People without children are pushing this.This whole Bill needs to go into the trash! Do we not already have laws on the books for protecting children, hate crimes et al? If they need to be amended, then do so but the rest can be garbaged.

Bill’s C-10 & C-11. If we aren’t talking about it already, shouldn’t we be?

- Thread starter Ron in Regina

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

CRTC launches review of Canadian content definition

Author of the article:Canadian Press

Canadian Press

Anja Karadeglija

Published Nov 15, 2024 • Last updated 1 day ago • 2 minute read

OTTAWA — The CRTC is looking at how to redefine Canadian content, launching a new consultation on the question with plans to hold a public hearing in the spring.

Scott Shortliffe, the CRTC’s executive director of broadcasting, said Friday the regulator hopes to get robust public participation on the new definition.

The consultation is part of the CRTC’s implementation of the Online Streaming Act, which updated broadcasting laws to capture online platforms. Part of that effort involves looking to ensure Canadian content is visible and easily discoverable on streaming services.

The CRTC has issued a preliminary position suggesting it keep the points system that has long been used to determine whether content is considered Canadian. It is considering expanding that to allow more creative positions to count toward the points total.

“Canadian producers and entities are used to a points system … switching to a different system would be a great dislocation,” Shortliffe said.

The regulator also wants input on questions including whether artificial intelligence-created video can be considered Cancon.

While the Online Streaming Act was passed just last year, Shortliffe noted “it did not mention artificial intelligence because very honestly, that was an emerging issue.”

“In the time since it’s passed, the commission has become convinced that this is an issue that we must take into account,” he said.

Shortliffe said that includes questions about whether AI can be considered Canadian content, and if so, under what circumstances.

The regulator already held consultations with hundreds of stakeholders to discuss redefining Canadian content. Shortliffe said Canadian producers, writers and directors were “of course, extremely well represented.”

“We are very pleased that foreign streamers did take part. I would suspect that the foreign streamers possibly felt outnumbered at some of the sessions, but they had an important voice too.”

The consultation launched Friday applies to video content like television, not radio and streaming audio.

The CRTC is already facing a court challenge over its efforts to bring online platforms under regulation.

Global streaming services such as Netflix and Disney Plus are fighting an earlier directive the CRTC made under the Online Streaming Act requiring them to contribute money to Canada’s broadcast sector.

torontosun.com

torontosun.com

Author of the article:Canadian Press

Canadian Press

Anja Karadeglija

Published Nov 15, 2024 • Last updated 1 day ago • 2 minute read

OTTAWA — The CRTC is looking at how to redefine Canadian content, launching a new consultation on the question with plans to hold a public hearing in the spring.

Scott Shortliffe, the CRTC’s executive director of broadcasting, said Friday the regulator hopes to get robust public participation on the new definition.

The consultation is part of the CRTC’s implementation of the Online Streaming Act, which updated broadcasting laws to capture online platforms. Part of that effort involves looking to ensure Canadian content is visible and easily discoverable on streaming services.

The CRTC has issued a preliminary position suggesting it keep the points system that has long been used to determine whether content is considered Canadian. It is considering expanding that to allow more creative positions to count toward the points total.

“Canadian producers and entities are used to a points system … switching to a different system would be a great dislocation,” Shortliffe said.

The regulator also wants input on questions including whether artificial intelligence-created video can be considered Cancon.

While the Online Streaming Act was passed just last year, Shortliffe noted “it did not mention artificial intelligence because very honestly, that was an emerging issue.”

“In the time since it’s passed, the commission has become convinced that this is an issue that we must take into account,” he said.

Shortliffe said that includes questions about whether AI can be considered Canadian content, and if so, under what circumstances.

The regulator already held consultations with hundreds of stakeholders to discuss redefining Canadian content. Shortliffe said Canadian producers, writers and directors were “of course, extremely well represented.”

“We are very pleased that foreign streamers did take part. I would suspect that the foreign streamers possibly felt outnumbered at some of the sessions, but they had an important voice too.”

The consultation launched Friday applies to video content like television, not radio and streaming audio.

The CRTC is already facing a court challenge over its efforts to bring online platforms under regulation.

