How the GW myth is perpetuated

- Thread starter Walter

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

It's Cold Outside, But Global Warming Industry Still Hard At Work

by Christopher C. Horner (more by this author)

Posted 12/23/2008 ET

The most expensive secret you’re not supposed to know is that George W. Bush leaves office with the planet cooler than when he entered. This dangerous trend threatens the multi-billion dollar “global warming” industry, adding new urgency to the ritual shriek of “we must act now!” in the scramble to impose a costly regime of mandates and energy taxes.

The global warming industry’s tactics already range from comical to reprehensible. As a result of a cooling atmosphere -- which thanks to the “global cooling” panic we began measuring in 1979 -- you are distracted with irrelevant surface temperatures. This is possibly because more than 90% of our surface thermometer network is in violation of rules for locating the instruments. For example, why are so many now on asphalt parking lots, black tar roofs, airport tarmacs, and even hanging directly above barbeque grills?

Such childishness is only the tip of the iceberg of outrages employed to advance an ideological agenda. Our schools torment those whom they are charged with protecting from abuse, with night terrors among the less egregious outcomes. Their brainwashing includes hate mail campaigns to skeptics, reporting on their parents’ willingness to adopt an agenda, and even emotional breakdown requiring institutionalization.

High government officials around the world abuse their powers to expand government’s powers. The media moved from pushing catastrophism in order to sell copy, to expressly abandoning journalistic principles and declaring that, regarding global warming, “balance is bias.”

Last year, after Kevin Rudd was elected Australia’s Prime Minister, he addressed a gathering of that nation’s “best and brightest” pondering how to achieve their policy dreams. One idea floated was to strip Aussies of their citizenship if they expressed doubts about man-made climate catastrophe. So as to not be extremist, however, this allowed for the prospect of restoring one’s standing upon -- you guessed it -- reeducation.

The mostly taxpayer-funded science community is repeatedly caught fudging their numbers to exaggerate and even manufacture warming. Peer-review journals place hurdles in the “skeptic” path to publication while publishing demonstrable falsehoods without bothering to check the claims’ viability.

Gang Green smears any who dare speak out as unqualified or shills corrupted by “Big Oil” money. Media and lawmakers repeat the claims, yet show no curiosity about the staggering $300 million given to Al Gore. Who is it so covetous of frightening you into accepting costly policies in the name of a “climate crisis” as to underwrite this aggressive lobbying and re-branding blitz? Gore won’t tell us, but you can bet they stand to profit at your expense.

The establishment furiously engages to shout down, censor and shut down dissent. They now have the active participation of the National Academy of Sciences thanks to a back door created to elect “environmentalists” who otherwise would not attain this status and who then exercise a veto over others who do not share their worldview. Forget the policy implications, and consider how this threatens the various institutions of science once the entire enterprise is inevitably exposed.

It is now mainstream in the campaign to suppress speech to call for criminalization of skepticism (that is, of science) and imprisonment of its practitioners. British Foreign Secretary Margaret Beckett publicly demands that media outlets refuse to grant “skeptics” space, on the grounds that they are just like Islamic terrorists.

Who, then, is surprised that scientists receive professional and even death threats for their heresy, and one in Norway had the wheels fall off of his car -- twice -- after speaking out, once when his young daughter was a passenger? His mechanic said the lugs had been loosened. Apparently dissent is not patriotic to the global warming industry.

One prominent former CEO now pushing alarmism says that continued opposition to “climate” policies, specifically a supranational organization to which we cede the necessary authority, will be “paralyzing” and “suffocating”. Officials and opinion leaders similarly argue that the global warming issue is simply too important to be left to democracy and that we must suspend certain such arcane notions, if just for this one issue.

This is madness. It has to stop.

The first step in our recovery is to have a public discussion about why proponents of the global warming agenda must stoop to these tactics.

by Christopher C. Horner (more by this author)

Posted 12/23/2008 ET

The most expensive secret you’re not supposed to know is that George W. Bush leaves office with the planet cooler than when he entered. This dangerous trend threatens the multi-billion dollar “global warming” industry, adding new urgency to the ritual shriek of “we must act now!” in the scramble to impose a costly regime of mandates and energy taxes.

The global warming industry’s tactics already range from comical to reprehensible. As a result of a cooling atmosphere -- which thanks to the “global cooling” panic we began measuring in 1979 -- you are distracted with irrelevant surface temperatures. This is possibly because more than 90% of our surface thermometer network is in violation of rules for locating the instruments. For example, why are so many now on asphalt parking lots, black tar roofs, airport tarmacs, and even hanging directly above barbeque grills?

Such childishness is only the tip of the iceberg of outrages employed to advance an ideological agenda. Our schools torment those whom they are charged with protecting from abuse, with night terrors among the less egregious outcomes. Their brainwashing includes hate mail campaigns to skeptics, reporting on their parents’ willingness to adopt an agenda, and even emotional breakdown requiring institutionalization.

High government officials around the world abuse their powers to expand government’s powers. The media moved from pushing catastrophism in order to sell copy, to expressly abandoning journalistic principles and declaring that, regarding global warming, “balance is bias.”

