Capitalism will save this world

- Thread starter Angstrom

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Greedy by wanting more without investing financially or physically personally to obtain it, of course not ignoring the fact that he has special permission to be in this country from a tribe that denounced it's legal existed since the 50's

A few human needs (generally "wants") are met by corporate greed; those of the shareholders, CEOs, etc.Human needs are met because of corporate greed.

Most human needs are supplied through empathy, charity, etc.

But I'm not surprised you can't tell the difference between greed and charity.

Well, I'm glad the corporation I work for has money because they pay my salary. My salary pays for my "needs" & "wants" so because the corporation I work for makes money and is well funded, I am quite happy, thank you very much! If you want to call that "greed" so be it but corporations, (which btw make up most of the businesses in the country), pay a lot of wages & salaries. Just sayin....

Most people do not rely on charity.A few human needs (generally "wants") are met by corporate greed; those of the shareholders, CEOs, etc.

Most human needs are supplied through empathy, charity, etc.

But I'm not surprised you can't tell the difference between greed and charity.

Check out what some of those charities pay their management team and how much they spend in advertising. It might change your definition of greed. And corporate greed is nothing compared to civil service greed. Or political for that matter.A few human needs (generally "wants") are met by corporate greed; those of the shareholders, CEOs, etc.

Most human needs are supplied through empathy, charity, etc.

But I'm not surprised you can't tell the difference between greed and charity.

As well as the owners of those corporations being pension funds, including government pension funds.Well, I'm glad the corporation I work for has money because they pay my salary. My salary pays for my "needs" & "wants" so because the corporation I work for makes money and is well funded, I am quite happy, thank you very much! If you want to call that "greed" so be it but corporations, (which btw make up most of the businesses in the country), pay a lot of wages & salaries. Just sayin....

Well, my corporation is owned by two (2) people; most corporations are small businesses. The individuals who own the corporation I work for have done very well for themselves (bravo) and they deserve the fruit of their labor as I benefit as well.

When I first started working there, my boss was NEVER at home; he was on the road looking for business & customers all over the province. His wife and family suffered because he was busy building his business but he was never at home. After over 10 years of going all over hells half-acre, he is now able to have others do the job he had initially and can now concentrate on keeping & improving on the business. I would not, for 1 minute, want to have to go through what he did for all those years simply to build a business. You have to have a passion for what you're doing to be so focused and driven and I don't have that. Most people don't. That doesn't even cover the "risk" he made in investing his own resources into building the business.

So apparently, the fact that he is now wealthy and has a comfortable life is somehow him being greedy? After 10+ years, doesn't he deserve to spend more time with his family, enjoy the fruits of his labor? He now has people who he was able to put on the payroll to do what he did and pay them a good salary - the result of his hard work.

My point is that saying that corporations are "greedy" is a generalization for sure and just as people shouldn't generalize about others, it applies to companies as well. Most corporations are very much in tune with their communities and are quite generous. I know in my community, they are extremely generous and we would likely not have some amenities & benefits had it not been for the very generous donations given by the larger companies where I live.

Just sayin....

When I first started working there, my boss was NEVER at home; he was on the road looking for business & customers all over the province. His wife and family suffered because he was busy building his business but he was never at home. After over 10 years of going all over hells half-acre, he is now able to have others do the job he had initially and can now concentrate on keeping & improving on the business. I would not, for 1 minute, want to have to go through what he did for all those years simply to build a business. You have to have a passion for what you're doing to be so focused and driven and I don't have that. Most people don't. That doesn't even cover the "risk" he made in investing his own resources into building the business.

So apparently, the fact that he is now wealthy and has a comfortable life is somehow him being greedy? After 10+ years, doesn't he deserve to spend more time with his family, enjoy the fruits of his labor? He now has people who he was able to put on the payroll to do what he did and pay them a good salary - the result of his hard work.

My point is that saying that corporations are "greedy" is a generalization for sure and just as people shouldn't generalize about others, it applies to companies as well. Most corporations are very much in tune with their communities and are quite generous. I know in my community, they are extremely generous and we would likely not have some amenities & benefits had it not been for the very generous donations given by the larger companies where I live.

Just sayin....

uuummmm there's a difference between human charity and a charity organisation.Check out what some of those charities pay their management team and how much they spend in advertising. It might change your definition of greed. And corporate greed is nothing compared to civil service greed. Or political for that matter.

Those corporations are composed of charitable people to a point. DUH If they were completely greedy, their employees wouldn't be employees, they'd be slaves.Most people do not rely on charity.

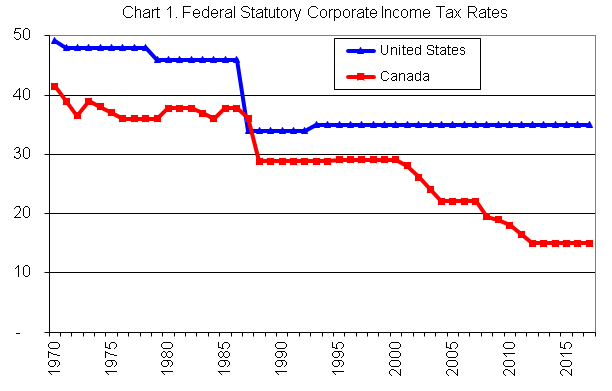

In Canada a person making $20,000 a year pays a higher rate of tax than a corporation making billions in profits (and shipping that money out of Canada)

What's the tax rate on the share holders at the second level of taxes toward corporations?

Mark Carney’s “Greta” Finance Model

Depending on the part of the world you’re in, the mention of economist, Mark Carney, will elicit different responses. In Canada, Carney is widely credited with steering the country through the rocky waters of the 2008 financial crisis, but in the United Kingdom he is often labeled a political activist disguised as an economist.

