It's that time of year again in which the Chancellor of the Exchequer unveiled the annual Budget and, with Britain currently in recession, Alistair Darling has unveiled several measures which he hopes will get the world's 5th largest economy back on track again.

Most other countries' Financial Ministers will, quite boringly, just announce the Budget.

But this being Britain, there exist some little traditions that have taken place seemingly forever that are usually undertaken during the Budget.

One of them is the red Budget Box, a red briefcase which the Chancellor of the Exchequer uses to carry the details of his budget in. On the morning of the budget, it is traditional for the Chancellor to stand outside his home - 11 Downing Street - holding up his briefcase for the photographers, with several of his Treasury around him. He then proceeds to the Palace of Westminster to read his Budget to the House of Commons. The Budget Box has been used since 1860 by then-Chancellor William Gladstone, and that very one has been used by every Chancellor since, with the exception of Chancellor James Callaghan (1964-1967) and Chancellor Gordon Brown (1997-2007), who both used new ones.

Of course, the monarch is usually the first person to be told of the Budget and it is tradition that, the day before Budget Day (this year 22nd April), the Queen invites the Chancellor to Buckingham Palace for dinner where she is given an outline of the Budget.

Another, probably uniquely British, tradition is the fact that the Chancellor of the Exchequer is the only person allowed to drink alcohol in the Commons, and that is only when he is making his Budget speech on Budget Day, to calm nerves.

The current Chancellor of the Exchequer, Alistair Darling, actually only drinks water during the speech, but Kenneth Clarke (1993-1997) sipped on whisky, Benjamin Disraeli (1866-1868 ) drank brandy and water, George Goschen (1886-1887) drank port, and William Gladstone (1852-1855, 1859-1866, 1873-1874, 1880-1882) had a strang concoction of sherry and beaten egg.

Now onto today's Budget.

Darling has, amongst other things, unveiled a 50 per cent top tax rate for high earners as well as plans to scrap personal tax allowances for those on more than £100,000 from next April.

And he revealed the Government will need to borrow a jaw-dropping £703billion over the next five years to make ends meet, including £175billion this year alone.

Duty on alcohol and cigarettes is to rise by 2% today

And the British economy which, over the last 15 years or so has been remarkably brilliant and, until this year, Britain was the only G7 nation to have not experienced recession since 1997, has been forecast to grow by 3.5% from 2011.

BUDGET 2009: Darling puts Britain into debt for a decade (oh, but he will squeeze the rich)

By Kirsty Walker and Nicola Boden

22nd April 2009

Daily Mail

The Chancellor forecast net debt in the UK would soar to 79 per cent of GDP in the next six years, compared to 43 per cent when Labour first came to power.

In a Budget that harked back to the bleak days of Old Labour, Mr Darling stunned Westminster with plans to soak the rich to plug the huge hole in public finances.

He unveiled a new 50 per cent top tax rate for high earners as well as plans to scrap personal tax allowances for those on more than £100,000 from next April.

And he revealed the Government will need to borrow a jaw-dropping £703billion over the next five years to make ends meet, including £175billion this year alone.

Scroll down to see our tax tables

Years of debt: Alistair Darling delivers his devastating Budget to the Commons

A fresh assault on middle class pensions will also be implemented in April 2011 with the scrapping of high-rate tax relief on incomes above £150,000.

David Cameron said the devastating levels of Government debt meant any claim Labour had ever made to economic competence was 'dead, over, finished'.

'This Prime Minister has certainly got himself himself into the history books - he has written a whole chapter in red ink: Labour's decade of debt,' he declared.

The Government was the 'living dead' which had not only run out of money but out of 'moral authority', the Tory leader said.

In a humiliating 50-minute speech, the Chancellor was forced to admit his previous predictions about the extent of Britain's economic woes were a gross miscalculation.

He had predicted in his pre-budget report five months ago that the economy would shrink by between 0.75 per cent and 1.25 per cent.

But today he revealed the decline would be an astonishing 3.5 per cent, worst than many experts had feared, before the recovery started at the end of the year.

'Because of our underlying strength, the measures we are taking, domestically and internationally, I expect to see growth resume towards the end of the year,' he said.

The International Monetary Fund immediately contradicted this view, predicting the slump would be an even deeper 4.1 per cent this year.

And embarrassingly for Mr Darling, it disagreed the recovery would start towards the end of 2009 by predicting a further contraction of 0.4 per cent in 2010.

Ready for the off: Mr Darling and his Treasury team on the steps of Number 11 Downing Street before they head to the Commons

Meanwhile, borrowing will soar to £175billion this year - far greater than his forecast of £118billion in the autumn and equal to 12 per cent of GDP.