Last year, after Kevin Rudd was elected Australia’s Prime Minister, he addressed a gathering of that nation’s “best and brightest” pondering how to achieve their policy dreams. One idea floated was to strip Aussies of their citizenship if they expressed doubts about man-made climate catastrophe. So as to not be extremist, however, this allowed for the prospect of restoring one’s standing upon -- you guessed it -- reeducation.

The mostly taxpayer-funded science community is repeatedly caught fudging their numbers to exaggerate and even manufacture warming. Peer-review journals place hurdles in the “skeptic” path to publication while publishing demonstrable falsehoods without bothering to check the claims’ viability.

Gang Green smears any who dare speak out as unqualified or shills corrupted by “Big Oil” money. Media and lawmakers repeat the claims, yet show no curiosity about the staggering $300 million given to Al Gore. Who is it so covetous of frightening you into accepting costly policies in the name of a “climate crisis” as to underwrite this aggressive lobbying and re-branding blitz? Gore won’t tell us, but you can bet they stand to profit at your expense.

The establishment furiously engages to shout down, censor and shut down dissent. They now have the active participation of the National Academy of Sciences thanks to a back door created to elect “environmentalists” who otherwise would not attain this status and who then exercise a veto over others who do not share their worldview. Forget the policy implications, and consider how this threatens the various institutions of science once the entire enterprise is inevitably exposed.

It is now mainstream in the campaign to suppress speech to call for criminalization of skepticism (that is, of science) and imprisonment of its practitioners. British Foreign Secretary Margaret Beckett publicly demands that media outlets refuse to grant “skeptics” space, on the grounds that they are just like Islamic terrorists.

Who, then, is surprised that scientists receive professional and even death threats for their heresy, and one in Norway had the wheels fall off of his car -- twice -- after speaking out, once when his young daughter was a passenger? His mechanic said the lugs had been loosened. Apparently dissent is not patriotic to the global warming industry.

One prominent former CEO now pushing alarmism says that continued opposition to “climate” policies, specifically a supranational organization to which we cede the necessary authority, will be “paralyzing” and “suffocating”. Officials and opinion leaders similarly argue that the global warming issue is simply too important to be left to democracy and that we must suspend certain such arcane notions, if just for this one issue.

This is madness. It has to stop.

The first step in our recovery is to have a public discussion about why proponents of the global warming agenda must stoop to these tactics.

Global warming skeptics on video discussing how they have been villified

January 23, 5:57 AM

by Justin Berk, Baltimore Weather Examiner

Below is a report from 20/20 about credible scientists who debate Global Warming. John Stossel discusses the professional and personal attack on these educated men who dared to stick with their research and beliefs. There is a lot of debate in the scientific community, but many scientists have been silenced out of fear.

Dr. Heidi Cullen from The Weather Channels Climate Code told Larry King (2007) that TV meteorologists who don't adopt a policy to warn the public of global warming, should have their seals revoked. That invoked outrage from not hundreds but thousands of forecasts (in and out of TV) who have had any questions. The public's interaction with meteorology is with forecasters who use synoptic models that extend out a few days. There are often contradictions and inaccuracies with forecasts out five to seven days. So questioning climate models with similar math and physics going out five to seven decades seems rational.

Joe Bastardi from Accuweather declared on his blog (a few years ago) that he had to stop discussing his debate of climate change since company advertisers threatened to pull out. Have you heard the expression that "History repeats itself"? Well, Galileo was jailed for his theory oh heliocentrism. The idea that the planets moved around the sun opposed the powerful Catholic Church of that day, which followed the premise that Earth was the center of all. Galileo was declared a heretic and could have been sentenced to death, but instead was cleared when we promised not to publicly discuss this beliefs again. He later published his theory and was sentenced to house arrest until his death.

Science should be an open debate, with all valid research getting equal display. Consensus can't be claimed when many questions continue unanswered. Silencing those who question popular culture does not benefit the truth sought by science.

January 23, 5:57 AM

by Justin Berk, Baltimore Weather Examiner

Below is a report from 20/20 about credible scientists who debate Global Warming. John Stossel discusses the professional and personal attack on these educated men who dared to stick with their research and beliefs. There is a lot of debate in the scientific community, but many scientists have been silenced out of fear.

Dr. Heidi Cullen from The Weather Channels Climate Code told Larry King (2007) that TV meteorologists who don't adopt a policy to warn the public of global warming, should have their seals revoked. That invoked outrage from not hundreds but thousands of forecasts (in and out of TV) who have had any questions. The public's interaction with meteorology is with forecasters who use synoptic models that extend out a few days. There are often contradictions and inaccuracies with forecasts out five to seven days. So questioning climate models with similar math and physics going out five to seven decades seems rational.

Joe Bastardi from Accuweather declared on his blog (a few years ago) that he had to stop discussing his debate of climate change since company advertisers threatened to pull out. Have you heard the expression that "History repeats itself"? Well, Galileo was jailed for his theory oh heliocentrism. The idea that the planets moved around the sun opposed the powerful Catholic Church of that day, which followed the premise that Earth was the center of all. Galileo was declared a heretic and could have been sentenced to death, but instead was cleared when we promised not to publicly discuss this beliefs again. He later published his theory and was sentenced to house arrest until his death.