Global streaming services such as Netflix and Disney Plus are fighting an earlier directive the CRTC made under the Online Streaming Act requiring them to contribute money to Canada’s broadcast sector.

Can AI be Cancon? CRTC launches review of Canadian content definition

The CRTC is looking at how to redefine Canadian content, launching a new consultation with plans to hold a public hearing in the spring.

Oh boy. More B.S. in "redefining" some words. I can't imagine this turning out well for Canadians.CRTC launches review of Canadian content definition

Author of the article:Canadian Press

Canadian Press

Anja Karadeglija

Published Nov 15, 2024 • Last updated 1 day ago • 2 minute read

OTTAWA — The CRTC is looking at how to redefine Canadian content, launching a new consultation on the question with plans to hold a public hearing in the spring.

Scott Shortliffe, the CRTC’s executive director of broadcasting, said Friday the regulator hopes to get robust public participation on the new definition.

The consultation is part of the CRTC’s implementation of the Online Streaming Act, which updated broadcasting laws to capture online platforms. Part of that effort involves looking to ensure Canadian content is visible and easily discoverable on streaming services.

The CRTC has issued a preliminary position suggesting it keep the points system that has long been used to determine whether content is considered Canadian. It is considering expanding that to allow more creative positions to count toward the points total.

“Canadian producers and entities are used to a points system … switching to a different system would be a great dislocation,” Shortliffe said.

The regulator also wants input on questions including whether artificial intelligence-created video can be considered Cancon.

While the Online Streaming Act was passed just last year, Shortliffe noted “it did not mention artificial intelligence because very honestly, that was an emerging issue.”

“In the time since it’s passed, the commission has become convinced that this is an issue that we must take into account,” he said.

Shortliffe said that includes questions about whether AI can be considered Canadian content, and if so, under what circumstances.

The regulator already held consultations with hundreds of stakeholders to discuss redefining Canadian content. Shortliffe said Canadian producers, writers and directors were “of course, extremely well represented.”

“We are very pleased that foreign streamers did take part. I would suspect that the foreign streamers possibly felt outnumbered at some of the sessions, but they had an important voice too.”

The consultation launched Friday applies to video content like television, not radio and streaming audio.

The CRTC is already facing a court challenge over its efforts to bring online platforms under regulation.

Global streaming services such as Netflix and Disney Plus are fighting an earlier directive the CRTC made under the Online Streaming Act requiring them to contribute money to Canada’s broadcast sector.

Can AI be Cancon? CRTC launches review of Canadian content definition

The CRTC is looking at how to redefine Canadian content, launching a new consultation with plans to hold a public hearing in the spring.torontosun.com

This Bill should never see the light of day. If they needed to strengthen the laws abour child porn, trafficking etc., then that's what they need to do. But they're putting a whole raft ofI'm still not sure how I feel about this bill.

On the one hand I feel like trying to regulate/control the internet in any way is like herding cats.

On the other hand, there needs to be some sort of regulations/guidelines at least for content at least on commercial platforms, and considering what's out there online, relying on individual people to do the regulating isn't smart, cause... people won't.

But again, I'm not sure which is worse.

“I would move away from that, and think about the other places that we have a mutual interest in moving forward,” Morneau told CTV’s Question Period host Vassy Kapelos in an interview airing Sunday. “And do that in a way that's calm and that recognizes that we need to have an enduring ability to work together.”On June 28, Ontario Finance Minister Peter Bethlenfalvy wrote to Freeland asking that the tax's implementation be paused because it’s just such an awesome idea? Nope, ‘cuz “We must do this carefully and not in a way that will impose unnecessary taxes on people and businesses or risk isolating Canada from the U.S. marketplace." Oh, well, that too I guess.

Morneau said that in dealing with U.S. president-elect Donald Trump — and his looming threat of tariffs on Canadian imports — the federal government should look for issues on which the two countries can work together, as opposed to ones that “can inflame differences."

It has been deeply unpopular and widely criticized by American lawmakers, who have argued for years that the policy disproportionately impacts U.S. companies…so the Liberal/NDP put it in place on July 4th ‘cuz diplomacy.Anywho….today is a banner day for Lib/NDP etc…

If we’re going to discriminate against our largest (& only physically connected) trade partner…might as well come into effect July 4th. Who’s potentially the next US octogenarian president going to be again? Trudeau’s buddy….whats his name again?