It means that struggling families are now facing the grim prospect of severe tax rises and spending cuts from 2011, which could last up to a decade.

Mr Darling forecast national debt would hit almost 80 per cent of GDP by 2015 before starting to drop back, while public finances would not be balanced until 2018.

In a sign of the tax rises to come, he announced that fuel duty will increase by 2p per litre in September and then by 1p a litre every year for the next four years.

Alcohol and tobacco duty will also go up by 2 per cent from midnight tonight - in a bid to raise over £6 billion by 2012.

In a rare glimmer of hope for savers, the threshold for tax-free ISAs will be raised from £7,000 to £10,200 for everyone from next year.

A £2,000 car scrappage scheme to try and boost the ailing motor industry was also unveiled, only to be ridiculed by the Tories.

'Let me see if I can get this right. You take something ten years old, completely clapped out, it pumps out hot air, pollutes its surroundings - it is absolutely ripe for the knackers yard. What a brilliant idea,' Mr Cameron said.

It's over: Mr Darling looks glum as the Prime Minister grins and gives him a pat on the shoulder after his 50-minute speech

Mr Darling tried to rescue his credibility by predicting the recovery will start at the end of the year, with growth at 1.25 per cent in 2010 rising to 3.5 per cent by 2011.

But this forecast will be met with deep scepticism following his wildly inaccurate predictions about the state of the public finances last year.

Despite gambling on a rapid recovery, Mr Darling said the economy will slump further into deflation with the Retail Prices Index plunging to minus 3 per cent by September.

His Budget - the gloomiest for a generation - comes amid a background of soaring unemployment and falling prices.

New figures released by the Office for National Statistics today have revealed that unemployment has soared to its highest level since Labour came to power in 1997.

And separate data showed public borrowing soared to £90billion in the last financial year, outstripping Mr Darling's forecast and almost double the previous figure.

In March alone, net borrowing was a record £19.1billion - the highest monthly figure since records began more than 15 years ago.

'Decade of debt: Mr Brown manages to crack a smile despite a withering response from the Tory leader David Cameron

Mr Darling did his best to paint the crisis as a global issue which had ravaged the world economy and insisted that Britain could once again be a 'world leader'.

The Budget would 'speed recovery and spread prosperity', he said, insisting the UK is well placed to weather the global storm.

Action taken to shore up the banking system would ensure that billions more was lent to struggling businesses and home owners.

Britain would 'invest and grow' its way out of the recession', he said, but admitted: 'There are no quick fixes, there is no overnight solution.'

'Getting credit flowing again is the essential precondition to economic recovery,' he told the Commons.

His Budget was one of the most eagerly awaited in recent history and had been dubbed the 'day of Judgement' for both him and the Prime Minister.

Likely to be the penultimate one before an expected general election next May and with the Tories soaring ahead in the polls, it is crucial to Labour's fortunes.

The worsening state of the public finances has left Mr Brown little scope for fresh action to revive the economy before going to the country.

Official figures underlined this yesterday by showing the economy has now entered a period of deflation for the first time in almost half a century.

The Tories have warned that the Government's attempt to spend its way out of recession is not working and that Britain needs a change of direction.

Enlarge

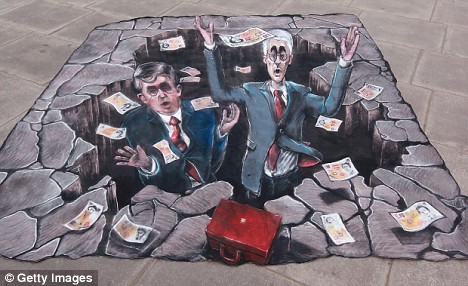

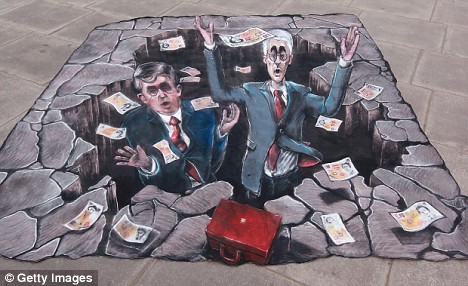

In a hole: Street artists depicted Mr Brown and Mr Darling in a 'financial black hole' today on the pavement outside the Treasury building

Labour's Credit Crunch Budget:

Tax

A new top income tax rate of 45 per cent for those earning more than £150,000 will be increased to 50 per cent.

The rise will also take effect from next April, a year earlier than planned.

