Canadian Heritage was the second-biggest spender on promotional trinkets, spending more than $2 million.

That number included spending $1.7 million on three-foot by six-foot Canadian flags, $143,000 on Canadian flag lapel pins, $14,000 on Canadian flags for desks and $16,000 for pins and cards with words of encouragement for Canadian athletes competing in the 2024 Paris Olympics.

CBC-Radio Canada also declined to provide details on what they spent on branded kickshaws.

Mint spends a mint on leather notepads

The Department of National Defence spent $1.4 million on promotional knickknacks, while Farm Credit Canada spent $871,000 — including $32,600 on tractor-shaped air fresheners.

Trendy Yeti and Stanley drinkware were also hot items, with $40,000 spent on the tumblers.

Public Safety Canada alone spent nearly $16,000 on branded YETI water bottles for their Young Women in Public Safety program, an initiative that also saw the department spend $5,715 on Whitney water bottles, $1,205 on T-shirts, $804 on wine tumblers.

Natural Resources Canada spent $256,061 on promotional items, including $7,000 for environmentally-friendly notebooks, and $8,000 on Geological Survey of Canada notebooks.

Nearly $42,000 was spent by the Royal Canadian Mint on leather journals with laser-engraved pens, while VIA Rail spent $262,000 on merch — including $5,000 on air fresheners promoting the national railway’s new rolling stock.

Questionable spending not isolated

Thousands more were spent across all departments on temporary tattoos, sunglasses, branded charcuterie boards and coffee mugs.

“Government bureaucrats dropping thousands of dollars on stress balls really stresses taxpayers out,” Terrazzano said.

“Unless the temporary tattoos show the national debt to remind bureaucrats to cut spending, it’s a waste of money.”

This isn’t the only instance of questionable government spending.

Last year, Canadian bureaucrats spent nearly $8 million renting art from the government-run federal art bank, while the Trudeau Liberals shelled out nearly $2 million to produce government podcasts that few Canadians bothered listening to — including $155,736 by Canadian Heritage to produce seven episodes of a podcast on the care and conservation of cultural artifacts.

bpassifiume@postmedia.com

X: @bryanpassifiume

Hats to socks — federal government spends millions on promo merch

Government departments spent $207,000 on hats, $607,000 on bags and $52,000 on socks since 2022

Tradeshow swag. Nothing uncommon about it.federal government spends millions on promo merch

Government departments spent $207,000 on hats, $607,000 on bags and $52,000 on socks since 2022

Author of the article:Bryan Passifiume

Published Oct 28, 2025 • Last updated 1 day ago • 2 minute read

Canadian dollars, Counting on smartphone calculator, CAD money, notes in notebook. Financial settlement, Household budget, Taxes, Canada currency exchange rate, Business Financial Analysis Concept

Canada's bureaucracy spent over $13 million on branded merchandise since 2022.

OTTAWA — Hats and bags were in high demand among government bureaucrats, as federal departments spent nearly $1 million on just those two pieces of highly-priced tat.

In government documents uncovered via an enormous 900-page response to an order paper question filed by Conservative MP Michelle Rempel Garner, Canada’s bureaucracy spent over $13 million on branded merchandise since 2022 — consisting of all manner of promotional tchotchkes, including socks, pricey Yeti and Stanley tumblers, air fresheners and pens.

“It’s like the government had a contest to see which department could come up with the dumbest way to spend taxpayers’ money and they all won,” said Franco Terrazzano, federal director of the Canadian Taxpayers Federation, who uncovered the documents.

“This is what happens when you have too many bureaucrats with too many tax dollars.”

RCMP biggest spender, but refused to disclose details

Across all departments, $207,000 was spent on hats, $607,000 on bags and $52,000 on socks.

The biggest spender was the RCMP, with the federal police service spending over $4 million on merchandise — but claimed no records existed detailing what was spent on what.

Canadian Heritage was the second-biggest spender on promotional trinkets, spending more than $2 million.

