Trudeau’s Newest New Carbon Tax

- Thread starter Ron in Regina

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

He would likely respond with something like - but I buy (Intangible) credits as though that's going to help with climate change. I don't know that he does purchase carbon credits maybe we do on his behalf but whatever, it's costing us a fortune and we can't afford to continue this especially since nothing will change with climate. Climate will do what it has always done: change!He leaves a bigger carbon footprint every trip than your entire family does annually by several times over….seriously.

Good gravy, don't give them any ideas as I'm sure if they could, they would.The Canadian government better tax that right away before it….Does whatever it does…to encourage it to do something else….right? Make it an annually increasing tax so that it’s a real burden before the next solar maximum in 9 to 14 years.

This summer, thanks to the Trudeau government’s new Clean Fuel Regulations (CFR), Canadians already struggling with the high cost of gasoline, groceries and other essentials will see the cost of living rise even higher.

The CFR, which went into effect July 1, forces fuel producers and importers to gradually reduce the carbon content of the fuels they sell. By 2030, the “carbon intensity” of these fuels, which measures the emissions generated per unit of energy, must be 15% below 2016 levels. If fuel suppliers fail to meet these standards, they must purchase credits, increasing costs that will inevitably be passed on to Canadians who rely on gasoline or diesel.

According to a recent analysis by the Parliamentary Budget Officer (PBO), when fully implemented in 2030, these regulations will increase the cost of gasoline by up to 17¢ per litre and diesel fuel by up to 16¢ per litre. And that’s on top of the 37¢ the carbon tax will add to a litre of gasoline by 2030.

www.youtube.com

California and British Columbia have adopted similar regulations, contributing to high gas prices. Since the introduction of California’s clean fuel standards, the gap between the average gas price in the United States and the average price in California has steadily increased, with Californians now paying the highest gas prices in the country.

www.youtube.com

California and British Columbia have adopted similar regulations, contributing to high gas prices. Since the introduction of California’s clean fuel standards, the gap between the average gas price in the United States and the average price in California has steadily increased, with Californians now paying the highest gas prices in the country.

And crucially, as the cost of gasoline and diesel rise, the overall cost of goods and services follows because nearly everything we consume must be transported at some point. According to the PBO analysis, Ottawa’s CFR will increase costs for the average Canadian household by up to $573 and disproportionately impact lower-income earners, as a larger portion of their income is allocated to energy and other goods impacted by price increases. The PBO estimates the poorest households will face an additional $231 in expenses.

Put simply, the higher energy costs resulting from these new regulations will have the most significant impact on low-income families who are more susceptible to energy cost fluctuations and less able to afford alternatives such as electric vehicles.

Furthermore, the CFR’s effects are not evenly distributed across Canada. The PBO estimates that households in Saskatchewan, Alberta and Newfoundland and Labrador will bear relatively higher costs due to their fuel-intensive economies. For example, the CFR will cost the average household in Saskatchewan $1,117 annually compared to only $436 in Quebec.

Finally, it’s worth noting Canada already has a carbon tax, set to reach $170 per tonne of CO2-equivalent by 2030. There’s general agreement that a carbon tax is the most efficient (i.e. least costly) way to reduce greenhouse gas emissions, as it relies on market forces and decentralized decision-making by entrepreneurs, investors, business owners and consumers. But imposing new fuel regulations on top of the existing carbon tax undermines the intended cost-effectiveness of the tax, needlessly burdening the economy.

The CFR will impose significant costs on Canadians, particularly low-income earners, at a time when they’re already struggling with high living expenses. The Trudeau government should re-evaluate its approach to climate policy and consider the profound impact on Canadian families and businesses.

apple.news

apple.news

The carbon tax won't make you money (despite what the Liberals say)

When you hear the Trudeau government talking up the carbon tax, you’d think they’d highlight the fact that it reduces emissions by making fossil fuels more e...

And crucially, as the cost of gasoline and diesel rise, the overall cost of goods and services follows because nearly everything we consume must be transported at some point. According to the PBO analysis, Ottawa’s CFR will increase costs for the average Canadian household by up to $573 and disproportionately impact lower-income earners, as a larger portion of their income is allocated to energy and other goods impacted by price increases. The PBO estimates the poorest households will face an additional $231 in expenses.