The federal government has enacted a controversial digital services tax that will bring in billions of dollars while threatening Canada's trading relationships by taxing the revenue international firms earn in Canada….& after a 10 month overlap between Trudeau/Singh & that other dude (blond mop, orange skin, what’s his name again? Oompa Loompa or something?).

The Liberal government proposed the tax in its 2019 election platform. It later agreed to delay implementing the measure until the end of 2023 in the hopes it could reach a deal with other OECD countries on how multinational digital companies should be taxed.

Deputy Prime Minister and Finance Minister Chrystia Freeland told reporters in Milton, Ont. on Thursday that "Canada's preference is, and has always been, a multilateral solution."

"It’s simply not reasonable, not fair, for Canada to indefinitely put our own measures on hold," she said. "A number of other countries have a DST in place right now, and they have had a DST in place for a number of years with no retaliation [from the U.S.]."

Digital firms that have global annual income of at least $1.1 billion will see annual revenues in Canada over $20 million taxed at a rate of three per cent. The first year of the tax includes revenue earned since Jan. 1, 2022.

…& whom will eat this tax? Canadian content providers &/or subscription holders to these services? Wouldn’t that just make things more expensive for Canadians in general on top of pissing off our closest trade partner? Would that matter to a Liberal government?

The Liberal government's decision to impose the tax before an international agreement could be reached with other OECD countries has raised concerns about “possible” negative impacts.

U.S. Ambassador to Canada David Cohen issued a media statement Thursday calling the tax "discriminatory."

"[The United States Trade Representative] has noted its concern with Canada's digital services tax and is assessing, and is open to using, all available tools that could result in meaningful progress toward addressing unilateral, discriminatory [digital services taxes]," Cohen said in the statement.

As soon as the legislation enabling the tax became law, the U.S. Chamber of Commerce and the American Chamber of Commerce in Canada issued a statement strongly objecting to the measure, which they say will raise prices for everyone.

They said a digital services tax would disproportionately hit U.S. companies, undermine digital exports to Canada and violate Canada's obligations under the U.S.-Canada-Mexico free trade agreement and the World Trade Organization.

"At this very sensitive time in the Canada–U.S. trade relationship, we urge the Government of Canada to reconsider this unilateral and discriminatory new levy," the statement said.

Last month, the U.S. Computer and Communications Industry Association, which represents big tech companies such as Amazon, Apple and Uber, wrote to U.S. President Joe Biden asking his administration to initiate formal dispute settlement procedures under the United States-Mexico-Canada Agreement (USMCA). Happy July 4th to our American Friends and Neighbours!!!

The Canadian Chamber of Commerce told CBC News Thursday that "a retroactive discriminatory digital services tax" will harm Canada's relationship with the U.S. and raise the cost of living in Canada.

Liberal government enacts controversial digital services tax, raising trade concerns — CBC News

The federal government has enacted a controversial digital services tax that will bring in billions of dollars while threatening Canada's trading relationships by taxing the revenue international firms earn in Canada.apple.news

"The government should reverse its unilateral decision that is out of step with our allies, and instead work with our trading partners on an international solution that would better serve Canadians," Robin Guy, the chamber's vice president of government relations, told CBC News.

On June 28, Ontario Finance Minister Peter Bethlenfalvy wrote to Freeland asking that the tax's implementation be paused because it’s just such an awesome idea? Nope, ‘cuz “We must do this carefully and not in a way that will impose unnecessary taxes on people and businesses or risk isolating Canada from the U.S. marketplace." Oh, well, that too I guess.

While Finance Minister Chrystia Freeland has pointed to similar taxes levied by other western allies when faced with criticisms of the policy, American officials have countered by asking Ottawa to wait until a global framework is in place.

Last October, the parliamentary budget officer estimated the tax will generate $7.2 billion in revenues for the federal government over five years.

Despite the plan being announced more than three years ago, the digital services tax was only recently implemented on July 4th ‘cuz knowing how to read the room, etc... In August, U.S. Trade Representative Katherine Tai announced that her government had requested dispute settlement consultations through the North American free trade agreement — called CUSMA — over the issue.

