U.S. tariffs cast pall over Ontario budget with $14.6B deficit, slower growth

Author of the article:Canadian Press

Canadian Press

Allison Jones

Published May 15, 2025 • Last updated 11 hours ago • 4 minute read

U.S. President Donald Trump’s tariffs cast a pall over Ontario’s budget Thursday, dragging down GDP growth and knocking the province off its path to balance, with a $14.6-billion deficit projected this year.

Now is the time to spend on infrastructure and job creation in Ontario so the province can come out stronger on the other side, Finance Minister Peter Bethlenfalvy said.

“Ontario and all of Canada are at a precipice and we need to take serious steps to make sure we do not find ourselves anywhere near the bottom,” Bethlenfalvy said as he tabled his $232.5-billion budget.

“Whether it is our competitive advantage in critical minerals, energy, technology, talent, our workers, or any other area, we will need to bolster our economy by investing in our powerful and promising industries by building more, and building faster and by protecting jobs and job creators.”

The province had previously eyed a balanced budget for 2026-27, but that came before the election of Trump and the implementation of tariffs and now Ontario is set to inch into the black in 2027-28 with a small surplus.

In the meantime, Bethlenfalvy’s budget is forecasting a $14.6-billion deficit this fiscal year — up from a projection of $4.6 billion in last year’s budget — and a deficit of $7.8 billion next year.

Much of the increased pressure comes from about $30 billion in spending to stimulate the economy in the face of tariffs, including a $5-billion fund to give businesses relief, adding $5 billion to an infrastructure financing fund, and implementing a new, $500-million Critical Minerals Processing Fund.

As well, the government is planning to add $1 billion to its Skills Development Fund to retrain workers, add $600 million to a fund that helps businesses set up or expand in Ontario, $200 million for a shipbuilding grant program and create a $50-million fund to help businesses make new supply chains and help boost interprovincial trade.

But for all of the various funds for businesses, opposition leaders said there is very little in the budget for people and their most pressing needs, such as housing and health care.

“This budget talks a lot about cars and infrastructure,” Green Party Leader Mike Schreiner said. “It doesn’t talk a lot about actually investing in people.”

NDP Leader Marit Stiles called it a “Band-Aid budget.”

“It is a missed opportunity to strengthen Ontario,” she said. “The government could have built a tariff-proof future with good schools, affordable homes, world-class public health care and reliable public services. Instead, the Ford government chose more cuts, less relief and no real support for families who need help right now.”

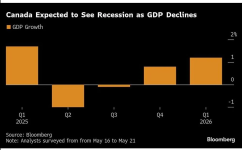

The financial accountability officer has said that a “modest” recession may occur in 2025. Bethlenfalvy said he wouldn’t speculate on whether Ontario will enter recession territory, but all of the investments announced in the budget are meant to shore up the province’s economy at a critical time.

“(We’re trying) to fortify and immunize Ontario as best as possible,” he said.

“I think we’ve got the right plan and the vision for not just dealing with the moment, but laying the groundwork for the future.”

Real GDP is projected to rise by just 0.8 per cent next year, sharply down from the 2024 budget projection of 1.9 per cent for this year. Job creation is also forecasted to greatly slow and the unemployment rate is expected to be at 7.6 per cent in 2025, up from the previous projection of 6.6 per cent.

Ontario is among the jurisdictions most exposed to U.S. trade policy, the government says in its budget.

About 285,000 jobs across the province depend on exporting goods to the United States, representing nearly 3.5 per cent of total employment, it says.

The U.S. is Ontario’s largest trading partner, with $194.9 billion in merchandise exports to that country in 2024.

Revenue is projected to be nearly $220 billion this fiscal year, down from $221.6 billion last year, in part due to less revenue from corporations’ taxes. Ontario is expected to spend $216.3 billion on programs this year and $16.2 billion on interest and other debt servicing charges.

The reserve, meanwhile, is set at the unusually high amount of $2 billion for this year and the next few years. The contingency fund, meant as another buffer to mitigate risk, is set at $3 billion for 2025-26.

The budget document says that fund “increases further through the remainder of the medium-term outlook,” but it does not specify amounts.

Opposition parties and the province’s financial accountability officer have been critical in the past of the large unallocated amounts the Progressive Conservative government has set aside in contingency funds, a practice they say is not transparent.

Liberal finance critic Stephanie Bowman said it’s some “funny” accounting.

“They’re adding money for contingency funds, which create a bigger deficit, so that if they don’t need that money, it looks like they’ve come in ahead of budget and have a lower deficit,” she said.

Ontario’s net debt this year stands at more than $460 billion. The province’s net debt-to-GDP ratio is set to climb this year to 37.9 per cent after previously sitting at a 13-year low, and is expected to rise further to 38.9 per cent in 2026-27.

Environmental Defence said while the province is spending large amounts on infrastructure, it is done inefficiently.

“This budget should have focused investment on removing bottlenecks to building housing in existing neighbourhoods where most of the services and infrastructure already exist,” Phil Pothen, program manager of land use, land development and Ontario environment, said in a statement.