Furthermore, the CFR’s effects are not evenly distributed across Canada. The PBO estimates that households in Saskatchewan, Alberta and Newfoundland and Labrador will bear relatively higher costs due to their fuel-intensive economies. For example, the CFR will cost the average household in Saskatchewan $1,117 annually compared to only $436 in Quebec.

OPINION: Trudeau’s new regulations will hike costs for low-income families — Toronto Sun

This summer, thanks to the Trudeau government’s new Clean Fuel Regulations (CFR), Canadians already struggling with the high cost of gasoline, groceries and other essentials will see the cost of living rise even higher. The CFR, which went into effect July 1, forces fuel producers and importers...

Why care for your base as long as they vote for you .This summer, thanks to the Trudeau government’s new Clean Fuel Regulations (CFR), Canadians already struggling with the high cost of gasoline, groceries and other essentials will see the cost of living rise even higher.

The CFR, which went into effect July 1, forces fuel producers and importers to gradually reduce the carbon content of the fuels they sell. By 2030, the “carbon intensity” of these fuels, which measures the emissions generated per unit of energy, must be 15% below 2016 levels. If fuel suppliers fail to meet these standards, they must purchase credits, increasing costs that will inevitably be passed on to Canadians who rely on gasoline or diesel.

According to a recent analysis by the Parliamentary Budget Officer (PBO), when fully implemented in 2030, these regulations will increase the cost of gasoline by up to 17¢ per litre and diesel fuel by up to 16¢ per litre. And that’s on top of the 37¢ the carbon tax will add to a litre of gasoline by 2030.

California and British Columbia have adopted similar regulations, contributing to high gas prices. Since the introduction of California’s clean fuel standards, the gap between the average gas price in the United States and the average price in California has steadily increased, with Californians now paying the highest gas prices in the country.

The carbon tax won't make you money (despite what the Liberals say)

When you hear the Trudeau government talking up the carbon tax, you’d think they’d highlight the fact that it reduces emissions by making fossil fuels more e...www.youtube.com

And crucially, as the cost of gasoline and diesel rise, the overall cost of goods and services follows because nearly everything we consume must be transported at some point. According to the PBO analysis, Ottawa’s CFR will increase costs for the average Canadian household by up to $573 and disproportionately impact lower-income earners, as a larger portion of their income is allocated to energy and other goods impacted by price increases. The PBO estimates the poorest households will face an additional $231 in expenses.

Put simply, the higher energy costs resulting from these new regulations will have the most significant impact on low-income families who are more susceptible to energy cost fluctuations and less able to afford alternatives such as electric vehicles.

Furthermore, the CFR’s effects are not evenly distributed across Canada. The PBO estimates that households in Saskatchewan, Alberta and Newfoundland and Labrador will bear relatively higher costs due to their fuel-intensive economies. For example, the CFR will cost the average household in Saskatchewan $1,117 annually compared to only $436 in Quebec.

Finally, it’s worth noting Canada already has a carbon tax, set to reach $170 per tonne of CO2-equivalent by 2030. There’s general agreement that a carbon tax is the most efficient (i.e. least costly) way to reduce greenhouse gas emissions, as it relies on market forces and decentralized decision-making by entrepreneurs, investors, business owners and consumers. But imposing new fuel regulations on top of the existing carbon tax undermines the intended cost-effectiveness of the tax, needlessly burdening the economy.

The CFR will impose significant costs on Canadians, particularly low-income earners, at a time when they’re already struggling with high living expenses. The Trudeau government should re-evaluate its approach to climate policy and consider the profound impact on Canadian families and businesses.

OPINION: Trudeau’s new regulations will hike costs for low-income families — Toronto Sun

This summer, thanks to the Trudeau government’s new Clean Fuel Regulations (CFR), Canadians already struggling with the high cost of gasoline, groceries and other essentials will see the cost of living rise even higher. The CFR, which went into effect July 1, forces fuel producers and importers...apple.news

Support Blue Hydrogen!

I’ve never watched this below, but I hear that it’s interesting and eye-opening. Maybe someday, when time permits…

W

Whataboutery. It's a little bit of red herring and a little bit of false equivalence. With a smooth ad hominem topping, it's a symphony in fallacy!

New Brunswick Premier Blaine Higgs has long complained of the impact of federal climate policies on the price of fuel in the province, but Ottawa has signalled it may be willing to address those concerns.