Science should be an open debate, with all valid research getting equal display. Consensus can't be claimed when many questions continue unanswered. Silencing those who question popular culture does not benefit the truth sought by science.

Last edited:

Guardian: Al Gore says “business leaders see the writing on every wall they look at”

14 03 2009

Guest post by Steven Goddard

BTW - Before anyone starts claiming that the steadiness of the UIUC global sea ice anomaly graph above is irrelevant or coincidental, they might want to pause for a minute and think through if that position is scientifically tenable - or even vaguely rational.

In a WUWT reader’s poll earlier this month, 91% of respondents forecast that 2009 minimum ice extent will be greater than 2008 - apparently agreeing with Dr. Pope’s comment above. Perhaps Al Gore should swap his Nobel Prize with people who have a better aptitude for learning science.

14 03 2009

Guest post by Steven Goddard

In today’s Guardian, Al Gore is quoted as saying:

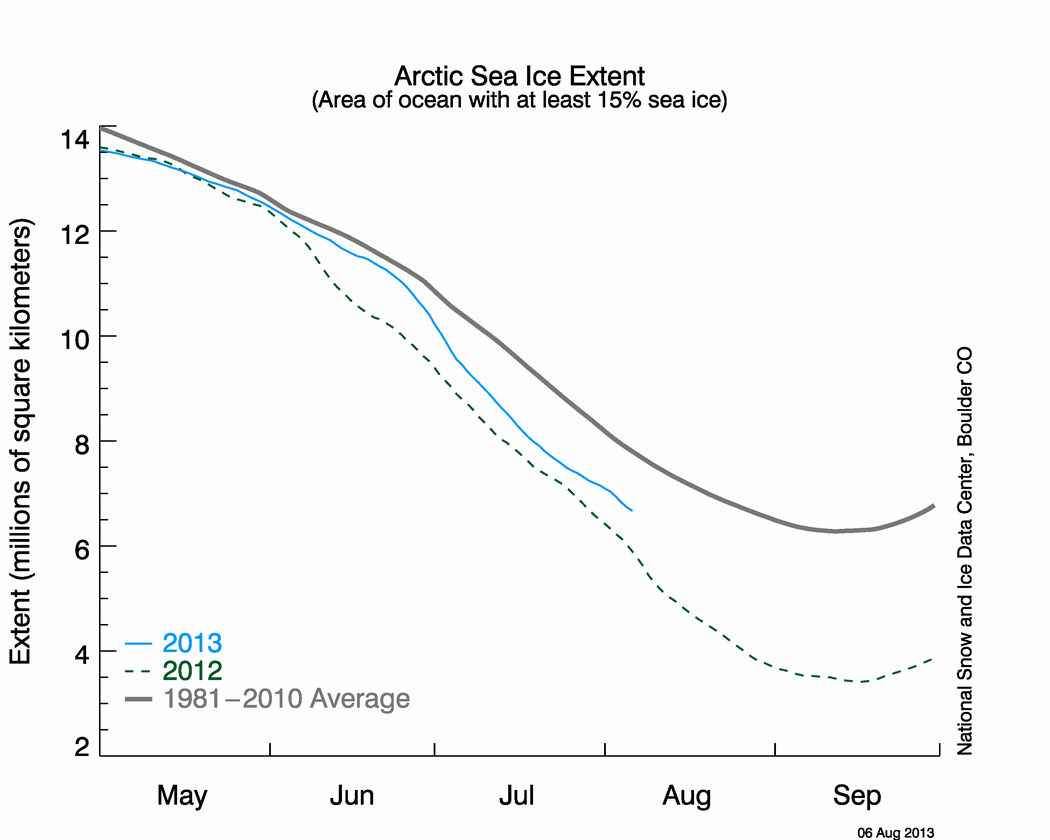

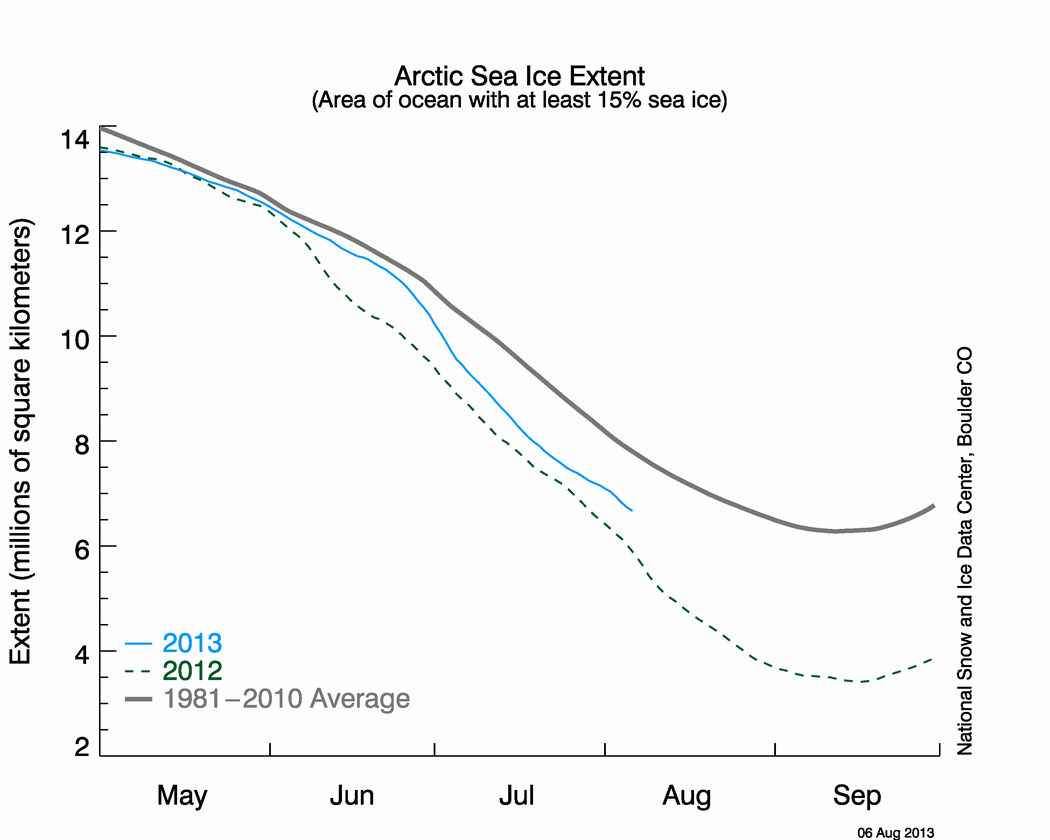

Gore says he has also detected a shift in the view of many business leaders. “They’re seeing the writing on every wall they look at. They’re seeing the complete disappearance of the polar ice caps right before their eyes in just a few years,” .

He also acknowledged something important about his scientific limitations :

Responding to James Lovelock, the originator of the Gaia theory, who said the European trading system for carbon was “disastrous”, Gore says: “James Lovelock has forgotten more about science than I will ever learn. “

Given that sea ice area at the poles is right at the 30 year mean (red line below,) one might conclude that Gore’s first comment is baseless and that his second comment about his own limited learning potential, is correct.

Dr. Vicki Pope at the UK Met Office warned about this on February 11, 2009 in an article titled “Stop Misleading Climate Claims“

Dr. Vicki Pope at the UK Met Office warned about this on February 11, 2009 in an article titled “Stop Misleading Climate Claims“

“Recent headlines have proclaimed that Arctic summer sea ice has decreased so much in the past few years that it has reached a tipping point and will disappear very quickly. The truth is that there is little evidence to support this. Indeed, the record-breaking losses in the past couple of years could easily be due to natural fluctuations in the weather, with summer sea ice increasing again over the next few years.

The Guardian published Dr. Pope’s article, but it seems that less than five weeks later they have forgotten her warning.

