The Wall Street Journal featured an editorial in its weekend edition declaring that if Donald Trump went ahead with his plan to impose tariffs on America’s two biggest trading partners, it would

constitute “the dumbest trade war in history.”

He did, and it is.

The Journal’s argument, which reflects similar cases made in innumerable other sites on TV, in print and on the internet, is that the crusade Trump launched “makes no sense.” It will penalize goods Americans buy because they want them and need them.

With tariffs, Donald Trump has done the impossible: he’s resurrected Justin Trudeau as an important figure

apple.news

Sunday felt like the morning after a marital break-up. There is the certain knowledge that there will be financial hardship down the road. But for now, there is just the sting of anger, bitterness and betrayal.

Canada is on the receiving end of a hostile act by a nation we considered our best friend. No wonder Canadians feel let down.

'The only way out of a mess that is not of our choosing is not only to inflict pain on American consumers and producers, but to let them know who is to blame'

apple.news

The closest parallel to Trump's action was the late president Richard Nixon's use of IEEPA's predecessor law, the 1917 Trading With the Enemy Act, to impose a 10% across-the-board U.S. tariff in 1971 to stem rising imports amid a balance-of-payments crisis after pulling the dollar off the gold standard.

Trade and legal experts said the 1977 International Emergency Economic Powers Act (IEEPA) is untested for imposing import tariffs and Trump's action will likely face swift court challenges that could set important precedents.

Courts upheld Nixon's action, but Jennifer Hillman, a trade law professor at Georgetown University and former World Trade Organization appellate judge, said Trump's action may not fit the emergency.

President Donald Trump has pushed into new trade law territory with an emergency sanctions law to justify punishing [USN:L1N3OS02C TEXT:"25% tariffs"] on Canadian and Mexican imports and an extra 10% duty on Chinese goods to curb fentanyl and illegal immigration into the U.S.

apple.news

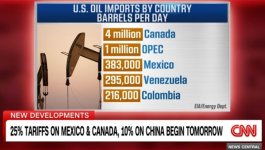

The Trump administration has already threatened that if Canada retaliates, the U.S. may up those tariffs to 50%. Good times. Canadian energy including oil, gas, critical minerals, electricity, and uranium received a reduced tariff of 10 percent.

Alberta Premier Danielle Smith took credit for her province’s oil sector getting a reduced 10% tariff, claiming her diplomatic efforts played a role. While denouncing Trump’s decision and saying she will work with her provincial and federal counterparts, Smith said that Canada must reorient trade to expand Canada’s opportunities.

“We must unleash the true economic potential of our country, which possesses more wealth and natural resources than any other nation on earth,” Smith said.

Let's build pipelines in all directions using steel from Ontario and Quebec, and workers from everywhere

apple.news

For far too long, we have restricted our own growth potential and limited our natural resources industry. Now, we may be forced to do what we should have been doing all along in the face of these American moves.

Whether we will do that, or stick to the low growth, low-carbon agenda of the Trudeau Liberals that put us in this weak spot, remains to be seen.

Tariffs take effect Tuesday and stay in place until border issues are dealt with, according to the U.S. president.

apple.news

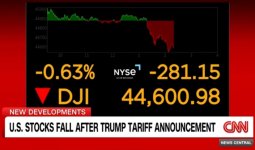

Trump on Saturday ordered

sweeping tariffs on goods from Mexico, Canada and China, kicking off a trade war that could dent global growth and reignite inflation.

Energy products from Canada will have only a 10% duty, but Mexican energy imports will be charged the full 25%, White House officials said.

"Tariffs on Canadian energy imports would likely be more disruptive for domestic energy markets than those on Mexican imports and might even be counterproductive to one of the president's key objectives - lowering energy costs."

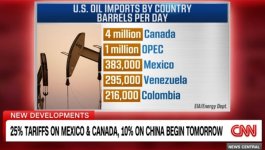

Canada and Mexico are the

top sources of U.S. crude imports, together accounting for about a quarter of the oil U.S. refiners process into fuels such as gasoline and heating oil, according to the U.S. Department of Energy.

The tariffs will

raise costs for the heavier crude grades U.S. refineries need for optimum production, industry sources said, cutting their profitability and potentially forcing production cuts. Whoopsies.

However, oil prices may fall beyond the next quarter as tariffs cause the demand outlook to deteriorate further and as OPEC+ has come under more pressure from Trump to unwind production cuts???

(I’m assuming OPEC isn’t going to increase to 5,383,000 Barrels/day at the special discount price Canada

subsidies America at, to replace Mexican & Canadian crude oil)

The Organization of the Petroleum Exporting Countries and their allies, a group known as OPEC+, is

unlikely to alter existing plans to raise output gradually when it meets on Monday, delegates from the producer group told Reuters, despite the pressure from Trump. Oh well, they produced the wrong grade of oil that so many US refineries are designed for to replace Canadian oil anyway.

Oil prices edged up in volatile trade on Monday but closed at a one-month low on the expiration of a higher-priced contract, as the market digested U.S. President Donald Trump's planned imposition of tariffs on Canada, Mexico and China.

apple.news

apple.news