I have previously written about Carney’s time as Governor of the Bank of England, a role he will leave on January 31. Through analysis of predictions made by the Bank of England relating to the impact of the Brexit vote, I argued that Carney had made a radical shift from economist and strategist to political activist with a clear agenda. Following the election of Boris Johnson as Prime Minister, and the realisation that Brexit is actually going to happen, the Bank of England wasforced to peddle back some of its predictions of impending economic crisis and now it seems that Carney has found a fresh cause to campaign for. In December 2019, United Nations Secretary General Antonio Guterres announced that Carney would lead a new push to ensure the financial sector embraces “climate emergency” issues, and will serve as the U.N. special envoy on climate action. It is a natural fit for Carney, who has been warning how climate change could “cause a new crash” since 2015.

In a statement, Carney said that the disclosures of climate risk “must become comprehensive” and that “investing for a net-zero world must go mainstream” —an assertion that demonstrates Carney’s willingness to advocate a political position while, at the same time, warning businesses that if they refuse to adapt to his vision then they could face severe financial penalty. Carney isn’t afraid to throw his weight around either. As the chief of the Financial Stability Board he directed companies to disclose potential risks they face as a result of climate change, despite bankers and finance professionals not identifying any imminent threat. The direction was widely criticised as little more than a vanity project.

In October 2019, Carney said that transition to net zero carbon emissions would change the value of every asset and raise the risk of shocks to the financial system. He is right. The value of assets in the fossil fuel industry will change, coal-fired plants are closing in major economies like the United States—but global energy demands are enormous and growing. President Donald Trump has demonstrated his commitment to protecting the coal industry and has proposed relaxing environmental regulation to make it easier to establish new oil drilling sites and coal mines. As it stands, renewable energy cannot meet the global economy’s growing demands for energy. The United States still relies on fossil fuels for 80 percent of its energy needs. In Canada, fossil fuels account for almost 90 percent of domestic energy production. In 2018, BloombergNEF’s annual survey of over 100 developing markets found that investments in solar, wind, and other renewable energy projects fell to $133B, down $33B from the year previous. Clean energy investments in India are declining as the nation struggles to keep up with its growing energy demands, and China is relying on more coal than ever before.

However well-intentioned it may be, the renewable energy industry isn’t ready for primetime yet, and the movement behind it has a tendency of attracting extreme-left, progressive ideologues. It is simply true that current renewable energy technology cannot satisfy demand and the costs are often prohibitive. Fossil fuel is not going away any time soon and Carney’s warnings, when put into the context of his tales of a Brexit economic doomsday, resemble threats more than honest analysis.

It is hard to ignore the political and professional affiliations of his wife too. Diana Carney is an environmental activist who was previously the Vice President of Research at progressive think tank Canada2020 and is an ambassador for the WWF. As Executive Director of Pi Capital, her work focused on “climate and energy issues” and “identifying pathways for more sustainable capitalism.” She supports green economy initiatives and is recognized globally as a leading campaigner for radical policy to address what she identifies as a climate emergency.

The parallels between Diana Carney’s work and Mark Carney’s recent interventions in finance have not gone unnoticed. It is an issue that has been long-discussed, and the couple even insisted in April 2013 that they are separate people with separate opinions. Events since then appear to suggest otherwise.

In fact, Carney’s vanity projects and haughty attempts to ensure businesses abide by rules dictated by his and his wife’s worldview pose two questions. The first is, why should we trust Mark Carney in the first place? Why should businesses believe the words of a man who showed disdain for the Brexit decision made by the British people, and who willingly incorporates the political agenda of his wife into his work as a leading global economist?

Secondly, it raises the question of whether he is suited to being a leading voice on such a divisive political issue. If consensus, or even compromise, is ever to be reached on the topic of climate change and renewable technology, is Mark Carney really the man to do it, or, is he another ideologue that represents establishment scorn for regular people?

Carney is quickly turning into the Greta Thunberg of finance, only it’s his wife pulling the strings and not his parents.

fcpp.org/2020/01/28/mark-carneys-greta-finance-model/

I went through that. I missed 7 years of my daughter growing up and a slough of other sacrifices.my boss was NEVER at home; he was on the road looking for business & customers all over the province. His wife and family suffered because he was busy building his business but he was never at home. After over 10 years of going all over hells half-acre, he is now able to have others do the job he had initially and can now concentrate on keeping & improving on the business. I would not, for 1 minute, want to have to go through what he did for all those years simply to build a business. You have to have a passion for what you're doing to be so focused and driven and I don't have that. Most people don't. That doesn't even cover the "risk" he made in investing his own resources into building the business.

It's still sweet f-ck all when compared to what my great and grandparents who started their lives in Canada from scratch went through to ensure my future.

Bullshit. A person making $20g a year doesn't pay any net taxes.In Canada a person making $20,000 a year pays a higher rate of tax than a corporation making billions in profits (and shipping that money out of Canada)

More’s the pity.Bullshit. A person making $20g a year doesn't pay any net taxes.

Corporations making billions (in the USA) pay a small token rate and nothing if they transfer profits offshore.. Trump and cronies essentially voided their income taxes. Before Trump, the effective rate they paid was under 25% (the marginal rate was 35%). After Trump messed with the tax, it is marginally 21% and effectively less than 11%.A person making $20g a year doesn't pay any net taxes.

Sucks to be us .Corporations making billions (in the USA) pay a small token rate and nothing if they transfer profits offshore.. Trump and cronies essentially voided their income taxes. Before Trump, the effective rate they paid was under 25% (the marginal rate was 35%). After Trump messed with the tax, it is marginally 21% and effectively less than 11%.