Following a meeting of the four Atlantic premiers and federal ministers in Moncton on Tuesday, Higgs took the opportunity to voice his concerns, while sitting directly next to federal intergovernmental affairs minister Dominic Leblanc.

“We spoke about energy and climate change targets being set by the federal government. These policies are causing inflation, rising interest rates and the increase in costs for everything from fuel to groceries,” Higgs said.

Yep…surprisingly not surprised about a Carbon Tax, then another Carbon Tax on top of the first one, then both taxes being taxed with the GST, increasing the cost of pretty much everything.

The price of fuel in the province has jumped by about seven cents since the beginning of the month, when the tax on carbon increased by over two cents per litre and new federal clean fuel standards took effect. New Brunswick created a mechanism for the Energy and Utilities Review Board (EURB) to pass on the price of the clean fuel standards from suppliers to consumers resulting in a further increase in prices…again Unsurprisingly.

But Higgs said the region faces a greater impact from climate policies than other areas of the country????? Oh???

“I think there’s been a recognition for some time now that Atlantic Canada is disproportionately impacted by the increase in costs and that has to relate to the impact it has based on the size of our economy, the fact that we’re rural in nature and that we don’t have the mass transit that other provinces have,” he said.

Huh…Really….kinda like Manitoba and Alberta and Saskatchewan…rural mostly without mass transportation outside of the few urban centres? With Alberta and Saskatchewan also being oil producers?

Yet Higgs said that there seems to be a growing willingness from the feds to recognize and address the impact of high fuel costs. Really? How so?

When reporters asked what could be on the table, Leblanc quickly gestured to current programs that transfer money to Canadians. New Brunswickers, for example, will receive a double payment of the carbon tax rebate in the fall and the federal government has earmarked a large portion of a program to help Canadians switch to non-fuel-based home heating specifically for the Atlantic region???

But the form additional measures to offset the price of fuel in Atlantic Canada may take isn’t clear.

“There are a number of measures that we have in place but we’re always interested in hearing ways that the national government can address affordability issues broadly in the region not only in terms of energy costs but in terms of other affordability issues as well,” Leblanc said? Oh, OK then.

apple.news

apple.news

The federal government has also said that it plans to argue to the EURB that the impact of the clean fuel standards should be borne by producers and suppliers, not consumers. Oh, OK then. That’s not how things work, but that’s some interesting lip service.

apple.news

apple.news

Following a meeting of the four Atlantic premiers and federal ministers in Moncton on Tuesday, Higgs took the opportunity to voice his concerns, while sitting directly next to federal intergovernmental affairs minister Dominic Leblanc.

“We spoke about energy and climate change targets being set by the federal government. These policies are causing inflation, rising interest rates and the increase in costs for everything from fuel to groceries,” Higgs said.

Yep…surprisingly not surprised about a Carbon Tax, then another Carbon Tax on top of the first one, then both taxes being taxed with the GST, increasing the cost of pretty much everything.

The price of fuel in the province has jumped by about seven cents since the beginning of the month, when the tax on carbon increased by over two cents per litre and new federal clean fuel standards took effect. New Brunswick created a mechanism for the Energy and Utilities Review Board (EURB) to pass on the price of the clean fuel standards from suppliers to consumers resulting in a further increase in prices…again Unsurprisingly.

But Higgs said the region faces a greater impact from climate policies than other areas of the country????? Oh???

“I think there’s been a recognition for some time now that Atlantic Canada is disproportionately impacted by the increase in costs and that has to relate to the impact it has based on the size of our economy, the fact that we’re rural in nature and that we don’t have the mass transit that other provinces have,” he said.

Huh…Really….kinda like Manitoba and Alberta and Saskatchewan…rural mostly without mass transportation outside of the few urban centres? With Alberta and Saskatchewan also being oil producers?

Yet Higgs said that there seems to be a growing willingness from the feds to recognize and address the impact of high fuel costs. Really? How so?

When reporters asked what could be on the table, Leblanc quickly gestured to current programs that transfer money to Canadians. New Brunswickers, for example, will receive a double payment of the carbon tax rebate in the fall and the federal government has earmarked a large portion of a program to help Canadians switch to non-fuel-based home heating specifically for the Atlantic region???

But the form additional measures to offset the price of fuel in Atlantic Canada may take isn’t clear.