It is a breach of Labour's manifesto pledge in 2005 not to increase the basic or top rates of income tax in the next parliament.

From April 2011, pension tax relief for people earning more than £150,000 will also be restricted.

Savers

The annual savings allowance for tax-free ISAs will rise to £10,200 a year, up from £7,000.

People aged 50 and over will be able to save more from this year with the rise coming into effect for everyone else from 2010.

Alistair Darling said the cash limit within the overall allowance would rise from £3,600 to £5,100.

Car scrappage scheme

A 'cash for bangers' scheme will be used to try and kick-start the ailing motor industry.

Anyone with a car registered before July 31 1999 will get a cash incentive of £2,000 to trade in their old vehicle for a brand new one.

A total of £1,000 will come from the Government and the remaining £1,000 from the industry itself.

Participants will be able to buy any new vehicle, including small vans, rather than just low-pollution models.

The £300million scheme could come into effect as early as the middle of next month and will last until the grant runs out - allowing 300,000 people to benefit.

Housing

The stamp duty holiday on properties of up to £175,000 will be extended until the end of the year.

Chancellor Alistair Darling said the exemption meant that 60 per cent of homebuyers would not be liable for the tax.

The threshold at which the tax kicks in was initially increased from £125,000 to £175,000 for one year in September 2008.

Alcohol and Cigarettes

Duty on both will rise 2 per cent in a move that will anger the struggling pub and drinks industry.

The increase on alcohol will be implemented from midnight tonight and on tobacco from 6pm this evening.

The British Beer and Pub Association (BBPA) has said the increase would mean an extra 5p on the average pint of beer.

The UK pub industry is already under great pressure, with pubs closing at an average of 39 a week.

Mr Darling said said these measures would raise more than £6 billion by 2012.

Fuel duty

This will increase by 2p a litre in September and there will be further rises of 1p a litre for the next four Aprils.

The AA billed the move an 'unexpected bombshell' while the RAC described it as a 'brutal blow for motorists'.

The Freight Transport Association said it 'could be the death knell for parts of the logistics sector'.

Having slipped below 90p a litre at the pumps, petrol prices are now around 95p, with this month's planned Government fuel duty rise adding 2.12p a litre on prices.

Employment

An extra £1.7billion will be poured into the Jobcentre Plus network on top of £1.3billion already announced.

From January, everyone under the age of 25 who has been out of work for 12 months will be offered a job or a place in training and those in work will receive a wage.

Some 250,000 jobs will be created or supported as part of these measures, Mr Darling said.

Business

Up to £5billion will be given in extra trade credit insurance to businesses who have seen their level of cover reduced.

Firms will be able to buy six months 'top up' insurance from the Government after May until the end of the year if credit limits on their UK customers are reduced.

The move follows growing concern from businesses that reductions in the value of insurance cover created pressure on suppliers to shorten payment terms.

Public debt and the economy

Public borrowing to soar to £175billion this year, equal to 12 per cent of GDP.

It is forecast to fall back to £173billion next year, then £140billion in 2011 and £118billion in 2012.

This means the Government is set to borrow a massive £606billion over the next four years.

The economy will shrink by 3.5 per cent this year, Mr Darling said, before returning to growth next year with a 1.25 per cent rise.

Annual growth of 3.5 per cent expected from 2011.

The Retail Prices Index will fall to minus 3 per cent by this September as deflation worsens.

Government cuts

The Government aims to make £9billion in efficiency savings a year by 2013/14 despite promising not to cut back on vital public spending.

Mr Darling said he had been seeking to find an additional £5billion of efficiency savings in 2010-11, on top of a total of £30 billion in the current spending review period.

Families and pensions

From April next year, the child element of child tax credit will go up £20.

Grandparents who are carers of children will see that work qualify towards state pension.

Winter fuel allowance for pensioners is to be maintained.

Capital disregard on Pension Credit will be raised from £6,000 to £10,000 from November.

Environment

The world's first 'carbon budgets' will require Britain to cut its emissions by a third by 2020.

An extra £1billion will be spent on tackling climate change by supporting low-carbon industries.

Offshore wind projects will receive £525million over the next two years and £435million will be set aside for energy efficiency schemes in homes, officers and public buildings.

Another £405million will be spent on encouraging low-carbon energy and 'advanced green manufacturing'.

... And here's how the markets responded

The Stock Exchange gave the Budget a lukewarm response this afternoon as the pound tanked after the devastating forecasts on public finance.

The FTSE-100 dipped into the red as the Chancellor's forecasts of soaring public debt hit home.

Life and pensions firms dropped in response to the move to restrict pension tax relief for top earners.