That number included spending $1.7 million on three-foot by six-foot Canadian flags, $143,000 on Canadian flag lapel pins, $14,000 on Canadian flags for desks and $16,000 for pins and cards with words of encouragement for Canadian athletes competing in the 2024 Paris Olympics.

CBC-Radio Canada also declined to provide details on what they spent on branded kickshaws.

Mint spends a mint on leather notepads

The Department of National Defence spent $1.4 million on promotional knickknacks, while Farm Credit Canada spent $871,000 — including $32,600 on tractor-shaped air fresheners.

Trendy Yeti and Stanley drinkware were also hot items, with $40,000 spent on the tumblers.

Public Safety Canada alone spent nearly $16,000 on branded YETI water bottles for their Young Women in Public Safety program, an initiative that also saw the department spend $5,715 on Whitney water bottles, $1,205 on T-shirts, $804 on wine tumblers.

Natural Resources Canada spent $256,061 on promotional items, including $7,000 for environmentally-friendly notebooks, and $8,000 on Geological Survey of Canada notebooks.

Nearly $42,000 was spent by the Royal Canadian Mint on leather journals with laser-engraved pens, while VIA Rail spent $262,000 on merch — including $5,000 on air fresheners promoting the national railway’s new rolling stock.

Questionable spending not isolated

Thousands more were spent across all departments on temporary tattoos, sunglasses, branded charcuterie boards and coffee mugs.

“Government bureaucrats dropping thousands of dollars on stress balls really stresses taxpayers out,” Terrazzano said.

“Unless the temporary tattoos show the national debt to remind bureaucrats to cut spending, it’s a waste of money.”

This isn’t the only instance of questionable government spending.

Last year, Canadian bureaucrats spent nearly $8 million renting art from the government-run federal art bank, while the Trudeau Liberals shelled out nearly $2 million to produce government podcasts that few Canadians bothered listening to — including $155,736 by Canadian Heritage to produce seven episodes of a podcast on the care and conservation of cultural artifacts.

bpassifiume@postmedia.com

X: @bryanpassifiume

Hats to socks — federal government spends millions on promo merch

Government departments spent $207,000 on hats, $607,000 on bags and $52,000 on socks since 2022torontosun.com

Finance Department says Ottawa posted $11.1B deficit for April-to-August period

Author of the article:Canadian Press

Canadian Press

Published Oct 31, 2025 • 1 minute read

The gloves are off when it comes to a new bill being proposed by Immigration Minister Lena Diab, says Blacklock’s Reporter.

OTTAWA — The federal government posted a deficit of $11.1 billion for the April-to-August period of its 2025-26 fiscal year.

In its monthly fiscal monitor report, the Finance Department says the result compared with a deficit of $9.8 billion for the same period a year earlier.

Revenue for the five-month period totalled $201.2 billion compared with $196.3 billion for the same stretch a year earlier, helped by higher corporate and personal income tax revenue and higher customs import duties, partially offset by lower GST revenues.

Program expenses, excluding net actuarial losses, amounted to $187.2 billion, up from $179.8 billion a year earlier, as spending on elderly benefits rose and EI benefit costs also increased, reflecting a higher unemployment rate. Major transfers to provinces, territories and municipalities also climbed.

Public debt charges for the period totalled $23 billion, down from $23.2 billion a year ago, while net actuarial losses amounted to $2.1 billion, down from $3.2 billion.

The figures come ahead of the federal budget next week.

torontosun.com

torontosun.com

Author of the article:Canadian Press

Canadian Press

Published Oct 31, 2025 • 1 minute read

The gloves are off when it comes to a new bill being proposed by Immigration Minister Lena Diab, says Blacklock’s Reporter.

OTTAWA — The federal government posted a deficit of $11.1 billion for the April-to-August period of its 2025-26 fiscal year.

In its monthly fiscal monitor report, the Finance Department says the result compared with a deficit of $9.8 billion for the same period a year earlier.