If the current trend continues, we can expect to have sea ice at the poles for a very long time. When George Will brought this subject up, he was severely criticized because polar ice on that day was below the mean by about 1%. But apparently it is OK with the press for Gore to be off the mark by 100%. It seems that there is zero accountability or accuracy required for alarmists.

If the current trend continues, we can expect to have sea ice at the poles for a very long time. When George Will brought this subject up, he was severely criticized because polar ice on that day was below the mean by about 1%. But apparently it is OK with the press for Gore to be off the mark by 100%. It seems that there is zero accountability or accuracy required for alarmists.

BTW - Before anyone starts claiming that the steadiness of the UIUC global sea ice anomaly graph above is irrelevant or coincidental, they might want to pause for a minute and think through if that position is scientifically tenable - or even vaguely rational.

In a WUWT reader’s poll earlier this month, 91% of respondents forecast that 2009 minimum ice extent will be greater than 2008 - apparently agreeing with Dr. Pope’s comment above. Perhaps Al Gore should swap his Nobel Prize with people who have a better aptitude for learning science.

Unprecedented Incoherence In The Ice Message

From: Watt's Up With That

5 05 2009

This was based on a number of widely publicized scientific studies released this year claiming that both the Arctic and Antarctic are melting faster than expected.

http://arctic.atmos.uiuc.edu/cryosphere/iphone/images/iphone.anomaly.global.png

Yesterday, NSIDC announced that “Arctic sea ice extent at the end of April 2009 was within the expected range of natural variability.” and “The decline rate for the month of April was the third slowest on record“

The NSIDC graph below shows that April ice extent has actually increased by more than the size of Texas over past last two years. Clearly The UN Secretary General is mistaken when he claims “”polar ice caps were melting far faster than expected just two years ago.”

http://nsidc.org/images/arcticseaicenews/20090504_Figure3.png

I took this graph a step further and compared 2009 vs. past years. Current April extent is the greatest in the last 8 years. It is greater than it was 20 years ago.

If you look at the last 20 years, there is no statistically significant trend in the data.

Arctic ice extent is essentially normal.

http://nsidc.org/data/seaice_index/images/daily_images/N_daily_extent.png

http://nsidc.org/data/seaice_index/images/daily_images/N_timeseries.png

It is important to remember that ice area between mid-April and mid-August is what affects the earth’s climate, because that is when the sun is up highest in the sky. When the ice reaches it’s minimum in September, the sun is so low above the horizon that the presence or absence of ice has little impact on the earth’s SW radiation balance. A more complete explanation here .