“Instead, this budget would waste huge sums on projects _ like Highway 413, the 401 tunnel and encouraging sprawl — that simply divert workers and equipment away from the labour-efficient, family-sized homes existing neighbourhoods are already legalizing.”

torontosun.com

torontosun.com

Author of the article:Canadian Press

Canadian Press

Allison Jones

Published May 15, 2025 • Last updated 11 hours ago • 4 minute read

U.S. President Donald Trump’s tariffs cast a pall over Ontario’s budget Thursday, dragging down GDP growth and knocking the province off its path to balance, with a $14.6-billion deficit projected this year.

Now is the time to spend on infrastructure and job creation in Ontario so the province can come out stronger on the other side, Finance Minister Peter Bethlenfalvy said.

“Ontario and all of Canada are at a precipice and we need to take serious steps to make sure we do not find ourselves anywhere near the bottom,” Bethlenfalvy said as he tabled his $232.5-billion budget.

“Whether it is our competitive advantage in critical minerals, energy, technology, talent, our workers, or any other area, we will need to bolster our economy by investing in our powerful and promising industries by building more, and building faster and by protecting jobs and job creators.”

The province had previously eyed a balanced budget for 2026-27, but that came before the election of Trump and the implementation of tariffs and now Ontario is set to inch into the black in 2027-28 with a small surplus.

In the meantime, Bethlenfalvy’s budget is forecasting a $14.6-billion deficit this fiscal year — up from a projection of $4.6 billion in last year’s budget — and a deficit of $7.8 billion next year.

Much of the increased pressure comes from about $30 billion in spending to stimulate the economy in the face of tariffs, including a $5-billion fund to give businesses relief, adding $5 billion to an infrastructure financing fund, and implementing a new, $500-million Critical Minerals Processing Fund.

As well, the government is planning to add $1 billion to its Skills Development Fund to retrain workers, add $600 million to a fund that helps businesses set up or expand in Ontario, $200 million for a shipbuilding grant program and create a $50-million fund to help businesses make new supply chains and help boost interprovincial trade.

But for all of the various funds for businesses, opposition leaders said there is very little in the budget for people and their most pressing needs, such as housing and health care.

“This budget talks a lot about cars and infrastructure,” Green Party Leader Mike Schreiner said. “It doesn’t talk a lot about actually investing in people.”

NDP Leader Marit Stiles called it a “Band-Aid budget.”

“It is a missed opportunity to strengthen Ontario,” she said. “The government could have built a tariff-proof future with good schools, affordable homes, world-class public health care and reliable public services. Instead, the Ford government chose more cuts, less relief and no real support for families who need help right now.”

The financial accountability officer has said that a “modest” recession may occur in 2025. Bethlenfalvy said he wouldn’t speculate on whether Ontario will enter recession territory, but all of the investments announced in the budget are meant to shore up the province’s economy at a critical time.

“(We’re trying) to fortify and immunize Ontario as best as possible,” he said.

“I think we’ve got the right plan and the vision for not just dealing with the moment, but laying the groundwork for the future.”

Real GDP is projected to rise by just 0.8 per cent next year, sharply down from the 2024 budget projection of 1.9 per cent for this year. Job creation is also forecasted to greatly slow and the unemployment rate is expected to be at 7.6 per cent in 2025, up from the previous projection of 6.6 per cent.

Ontario is among the jurisdictions most exposed to U.S. trade policy, the government says in its budget.

About 285,000 jobs across the province depend on exporting goods to the United States, representing nearly 3.5 per cent of total employment, it says.

The U.S. is Ontario’s largest trading partner, with $194.9 billion in merchandise exports to that country in 2024.

Revenue is projected to be nearly $220 billion this fiscal year, down from $221.6 billion last year, in part due to less revenue from corporations’ taxes. Ontario is expected to spend $216.3 billion on programs this year and $16.2 billion on interest and other debt servicing charges.

The reserve, meanwhile, is set at the unusually high amount of $2 billion for this year and the next few years. The contingency fund, meant as another buffer to mitigate risk, is set at $3 billion for 2025-26.

The budget document says that fund “increases further through the remainder of the medium-term outlook,” but it does not specify amounts.

Opposition parties and the province’s financial accountability officer have been critical in the past of the large unallocated amounts the Progressive Conservative government has set aside in contingency funds, a practice they say is not transparent.

Liberal finance critic Stephanie Bowman said it’s some “funny” accounting.

“They’re adding money for contingency funds, which create a bigger deficit, so that if they don’t need that money, it looks like they’ve come in ahead of budget and have a lower deficit,” she said.

Ontario’s net debt this year stands at more than $460 billion. The province’s net debt-to-GDP ratio is set to climb this year to 37.9 per cent after previously sitting at a 13-year low, and is expected to rise further to 38.9 per cent in 2026-27.

Environmental Defence said while the province is spending large amounts on infrastructure, it is done inefficiently.

“This budget should have focused investment on removing bottlenecks to building housing in existing neighbourhoods where most of the services and infrastructure already exist,” Phil Pothen, program manager of land use, land development and Ontario environment, said in a statement.

“Instead, this budget would waste huge sums on projects _ like Highway 413, the 401 tunnel and encouraging sprawl — that simply divert workers and equipment away from the labour-efficient, family-sized homes existing neighbourhoods are already legalizing.”

U.S. tariffs cast pall over Ontario budget with $14.6B deficit, slower growth

Ontario Finance Minister Peter Bethlenfalvy’s budget is forecasting a $14.6-billion deficit this fiscal year.