Feds should consider scrapping controversial digital services tax amid Trump tariff threats: Morneau — CTV News

If the Canadian government wants to make headway with the incoming U.S. administration, it should look at scrapping some sticking-point policies, such as the controversial digital services tax, former Liberal finance minister Bill Morneau says.

So really just another tax grab.“I would move away from that, and think about the other places that we have a mutual interest in moving forward,” Morneau told CTV’s Question Period host Vassy Kapelos in an interview airing Sunday. “And do that in a way that's calm and that recognizes that we need to have an enduring ability to work together.”

Morneau said that in dealing with U.S. president-elect Donald Trump — and his looming threat of tariffs on Canadian imports — the federal government should look for issues on which the two countries can work together, as opposed to ones that “can inflame differences."

It has been deeply unpopular and widely criticized by American lawmakers, who have argued for years that the policy disproportionately impacts U.S. companies…so the Liberal/NDP put it in place on July 4th ‘cuz diplomacy.

While Finance Minister Chrystia Freeland has pointed to similar taxes levied by other western allies when faced with criticisms of the policy, American officials have countered by asking Ottawa to wait until a global framework is in place.

Last October, the parliamentary budget officer estimated the tax will generate $7.2 billion in revenues for the federal government over five years.

Despite the plan being announced more than three years ago, the digital services tax was only recently implemented on July 4th ‘cuz knowing how to read the room, etc... In August, U.S. Trade Representative Katherine Tai announced that her government had requested dispute settlement consultations through the North American free trade agreement — called CUSMA — over the issue.

Feds should consider scrapping controversial digital services tax amid Trump tariff threats: Morneau — CTV News

If the Canadian government wants to make headway with the incoming U.S. administration, it should look at scrapping some sticking-point policies, such as the controversial digital services tax, former Liberal finance minister Bill Morneau says.apple.news

That’ll potentially bite us in the ass.So really just another tax grab.

But instead…While Finance Minister Chrystia Freeland has pointed to similar taxes levied by other western allies when faced with criticisms of the policy, American officials have countered by asking Ottawa to wait until a global framework is in place.

Despite the plan being announced more than three years ago, the digital services tax was only recently implemented on July 4th ‘cuz knowing how to read the room, etc...

Independence Day (United States) - Wikipedia

Ah yes…Bill C-63. By proroguing Parliament on Monday, Prime Minister Justin Trudeau snuffed the life out of one of his favourite darlings: Bill C-63, also known as the online harms act. Good riddance.Indeed, even as Prime Minister Justin Trudeau issues statements denouncing Russia and China, his regime is now contemplating an online harms law, Bill C-63, which would permit judges to impose house arrest on those who they fear might commit a hate crime in the future. In the case of the most heinous speech, like advocating for genocide, this law would allow lifetime imprisonment. Lighter sentences or simple house arrest could be applied to anything that censors regard as hate speech, which could include such things as “misgendering” people or criticizing any aspect of Islam.

There’s no excuse for suspending democracy at a time like this, but we should at least celebrate the death of this atrocious bill. Had it (or the two bills the Liberals were to replace it with) passed, the Canadian Human Rights Commission would have been made sheriff of the Canadian internet, empowering it to drag anyone through a lengthy tribunal process making online comments perceived to be hateful. What’s worse, anyone reporting mean comments to this tribunal would be allowed to remain anonymous, which would have allowed the process to be weaponized with ease. Good times.

NP View: The age of Trudeau's censorship schemes is over

His campaign to place the internet under government control died when he prorogued Parliament

The act gave the CRTC the government’s blessing to impose Canadian content requirements on streaming giants, as well as some form of diversity requirements — similar to the ones imposed upon the CBC not too long ago. It also permitted the CRTC to take a cut of their Canadian revenues.

Despite the many objections they faced, the Liberals fast-tracked the bill through Parliament.

Now, not only is the government preparing to tell streaming companies what to produce and how to spend their budgets, it’s also making these services more expensive. (The fate of the CRTC’s house rake is currently in legal limbo as the streamers are currently challenging them in the courts, but some subscription prices have already been raised to account for these costs).