Also, the claim of Polar Bear endangerment is based largely on the idea that the ice is supposedly breaking up earlier than it used to in the spring. The “third slowest melt on record” would hardly support that popular claim.

I continue to be astonished at the amount of misinformation being propagated by some scientists and governmental officials. The correct information is readily available to anyone who has access to Google and five minutes of time. What is the real agenda?

From: Watt's Up With That

5 05 2009

Guest post by Steven Goddard

Last week, UN Secretary General Ban Ki-Moon warned that “polar ice caps were melting far faster than expected just two years ago“

Last week, UN Secretary General Ban Ki-Moon warned that “polar ice caps were melting far faster than expected just two years ago“

This was based on a number of widely publicized scientific studies released this year claiming that both the Arctic and Antarctic are melting faster than expected.

A team of UK researchers claims to have new evidence that global warming is melting the ice in Antarctica faster than had previously been thought.

Icecaps around the North and South Poles are melting faster than expected, raising sea levels as a result of climate change, a major scientific survey has shown.

As recently as last week, scientists were sounding the alarm.Icecaps around the North and South Poles are melting faster than expected, raising sea levels as a result of climate change, a major scientific survey has shown.

Tues., April 28, 2009

OSLO - The ice sheets of Greenland and Antarctica have awakened and are melting faster than expected, a leading expert told peers ahead of a conference of ministers from nations with Arctic territory.

Dorthe Dahl-Jensen, an expert with the Center for Ice and Climate at the University of Copenhagen, told the conference in the Arctic town of Tromsoe that the need for a wake-up call was genuine for the polar and glacial regions.

He apparently didn’t read this paper from last Autumn’s AGU MeetingOSLO - The ice sheets of Greenland and Antarctica have awakened and are melting faster than expected, a leading expert told peers ahead of a conference of ministers from nations with Arctic territory.

Dorthe Dahl-Jensen, an expert with the Center for Ice and Climate at the University of Copenhagen, told the conference in the Arctic town of Tromsoe that the need for a wake-up call was genuine for the polar and glacial regions.

Ice loss in Greenland has had some climatologists speculating that global warming might have brought on a scary new regime of wildly heightened ice loss and an ever-faster rise in sea level. But glaciologists reported at the American Geophysical Union meeting that Greenland ice’s Armageddon has come to an end.

One has to wonder if some scientists are lacking access to the Internet, as the amount of polar sea ice on the planet is above the 30 year mean.

http://arctic.atmos.uiuc.edu/cryosphere/iphone/images/iphone.anomaly.global.png

Yesterday, NSIDC announced that “Arctic sea ice extent at the end of April 2009 was within the expected range of natural variability.” and “The decline rate for the month of April was the third slowest on record“

The NSIDC graph below shows that April ice extent has actually increased by more than the size of Texas over past last two years. Clearly The UN Secretary General is mistaken when he claims “”polar ice caps were melting far faster than expected just two years ago.”

http://nsidc.org/images/arcticseaicenews/20090504_Figure3.png

I took this graph a step further and compared 2009 vs. past years. Current April extent is the greatest in the last 8 years. It is greater than it was 20 years ago.

If you look at the last 20 years, there is no statistically significant trend in the data.

Arctic ice extent is essentially normal.

http://nsidc.org/data/seaice_index/images/daily_images/N_daily_extent.png

http://nsidc.org/data/seaice_index/images/daily_images/N_timeseries.png

It is important to remember that ice area between mid-April and mid-August is what affects the earth’s climate, because that is when the sun is up highest in the sky. When the ice reaches it’s minimum in September, the sun is so low above the horizon that the presence or absence of ice has little impact on the earth’s SW radiation balance. A more complete explanation here .

Also, the claim of Polar Bear endangerment is based largely on the idea that the ice is supposedly breaking up earlier than it used to in the spring. The “third slowest melt on record” would hardly support that popular claim.

I continue to be astonished at the amount of misinformation being propagated by some scientists and governmental officials. The correct information is readily available to anyone who has access to Google and five minutes of time. What is the real agenda?

I continue to be astonished at the amount of misinformation being propagated by some scientists and governmental officials. The correct information is readily available to anyone who has access to Google and five minutes of time. What is the real agenda?

That's easy.... Renewal of gvt funding.

That's easy.... Renewal of gvt funding.

The funny part of this thread is that the only people who use the term 'global warming' these days, are the people who insist it's bunk.

But that's okay, I guess you need something to do.

But that's okay, I guess you need something to do.

Many enjoy to use the term global warming to assist in illustrating the flip-flopping of the eco-alarmists.... Mind you, it is interesting that the original GW proponents are awfully quiet these days, aren't they?

For me, it became apparent that the GW term was dropped when the brain-trust in the eco-lobbies determined that the cooling trends were not an anomaly and had to re-invent their marketing campaign in order to maintain their place in the media.

For me, it became apparent that the GW term was dropped when the brain-trust in the eco-lobbies determined that the cooling trends were not an anomaly and had to re-invent their marketing campaign in order to maintain their place in the media.

Well, if you honestly think that we can have all of the industrial activity that we do, and have NO effects on our climate, then there's zero point in discussing the issue.