“There are a number of measures that we have in place but we’re always interested in hearing ways that the national government can address affordability issues broadly in the region not only in terms of energy costs but in terms of other affordability issues as well,” Leblanc said? Oh, OK then.

N.B. Premier Higgs says he is optimistic feds will help offset Atlantic gas prices — Global News

The federal government signalled some help could be on the way for Atlantic Canada, which N.B. Premier Blaine Higgs says is disproportionately impacted by high fuel prices.

The federal government has also said that it plans to argue to the EURB that the impact of the clean fuel standards should be borne by producers and suppliers, not consumers. Oh, OK then. That’s not how things work, but that’s some interesting lip service.

N.B. Premier Higgs says he is optimistic feds will help offset Atlantic gas prices — Global News

The federal government signalled some help could be on the way for Atlantic Canada, which N.B. Premier Blaine Higgs says is disproportionately impacted by high fuel prices.

Alberta, Saskatchewan, & Newfoundland and Labrador at the top of this newest second Carbon Tax…& what do they have in common as numbers 1, 2, & 3 respectively?

The PBO report estimated the second carbon tax will cost the average household between $384 and $1,157 in 2030 depending on the province. The table at the end of this news release breaks down the cost for the average household by province.

The second carbon tax will increase the price of gasoline by up to 17 cents per litre in 2030.

The second carbon tax is “regressive for households” because “lower income households generally spend a larger share of their income on transportation and other energy-intensive goods and services compared to higher income households.”

The PBO also notes that, “Canada’s own emissions are not large enough to materially impact climate change.”

The second carbon tax is embedded within federal clean fuel regulations came into effect on July 1, 2023. The regulations will require producers to reduce the carbon content of their fuels. If they can’t meet those requirements, they’ll have to pay the second carbon tax. The second carbon tax is in addition to the current carbon tax. There are no rebates with the second carbon tax. Good times.

Quelle suprise. The top 3 energy Provinces.View attachment 18782

View attachment 18783

Alberta, Saskatchewan, & Newfoundland and Labrador at the top of this newest second Carbon Tax…& what do they have in common as numbers 1, 2, & 3 respectively?

Bingo!!Quelle suprise. The top 3 energy Provinces.

Yes, and with Actual Climate…like the Climate in a Canadian Prairie Winter….Climate.....LMFAO

Federal Carbon Tax

Carbon charges and your SaskEnergy billAs part of the federal government’s carbon pricing system, a Federal Carbon Tax applies to all fossil fuels, including natural gas, and is calculated based on the amount you use.

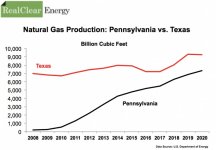

Why don't we ever hear about BC oil and gas being evil. They've been supplying Canadians and exporting for 60+ years. Trans Canada Pipeline was from FSJ to Ontario. Now ON burns gas from Pennsylvania.Bingo!!

Yes, and with Actual Climate…like the Climate in a Canadian Prairie Winter….

Here’s the increases from the Carbon Tax to households in SK to heat their homes in the winter from the Carbon Tax…unless you “choose” not to heat your home I guess.

Federal Carbon Tax

Carbon charges and your SaskEnergy billAs part of the federal government’s carbon pricing system, a Federal Carbon Tax applies to all fossil fuels, including natural gas, and is calculated based on the amount you use.www.saskenergy.com

Clean Green Pennsylvanian Natural Gas? But Trudeau said there’s no business model for Natural Gas exports, right?Why don't ever hear about BC oil and gas being evil. They've been supplying Canafians and exporting for 60+ years. Trans Canada Pipeline was from FSJ to Ontario. Now ON burns gas from Pennsylvania.

Yet Pennsylvania seems to be expanding their production for some mysterious reason. Maybe Trudeau isn’t Carbon Taxing them?

Odd huh?Clean Green Pennsylvanian Natural Gas? But Trudeau said there’s no business model for Natural Gas exports, right?

View attachment 18785

Yet Pennsylvania seems to be expanding their production for some mysterious reason. Maybe Trudeau isn’t Carbon Taxing them?

Maybe the $1.5B in crude oil from Canada has something to do with it?

Is climate objective or subjective?I know hey? When has climate NEVER changed?

Real Science or gluten/lactose free, vegan, gender neutral political crackpot mandated lobbyist science?