The Liberals wanted more control. They put millions of dollars into the dystopically named Changing Narratives Fund, to ensure that more media featuring favoured groups would be available to Canadian viewers. Even more millions were funnelled into a grab-bag of projects that claimed to combat disinformation and hate online.

To finally top it off, the government made its move to become censor-in-chief last February by tabling C-63 — and failed.

Ah yes…Bill C-63. By proroguing Parliament on Monday, Prime Minister Justin Trudeau snuffed the life out of one of his favourite darlings: Bill C-63, also known as the online harms act. Good riddance.

To finally top it off, the government made its move to become censor-in-chief last February by tabling C-63 — and failed.

Not so fast…Carney is using the same tactic of his predecessor (whom he is not, etc…). It was Justin Trudeau who first attempted to manipulate Canadians with fear for our children’s safety as a means to sneak in repressive, anti-free speech legislation.Amen

Consider then-prime minister Trudeau’s words from a February 2024 news conference in Edmonton: “We know and everyone can agree that kids are vulnerable online, to hatred, to violence, to being bullied, to seeing and being affected by terrible things online. And we need to do a better job as a society to protect our kids online,” Trudeau said, one week before tabling Bill C-63.There’s no excuse for suspending democracy at a time like this, but we should at least celebrate the death of this atrocious bill. Had it (or the two bills the Liberals were to replace it with) passed, the Canadian Human Rights Commission would have been made sheriff of the Canadian internet…

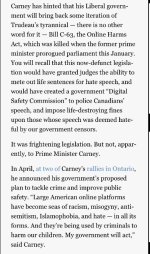

Using Trudeau’s old manipulation tactic, Carney has found an additional excuse to promote and justify government censorship. He revealed it at his April rally in Hamilton: “One of the issues we’re dealing with… misogyny, antisemitism, hatred, conspiracy theories — this sort of pollution that’s online that washes over our virtual borders from the United States… and, that’s fine… I can take the conspiracy theory and all that, but the more serious thing is when it affects how people behave in our society. When Canadians are threatened going to their community centres or their places of worship, or their schools,” said Carney.…empowering it to drag anyone through a lengthy tribunal process making online comments perceived to be hateful. What’s worse, anyone reporting mean comments to this tribunal would be allowed to remain anonymous, which would have allowed the process to be weaponized with ease. Good times.

Amy Hamm: The Mark Carney threat to free speech — National Post

He talks about controlling 'online platforms' the same way Trudeau did

New boss, etc…“Bill C-63 presents Canadians with a false choice: either we accept extraordinarily draconian punishments for our speech, or we can’t have common sense on-line protections,” said Executive Director Matt Hatfield in a letter to Virani in May. LINK, Etc…

If Carnage was truly concerned about any of this, he would abort the CBC.Using Trudeau’s old manipulation tactic, Carney has found an additional excuse to promote and justify government censorship. He revealed it at his April rally in Hamilton: “One of the issues we’re dealing with… misogyny, antisemitism, hatred, conspiracy theories — this sort of pollution that’s online that washes over our virtual borders from the United States… and, that’s fine… I can take the conspiracy theory and all that, but the more serious thing is when it affects how people behave in our society. When Canadians are threatened going to their community centres or their places of worship, or their schools,” said Carney.

Carney doesn't like Joe Rogan? Qu'elle surprise.View attachment 29105

Not so fast…Carney is using the same tactic of his predecessor (whom he is not, etc…). It was Justin Trudeau who first attempted to manipulate Canadians with fear for our children’s safety as a means to sneak in repressive, anti-free speech legislation.

Consider then-prime minister Trudeau’s words from a February 2024 news conference in Edmonton: “We know and everyone can agree that kids are vulnerable online, to hatred, to violence, to being bullied, to seeing and being affected by terrible things online. And we need to do a better job as a society to protect our kids online,” Trudeau said, one week before tabling Bill C-63.

Using Trudeau’s old manipulation tactic, Carney has found an additional excuse to promote and justify government censorship. He revealed it at his April rally in Hamilton: “One of the issues we’re dealing with… misogyny, antisemitism, hatred, conspiracy theories — this sort of pollution that’s online that washes over our virtual borders from the United States… and, that’s fine… I can take the conspiracy theory and all that, but the more serious thing is when it affects how people behave in our society. When Canadians are threatened going to their community centres or their places of worship, or their schools,” said Carney.