I don't like Al Gore, and I don't necessarily believe all of the hype, but our activity IS changing the climate of the earth. Victorian London saw that on a local scale, now that so much of the world is industrialized, we're seeing effects more widespread.

But that doesn't mean the world will end tomorrow.

I don't like Al Gore, and I don't necessarily believe all of the hype, but our activity IS changing the climate of the earth. Victorian London saw that on a local scale, now that so much of the world is industrialized, we're seeing effects more widespread.

But that doesn't mean the world will end tomorrow.

Sure that the industrial activity will have an impact... The fact that you and I are breathing also has an impact. The big question relates to the degree of that impact.

There is no way that human activity has anywhere near the same impact as the natural sources... And to be clear, we are talking about altering the weather patterns as opposed to the (separate) issue of pollution.

There is no way that human activity has anywhere near the same impact as the natural sources... And to be clear, we are talking about altering the weather patterns as opposed to the (separate) issue of pollution.

The Guardian Relocates The North Pole By 500km

16 05 2009

The Catlin crew was picked up this week, after completing less than 50% of their planned journey to the North Pole and coming up about 500km short. Immediately upon their return, The Guardian reported :

16 05 2009

By Steven Goddard

The Catlin crew was picked up this week, after completing less than 50% of their planned journey to the North Pole and coming up about 500km short. Immediately upon their return, The Guardian reported :

After 73 days, the Catlin Arctic Survey has come to an end. Pen Hadow’s team of British Arctic explorers have battled to the North Pole through freezing conditions collecting data about the ice en route.

This reminds me of the legend of “bringing the mountain to Mohammed.” The crew reported traveling over 400km, a non-trivial percentage of which was due to floating along with the Arctic drift. See this map of Arctic buoys and their drift patterns:

In summary :

Polar drift map over the last 60 days.

http://iabp.apl.washington.edu/maps_daily_track-map.html

Given the polar drift, one has to wonder how much ice was actually traversed, and how many measurements were taken near the same spot on the first year ice. The Catlin Crew reported in The Telegraph :

http://iabp.apl.washington.edu/maps_daily_track-map.html

Given the polar drift, one has to wonder how much ice was actually traversed, and how many measurements were taken near the same spot on the first year ice. The Catlin Crew reported in The Telegraph :

Arctic explorer Pen Hadow has warned that the polar ice cap he has been examining to gauge the extent of climate change appears far thinner than expected after trekking more than 250 miles to the North Pole

From the Catlin web site :

Expedition Leader Pen Hadow revealed that initial Survey results show the average ice thickness in the region to be 1.774m.

1.774m is fairly thick for first year ice (and requires a very accurate tape measure.) They started their expedition in March on ice which NSIDC had already identified in February as first year ice – so why were they surprised to find first year ice?

The NSIDC February map showed multi-year ice as shades of red and orange, and their start point (red dot) was more than 100km away from the edge of the multi-year ice. The crew also reported that their data is biased by a pragmatic choice of route across flat (first year) ice.

The NSIDC February map showed multi-year ice as shades of red and orange, and their start point (red dot) was more than 100km away from the edge of the multi-year ice. The crew also reported that their data is biased by a pragmatic choice of route across flat (first year) ice.

One further consideration, when interpreting the ice thickness measurements made by the CAS team, is navigational bias. The team systematically seeks out flatter ice because it is easier to travel over and camp on.

According to the Catlin web site, there was plenty of second year ice – but apparently the cold weather and lack of progress kept them from reaching it. Note in the map below that second year ice (SY) is not considered multi-year (MY) ice. The AGW world has recently redefined the word “multi-year” as meaning greater than two years. (Next year it may need to be defined as greater than three years.)

In summary :

- Due to horrifically cold weather, hypothermia and frostbite, they made it less than half way to the pole.

- Some of the distance they did travel was due to polar drift. They reported crossing the 85th parallel “in their sleep.”

- They started on ice which was already known to be first year ice, yet were “surprised” to find that it was first year ice.

- They stayed on first year ice for most of the truncated journey.

- Their ice measurements tell us that the first year ice this year is fairly thick.

- Their ice measurements tell us very little or about the thickness or “health” of multi-year ice.

- They will no doubt get an invite to St. James Palace for tea with Prince Charles

http://www.ijis.iarc.uaf.edu/seaice/extent/AMSRE_Sea_Ice_Extent.png

May, 2009 shows the greatest ice extent in the AMSR-E record, which seems to contradict Hadow’s highly publicised remarks about Arctic ice health.

May, 2009 shows the greatest ice extent in the AMSR-E record, which seems to contradict Hadow’s highly publicised remarks about Arctic ice health.

People been cheating. I am shocked. :roll:

- SciAmA convenient way of cutting industrial gases that warm the planet was supposed to be the United Nation's clean development mechanism (CDM). As a provision of the Kyoto Protocol, the CDM enables industrial nations to reduce their greenhouse gas emissions in part by purchasing "carbon offsets" from poorer countries, where green projects are more affordable. The scheme, which issued its first credits in 2005, has already transferred the right to emit an extra 250 million tons of carbon dioxide (CO2), and that could swell to 2.9 billion tons by 2012. Offsets will "play a more significant role" as emissions targets become tighter, asserts Yvo de Boer of the U.N. Framework Convention on Climate Change.

