Well, today is the Liberal/NDP Non-Coalition Coalition Budget Day!

- Thread starter Ron in Regina

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

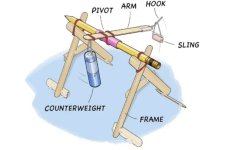

The concept is there to scale up to pork projectiles.Young Red Green's first project. . .

Minister calls for wartime effort to build infrastructure — CTV News

Canada’s energy and natural resources minister is calling for a wartime effort to build big national infrastructure projects as envisioned by recently passed bill C-5.

Canada promises to spend 5% of GDP on defence by 2035 in pact with NATO leaders — Apple News Spotlight

Get the news of the day, all in one place.

Hearkening back to a time when Canada faced “such a transformational upheaval of the world order,” Hodgson reminded the room that eight decades ago, instead of hesitating like the dumpster fire of the last decade, Canadians came together to do great things.

The “One Canadian Economy Act” passed parliament last week and is awaiting first reading in the Senate. It must pass third reading before getting Royal Ascent and then becoming law -- a process that could happen this week as the Upper Chamber is expected to rise for the summer on Thursday or Friday.

The Liberal government is sticking with its plan not to table a budget until at least the fall, so the eggheads at the C.D. Howe Institute took the liberty of doing it for them. They tallied up the government’s various new spending promises, estimated what tax revenue is going to look like for the foreseeable future, and concluded that Ottawa is on track to rack up $300 billion in new debt over the next four years, an average of about $75 billion per year (or, about $5 in new debt per Canadian, per day). And that’s under the most optimistic scenario. More likely is that it hits $350 billion.

This is way higher than any of the non-COVID spending charted under Prime Minister Justin Trudeau. Recall that it was only a few months ago that Trudeau was pressured into resigning in part due to shock that his government had allowed the deficit to swell to $62 billion. According to the C.D. Howe Institute, Canada is on a “troubling path.” “Adding $300 billion in federal debt while doing nothing to raise investment and productivity will make Canada more vulnerable, not less,” read the analysis. Oh well.

apple.news

apple.news

This is way higher than any of the non-COVID spending charted under Prime Minister Justin Trudeau. Recall that it was only a few months ago that Trudeau was pressured into resigning in part due to shock that his government had allowed the deficit to swell to $62 billion. According to the C.D. Howe Institute, Canada is on a “troubling path.” “Adding $300 billion in federal debt while doing nothing to raise investment and productivity will make Canada more vulnerable, not less,” read the analysis. Oh well.

FIRST READING: EU exempting heavy industry from carbon tax as Canada doubles down — National Post

With consumer carbon tax gone, Liberals still pursuing industrial carbon taxes

Fortunately we can track the debt filing by filing. So far only $3.4B since April 1 but that's also the day we mail in our tax cheques.The Liberal government is sticking with its plan not to table a budget until at least the fall, so the eggheads at the C.D. Howe Institute took the liberty of doing it for them. They tallied up the government’s various new spending promises, estimated what tax revenue is going to look like for the foreseeable future, and concluded that Ottawa is on track to rack up $300 billion in new debt over the next four years, an average of about $75 billion per year (or, about $5 in new debt per Canadian, per day). And that’s under the most optimistic scenario. More likely is that it hits $350 billion.

This is way higher than any of the non-COVID spending charted under Prime Minister Justin Trudeau. Recall that it was only a few months ago that Trudeau was pressured into resigning in part due to shock that his government had allowed the deficit to swell to $62 billion. According to the C.D. Howe Institute, Canada is on a “troubling path.” “Adding $300 billion in federal debt while doing nothing to raise investment and productivity will make Canada more vulnerable, not less,” read the analysis. Oh well.

FIRST READING: EU exempting heavy industry from carbon tax as Canada doubles down — National Post

With consumer carbon tax gone, Liberals still pursuing industrial carbon taxesapple.news

A new report from the C.D. Howe Institute concluded that the Trudeau government’s spending splurges played a major role in fuelling inflation during the pandemic. The report pointed the finger at Ottawa’s unfunded spending spree — more than the Bank of Canada’s monetary policies — that acted as “helicopter drops” of money for the private sector.

And not only do consumers pay higher prices but they must then pay again with the higher interest rates the central bank then implemented to try bringing those prices back down. In 2020, interest rates were down to 0.25 per cent as the Bank of Canada aimed to cushion the blow from the pandemic; by 2023, the rate had risen 20-fold, to five per cent.

apple.news

apple.news

And not only do consumers pay higher prices but they must then pay again with the higher interest rates the central bank then implemented to try bringing those prices back down. In 2020, interest rates were down to 0.25 per cent as the Bank of Canada aimed to cushion the blow from the pandemic; by 2023, the rate had risen 20-fold, to five per cent.

The pandemic drove up inflation. How come, years later, we're still paying more? — National Post

While inflation may have since been tamed, Statistics Canada’s monthly inflation figures show that the pandemic-era price hikes survived

Kinda didn’t want interest rates to go up 20 fold, and crazy government spending leading to an inflationary crunch that we’re probably gonna be dealing with for years…but here we are.Isn't that what you want? Money to the private sector?

Kinda didn’t want interest rates to go up 20 fold, and crazy government spending leading to an inflationary crunch that we’re probably gonna be dealing with for years…but here we are.

Not tax money. All that was really required was policy changes that made it possible for business to operate. Not gobs of tax money to favoured businesses. Like giving Loblaws, one of the most profitable grocery chains in the country, taxpayers' money to improve their freezers.Isn't that what you want? Money to the private sector?

Why mug customers when it's so much easier to have the politicians do it?Not tax money. All that was really required was policy changes that made it possible for business to operate. Not gobs of tax money to favoured businesses. Like giving Loblaws, one of the most profitable grocery chains in the country, taxpayers' money to improve their freezers.

I don’t think the Loblaw’s situation wasn’t an either/or but both.Why mug customers when it's so much easier to have the politicians do it?

Once lettuce goes back up to nine bucks a head, people will stop doing the chicken dance.Kinda didn’t want interest rates to go up 20 fold, and crazy government spending leading to an inflationary crunch that we’re probably gonna be dealing with for years…but here we are.

Even better! (From Loblaw's point of view.)I don’t think the Loblaw’s situation wasn’t an either/or but both.