Much like Trudeau first weaponized child safety to push for censorship, so too is Carney is using Canada’s despicable rise in antisemitic hate crimes, since the October 7 attack on Israel, to try to convince Canadians that what we really need protection from is, first and foremost, words on the internet.

Amy Hamm: The Mark Carney threat to free speech — National Post

He talks about controlling 'online platforms' the same way Trudeau didapple.news

New boss, etc…

View attachment 29106

Apparently, parents don't have any responsibility to "police" their kids online. Got it. It's all on the government. Nothing like abandoning individual responsibility over your own kids.View attachment 29105

Not so fast…Carney is using the same tactic of his predecessor (whom he is not, etc…). It was Justin Trudeau who first attempted to manipulate Canadians with fear for our children’s safety as a means to sneak in repressive, anti-free speech legislation.

Consider then-prime minister Trudeau’s words from a February 2024 news conference in Edmonton: “We know and everyone can agree that kids are vulnerable online, to hatred, to violence, to being bullied, to seeing and being affected by terrible things online. And we need to do a better job as a society to protect our kids online,” Trudeau said, one week before tabling Bill C-63.

Using Trudeau’s old manipulation tactic, Carney has found an additional excuse to promote and justify government censorship. He revealed it at his April rally in Hamilton: “One of the issues we’re dealing with… misogyny, antisemitism, hatred, conspiracy theories — this sort of pollution that’s online that washes over our virtual borders from the United States… and, that’s fine… I can take the conspiracy theory and all that, but the more serious thing is when it affects how people behave in our society. When Canadians are threatened going to their community centres or their places of worship, or their schools,” said Carney.

Much like Trudeau first weaponized child safety to push for censorship, so too is Carney is using Canada’s despicable rise in antisemitic hate crimes, since the October 7 attack on Israel, to try to convince Canadians that what we really need protection from is, first and foremost, words on the internet.

Amy Hamm: The Mark Carney threat to free speech — National Post

He talks about controlling 'online platforms' the same way Trudeau didapple.news

New boss, etc…

View attachment 29106

I honestly don’t think that legislation has much to do with children, & much more so to do with power and control.Apparently, parents don't have any responsibility to "police" their kids online. Got it. It's all on the government. Nothing like abandoning individual responsibility over your own kids.

NarrativeI honestly don’t think that legislation has much to do with children, & much more so to do with power and control.

In all likelihood, that is true. After all, there's nothing like power & control right?I honestly don’t think that legislation has much to do with children, & much more so to do with power and control.

With Steven Guilbeault appointed as the man responsible for overseeing the Canadian identity ministry, Carney appears prepared to double down on the censorship drive of the Trudeau years.

apple.news

(Guilbeault is the author of the Trudeau government’s censorship law, otherwise known as the Online Streaming Act)

apple.news

(Guilbeault is the author of the Trudeau government’s censorship law, otherwise known as the Online Streaming Act)

JAY GOLDBERG: Trudeau’s censorship czar retakes the helm — Toronto Sun

Prime Minister Mark Carney should repeal the Justin Trudeau government’s dangerous censorship law before it comes into full force. Sadly, with Steven Guilbeault appointed as the man responsible for overseeing the Canadian identity ministry, Carney appears prepared to double down on the...

What is Canadian identity?With Steven Guilbeault appointed as the man responsible for overseeing the Canadian identity ministry, Carney appears prepared to double down on the censorship drive of the Trudeau years.

(Guilbeault is the author of the Trudeau government’s censorship law, otherwise known as the Online Streaming Act)

JAY GOLDBERG: Trudeau’s censorship czar retakes the helm — Toronto Sun

Prime Minister Mark Carney should repeal the Justin Trudeau government’s dangerous censorship law before it comes into full force. Sadly, with Steven Guilbeault appointed as the man responsible for overseeing the Canadian identity ministry, Carney appears prepared to double down on the...apple.news

Ask Steven Guilbeault and he may or may not explain that.What is Canadian identity?

I don't think he knows either.Ask Steven Guilbeault and he may or may not explain that.