But criticism of the CDM has been mounting. Despite strenuous efforts by regulators, a significant fraction of the offset credits is fictitious "hot air" manufactured by accounting tricks, critics say. As a result, greenhouse gases are being emitted without compensating reductions elsewhere.

Why is the myth of AGW perpetuated? For the money, of course. AGW is now the biggest industry in the world!

Rest of the article at Lawrence Solomon: Enron's other secret - FP Comment

In the climate-change debate, the companies on the ‘environmental’ side have the most to gain.

First in a series.

By Lawrence SolomonWe all know that the financial stakes are enormous in the global warming debate — many oil, coal and power companies are at risk should carbon dioxide and other greenhouse gases get regulated in a manner that harms their bottom line. The potential losses of an Exxon or a Shell are chump change, however, compared to the fortunes to be made from those very same regulations.

The climate-change industry — the scientists, lawyers, consultants, lobbyists and, most importantly, the multinationals that work behind the scenes to cash in on the riches at stake — has emerged as the world’s largest industry. Virtually every resident in the developed world feels the bite of this industry, often unknowingly, through the hidden surcharges on their food bills, their gas and electricity rates, their gasoline purchases, their automobiles, their garbage collection, their insurance, their computers purchases, their hotels, their purchases of just about every good and service, in fact, and finally, their taxes to governments at all levels.

These extractions do not happen by accident. Every penny that leaves the hands of consumers does so by design, the final step in elaborate and often brilliant orchestrations of public policy, all the more brilliant because the public, for the most part, does not know who is profiteering on climate change, or who is aiding and abetting the profiteers.

Some of the climate-change profiteers are relatively unknown corporations; others are household names with only their behind-the-scenes role in the climate-change industry unknown. Over the next few weeks, in an extended newspaper series, you will become familiar with some of the profiteers, and with their machinations. This series begins with Enron, a pioneer in the climate-change industry.

Almost two decades before President Barack Obama made “cap-and-trade” for carbon dioxide emissions a household term, an obscure company called Enron — a natural-gas pipeline company that had become a big-time trader in energy commodities — had figured out how to make millions in a cap-and-trade program for sulphur dioxide emissions, thanks to changes in the U.S. government’s Clean Air Act. To the delight of shareholders, Enron’s stock price rose rapidly as it became the major trader in the U.S. government’s $20-billion a year emissions commodity market.

Enron Chairman Kenneth Lay, keen to engineer an encore, saw his opportunity when Bill Clinton and Al Gore were inaugurated as president and vice-president in 1993. To capitalize on Al Gore’s interest in global warming, Enron immediately embarked on a massive lobbying effort to develop a trading system for carbon dioxide, working both the Clinton administration and Congress. Political contributions and Enron-funded analyses flowed freely, all geared to demonstrating a looming global catastrophe if carbon dioxide emissions weren’t curbed. An Enron-funded study that dismissed the notion that calamity could come of global warming, meanwhile, was quietly buried.

Rest of the article at Lawrence Solomon: Enron's other secret - FP Comment

Hope I remember to read the rest of the article.

Not that we have much prescience, but we sold our oil shares a couple or 3 years ago and bought into alternate energies. Shortly after that, I had a pretty good discussion with a bean counter who was stating that business in general would die. I countered that, for instance, oil companies collapsed, alternative energy companies would pop up. People would stop working for one and head for the other and the economy would waddle along as usual.

Whether or not humans caused a bit of warming or not, warming happened. But, in this case, I think the means justifies the end as the planet, and hence, we will be better off for it.

Not that we have much prescience, but we sold our oil shares a couple or 3 years ago and bought into alternate energies. Shortly after that, I had a pretty good discussion with a bean counter who was stating that business in general would die. I countered that, for instance, oil companies collapsed, alternative energy companies would pop up. People would stop working for one and head for the other and the economy would waddle along as usual.

Whether or not humans caused a bit of warming or not, warming happened. But, in this case, I think the means justifies the end as the planet, and hence, we will be better off for it.

It has always been obvious to me that unless there was a ton of money to be made nothing would ever be done about the environment. They couldn't find a way to do it cleaning up the environment so they made up a bunch of stuff so it would look like they were ethical while making a ton of money for nothing. The environment will still continue to deteriorate, humans population growth will continue unabated, and species will continue to become extinct.

The lemmings are collecting wealth as they head for the cliff. There is no question about human intelligence. It doesn't exist.

The lemmings are collecting wealth as they head for the cliff. There is no question about human intelligence. It doesn't exist.

Ouch! You dumped oil shares just before the big surge? That must hurt!Hope I remember to read the rest of the article.

Not that we have much prescience, but we sold our oil shares a couple or 3 years ago and bought into alternate energies. Shortly after that, I had a pretty good discussion with a bean counter who was stating that business in general would die. I countered that, for instance, oil companies collapsed, alternative energy companies would pop up. People would stop working for one and head for the other and the economy would waddle along as usual.

Whether or not humans caused a bit of warming or not, warming happened. But, in this case, I think the means justifies the end as the planet, and hence, we will be better off for it.

But to be realistic, alternative energy sources are a good idea, but they can't as yet even come close to replacing fossil fuels, only supplement them a little.