This week federal Environment Minister Steven Guilbeault blasted regulators in the four Atlantic provinces for permitting gas station operators to pass on the cost of the federal carbon tax and the new federal clean fuel regulations to consumers.

Until July 1, drivers and home-heating consumers in Newfoundland, Nova Scotia, New Brunswick and PEI had not been paying the full cost of the federal carbon tax. As of Canada Day, the feds insisted they be taxed over 14 cents a litre, just like the rest of the country.

Add in the new federal clean fuel regulations that came into effect that day and on much of Canada’s East Coast, gasoline prices jumped nearly 20 cents a litre – in a day.

Voters in the solidly Liberal region are incensed. The ruling Trudeau-ites count on 30 more seats from the region by rote, but after the huge jump at the pump, Liberal poll support has plummeted.

So who did Guilbeault, the Guru of Carbon Taxes, blame? Refiners. And provincial regulators.

Guilbeault accused regional refiners of increasing their profit margins by nearly 26 cents a litre since 2019. He then criticized provincial regulators for letting them pass on the cost of the two increased federal taxes, rather than forcing Irving Oil and others to absorb the taxes out of their profits.

apple.news

“Hey, those 20 cents a litre shouldn’t go to oil companies, they should go to Ottawa! Guilbeault never considered that maybe consumers should keep the cash.

apple.news

“Hey, those 20 cents a litre shouldn’t go to oil companies, they should go to Ottawa! Guilbeault never considered that maybe consumers should keep the cash.

The true irony is Guilbeault loves carbon taxes. Under his plans, the cost per litre of “carbon pricing” should raise the price at the pump by nearly another 25 cents by 2030. He’s sure a carbon tax that totals 40 cents a litre will save the planet by discouraging Canadians from using their vehicles or heating their homes.

So why would he care if Atlantic Canadian governments are permitting consumers to feel the brunt of higher refinery profits AND higher federal taxes? If a high carbon tax is good for the planet, isn’t a higher one even better?

Well, yes, until said carbon tax begins to eat into Liberal support. Then the tax anger is someone else’s fault. Emissions must be curbed, but voters shouldn’t blame the Trudeau Liberals.

apple.news

apple.news

Until July 1, drivers and home-heating consumers in Newfoundland, Nova Scotia, New Brunswick and PEI had not been paying the full cost of the federal carbon tax. As of Canada Day, the feds insisted they be taxed over 14 cents a litre, just like the rest of the country.

Add in the new federal clean fuel regulations that came into effect that day and on much of Canada’s East Coast, gasoline prices jumped nearly 20 cents a litre – in a day.

Voters in the solidly Liberal region are incensed. The ruling Trudeau-ites count on 30 more seats from the region by rote, but after the huge jump at the pump, Liberal poll support has plummeted.

So who did Guilbeault, the Guru of Carbon Taxes, blame? Refiners. And provincial regulators.

Guilbeault accused regional refiners of increasing their profit margins by nearly 26 cents a litre since 2019. He then criticized provincial regulators for letting them pass on the cost of the two increased federal taxes, rather than forcing Irving Oil and others to absorb the taxes out of their profits.

GUNTER: Guilbeault, the Guru of Carbon Taxes — Toronto Sun

There used to be a fairly common bumper sticker that read, “Don’t steal. The government hates competition.” Boy, is that ever true. This week federal Environment Minister Steven Guilbeault blasted regulators in the four Atlantic provinces for permitting gas station operators to pass on the cost...

The true irony is Guilbeault loves carbon taxes. Under his plans, the cost per litre of “carbon pricing” should raise the price at the pump by nearly another 25 cents by 2030. He’s sure a carbon tax that totals 40 cents a litre will save the planet by discouraging Canadians from using their vehicles or heating their homes.

So why would he care if Atlantic Canadian governments are permitting consumers to feel the brunt of higher refinery profits AND higher federal taxes? If a high carbon tax is good for the planet, isn’t a higher one even better?

Well, yes, until said carbon tax begins to eat into Liberal support. Then the tax anger is someone else’s fault. Emissions must be curbed, but voters shouldn’t blame the Trudeau Liberals.

LILLEY: Guilbeault criticizes Canada from Beijing but silent on China — Toronto Sun

Environment Minister Steven Guilbeault calls out Canadian companies and regulators while visiting emissions-leading China