Revenue for the five-month period totalled $201.2 billion compared with $196.3 billion for the same stretch a year earlier, helped by higher corporate and personal income tax revenue and higher customs import duties, partially offset by lower GST revenues.

Program expenses, excluding net actuarial losses, amounted to $187.2 billion, up from $179.8 billion a year earlier, as spending on elderly benefits rose and EI benefit costs also increased, reflecting a higher unemployment rate. Major transfers to provinces, territories and municipalities also climbed.

Public debt charges for the period totalled $23 billion, down from $23.2 billion a year ago, while net actuarial losses amounted to $2.1 billion, down from $3.2 billion.

The figures come ahead of the federal budget next week.

Finance Department says Ottawa posted $11.1B deficit for April-to-August period

The federal government posted a deficit of $11.1 billion for the April-to-August period of its 2025-26 fiscal year.

Finance Department reports $11.1B deficit ahead of budget

Budget 2025 is set to be released Tuesday

Author of the article:Bryan Passifiume

Published Oct 31, 2025 • 1 minute read

OTTAWA — As Ottawa prepares to table Prime Minister Mark Carney’s first budget on Tuesday, the federal government reported a hefty deficit.

For the period between April and August in the current fiscal year, the Department of Finance posted a $11.1 billion deficit — up $1.3 billion from the same five-month period last year.

Expenses likewise saw an increase this year over last, aided by increased program spending on EI benefits, fall out from Canada’s high unemployment rate.

Unemployment still at record high

Canada’s jobless rate for September 2025 saw record highs unseen since Aug. 2021, holding at the same 7.1% figures seen in August.

Unemployment over the summer largely fell from the 7.0% seen in May, holding steady at 6.9% in June and July — and far higher than 2025’s lows of 6.6% seen in January and February.

Increased spending on old-age benefits also contributed to an increase in program expenses.

As context, program spending amounted to $179.8 billion between April and August in fiscal year 2024-25.

Revenues over that period were higher this year than they were a year ago, totaling $201.2 billion — a figure impacted by lower revenues from sales tax but bolstered by increased income tax revenue and a bump in import duties.

Revenue between April and August in fiscal year 2024-25 totaled $196.3 billion.

— With files from Canadian Press

bpassifiume@postmedia.com

X: @bryanpassifiume

torontosun.com

torontosun.com

Budget 2025 is set to be released Tuesday

Author of the article:Bryan Passifiume

Published Oct 31, 2025 • 1 minute read

OTTAWA — As Ottawa prepares to table Prime Minister Mark Carney’s first budget on Tuesday, the federal government reported a hefty deficit.

For the period between April and August in the current fiscal year, the Department of Finance posted a $11.1 billion deficit — up $1.3 billion from the same five-month period last year.

Expenses likewise saw an increase this year over last, aided by increased program spending on EI benefits, fall out from Canada’s high unemployment rate.

Unemployment still at record high

Canada’s jobless rate for September 2025 saw record highs unseen since Aug. 2021, holding at the same 7.1% figures seen in August.

Unemployment over the summer largely fell from the 7.0% seen in May, holding steady at 6.9% in June and July — and far higher than 2025’s lows of 6.6% seen in January and February.

Increased spending on old-age benefits also contributed to an increase in program expenses.

As context, program spending amounted to $179.8 billion between April and August in fiscal year 2024-25.

Revenues over that period were higher this year than they were a year ago, totaling $201.2 billion — a figure impacted by lower revenues from sales tax but bolstered by increased income tax revenue and a bump in import duties.

Revenue between April and August in fiscal year 2024-25 totaled $196.3 billion.

— With files from Canadian Press

bpassifiume@postmedia.com

X: @bryanpassifiume

Finance Department reports $11.1B deficit ahead of budget

As Ottawa prepares to table Prime Minister Mark Carney's first budget, the federal government reported a hefty deficit. Read more.