Read this guy's speech:

Let me suggest that our conversation about how to reduce CO2 emissions must begin with a few “inconvenient” realities.

Reality 1: Worldwide demand for energy will grow by 30-50% over the next two decades – and more than double by the time you‟re my age. Simply put, America and the rest of the world will need all the energy that markets can deliver.

Reality 2: There are no near-term alternatives to oil, natural gas, and coal. Like it or not, the world runs on fossil fuels, and it will for decades to come. The U.S. government‟s own forecast shows that fossil fuels will supply about 85% of world energy demand in 2030 – roughly the same as today. Yes, someday the world may run on alternatives. But that day is still a long way off. It‟s not about will. It‟s not about who‟s in the White House. It‟s about thermodynamics and economics.

Now, I was told back in the 1970s what you‟re being told today: that wind and solar power are „alternatives‟ to fossil fuels. A more honest description would be „supplements‟. Taken together, wind and solar power today account for just one-sixth of 1% of America‟s annual energy usage. Let me repeat that statistic – one-sixth of 1%.

Here‟s a pie chart showing total U.S. primary energy demand today. I “asked” PowerPoint to show a wedge for the portion of the U.S. energy pie that comes from wind and solar. But PowerPoint won‟t make a wedge for wind and solar – just a thin line.

Over the past 30 years our government has pumped roughly $20 billion in subsidies into wind and solar power, and all we‟ve got to show for it is this thin line!

Undaunted by this, President Obama proposes to double wind and solar power consumption in this country by the end of his first term. Great – that means the line on this pie chart would become a slightly thicker line in four years. I would point out that wind and solar power doubled in just the last three years of the Bush administration. Granted, W. started from a smaller baseline, so doubling again over the next four years will be a taller order. But if President Obama‟s goal is achieved, wind and solar together will grow from one-sixth of 1% to one-third of 1% of total primary energy use – and that assumes U.S. energy consumption remains flat, which of course it will not.

6

The problems with wind and solar power become apparent when you look at their footprint. To generate electricity comparable to a 1,000 MW gas-fired power plant you‟d have to build a wind farm with at least 500 very tall windmills occupying more than 30,000 acres of land. Then there‟s solar power. I‟m holding a Denver Post article that tells the story of an 8.2 MW solar-power plant built on 82 acres in Colorado. The Post proudly hails it “America‟s most productive utility-scale solar electricity plant”. But when you account for the fact that the sun doesn‟t always shine, you‟d need over 250 of these plants, on over 20,000 acres to replace just one 1,000 MW gas-fired power plant that can be built on less than 40 acres.

The Salt Lake Tribune recently celebrated the startup of a 14 MW geothermal plant near Beaver, Utah. That‟s wonderful! But the Tribune failed to put 14 MW into perspective. Utah has over 7,000 MW of installed generating capacity, primarily coal. America has about 1,000,000 MW of installed capacity. Because U.S. demand for electricity has been growing at 1-2 % per year, on average we‟ve been adding 10-20,000 MW of new capacity every year to keep pace with growth. Around the world coal demand is booming – 200,000 MW of new coal capacity is under construction, over 30,000 MW in China alone. In fact, there are 30 coal plants under construction in the U.S. today that when complete will burn about 70 million tons of coal per year.

Complete speech at http://www.questar.com/1OurCompany/newsreleases/2009_news/UVUSpeech.pdf

Last edited:

Timing was off a bit, yup. We saw it in a philosophical manner so timing and pain were relatively irrelevant.Ouch! You dumped oil shares just before the big surge? That must hurt!

Yup. Until more people realize petroleum products are a dead end and there are better things available. The more people see in alternate energies the bigger the field gets.But to be realistic, alternative energy sources are a good idea, but they can't as yet even come close to replacing fossil fuels, only supplement them a little.

I think he was doing well until he stated that the current warming period peaked in 1998. He was right but it has been higher since.Read this guy's speech:

Complete speech at http://www.questar.com/1OurCompany/newsreleases/2009_news/UVUSpeech.pdf

Data @ NASA GISS: GISS Surface Temperature Analysis: Graphs

http://www.questar.com/1OurCompany/newsreleases/2009_news/UVUSpeech.pdf

It kinda seemed as if the guy was implying that we will have even more oil in the future than we do now, too.

It kinda seemed as if the guy was implying that we will have even more oil in the future than we do now, too.

I think you missed what he was saying. First of all, fossil fuels aren't a dead end. They are, to all intents and purposes, infinite; we'll never run out. The other point is that existing alternatives aren't really alternatives because there's no way they can replace fossil fuel use, no matter how much people want them to. It's impossible.Yup. Until more people realize petroleum products are a dead end and there are better things available. The more people see in alternate energies the bigger the field gets.

I think he was doing well until he stated that the current warming period peaked in 1998. He was right but it has been higher since.

Data @ NASA GISS: GISS Surface Temperature Analysis: Graphs

Here's global temps:

Even the head of the IPCC (that Indian scientist) admitted that we've started cooling.

You might want to watch this video, lots of graphs and very informative:

YouTube - Science & social aspects of climate change pt 1http://www.youtube.com/watch?v=9tOFoFx7S6M&feature=related