But the index later recovered some lost ground to stand around 40 points higher, or more than 1 per cent.

The pound fared less well, dropping nearly 2 per cent against the euro to 1.11 euros and falling to 1.45 U.S. dollars - a drop of more than 1 per cent.

******************************************************

The Chancellor's "little bag"

THE DAILY POLITICS

THE DAILY POLITICS

Watch Daniel's film

Watch Daniel's film

Why is a budget called a budget, and how long has this been going on? Daniel Brittain reports for the Daily Politics from the East Street market in Southwark.

Our lords and masters seem always to have been trying to part us from our cash in one way or another.

Our lords and masters seem always to have been trying to part us from our cash in one way or another.

But as early as 1295, when Edward I wanted to raise taxes to fight the Scots and French, he thought it wise to get the backing of the Commons - because it gave his money-grabbing more legitimacy.

A little bag

The annual Budget first came about during Walpole's time in the 1720s. He was both PM and Chancellor. The word "budget" came from the French "bougette", a little bag. And from his little bag, Walpole certainly took some unpleasant pills and potions.

Paul Seward of the History Of Parliament Trust told me a few of them:

A window tax, a tax on male servants, a tax on pleasure horses - I'm not quite sure what pleasure horses were. The tax on salt was extremely unpopular - people called it grinding the faces of the poor. It was a very regressive tax, because everyone needed it.

A window tax, a tax on male servants, a tax on pleasure horses - I'm not quite sure what pleasure horses were. The tax on salt was extremely unpopular - people called it grinding the faces of the poor. It was a very regressive tax, because everyone needed it.

If there's a date in Budget history which taxpayers dread, it's 1799. William Pitt introduced Income Tax - purely as a temporary measure, you understand.

In fact, it's still legally regarded as temporary and has to be renewed every year, but don't hold your breath that - after 207 years - Gordon Brown is about to abolish it!

Banging on

Putting on a performance is an essential ingredient in presenting a budget. Gladstone took holy communion, and then banged on in the Commons for a record four and three quarter hours.

Disraeli kept it short and sweet at 45 minutes. Macmillan stayed in bed most of the morning fretting about it. Ken Clarke told me he was going to have some fun:

I greatly enjoyed it! My presentation obviously went down very well to a demoralised party who wanted to be cheered up, and to the House Of Commons.

I greatly enjoyed it! My presentation obviously went down very well to a demoralised party who wanted to be cheered up, and to the House Of Commons.

I got a tremendous reaction to the end of the speech. People were waving order papers and cheering; I kept pinching myself. I think I produced the budget whcih had raised more taxation than any other in living memory, so I had to wonder whether they'd been listening to it!

THE DAILY POLITICS

THE DAILY POLITICS

If you are cold, tea will warm you; if you are too heated, it will cool you; if you are depressed, it will cheer you; if you are excited, it will calm you.

If you are cold, tea will warm you; if you are too heated, it will cool you; if you are depressed, it will cheer you; if you are excited, it will calm you.

William Gladstone, sherry drinker

Latest show

Latest show

Sherry and beaten egg

Of course, all this speechifying is thirsty work - and the Chancellor's budget drink is a lifesaver. The only MP allowed to drink alcohol in the House of Commons is the Chancellor, on Budget day. Ken Clarke sipped on neat whisky; Disraeli went for brandy and water; Goschen drank port; Gladstone had a strange mixture of sherry and beaten egg. Jim Callaghan took a modest tonic water, whilst David Heathcoat-Amory favoured honey, milk and rum. And our own dear austere Chancellor? Surprise, surprise: he drinks water. Scottish, of course.

The Chancellor's "little bag"

THE DAILY POLITICS

THE DAILY POLITICS

Watch Daniel's film

Watch Daniel's film

Why is a budget called a budget, and how long has this been going on? Daniel Brittain reports for the Daily Politics from the East Street market in Southwark.

Our lords and masters seem always to have been trying to part us from our cash in one way or another.

Our lords and masters seem always to have been trying to part us from our cash in one way or another.

But as early as 1295, when Edward I wanted to raise taxes to fight the Scots and French, he thought it wise to get the backing of the Commons - because it gave his money-grabbing more legitimacy.

A little bag

The annual Budget first came about during Walpole's time in the 1720s. He was both PM and Chancellor. The word "budget" came from the French "bougette", a little bag. And from his little bag, Walpole certainly took some unpleasant pills and potions.

Paul Seward of the History Of Parliament Trust told me a few of them:

A window tax, a tax on male servants, a tax on pleasure horses - I'm not quite sure what pleasure horses were. The tax on salt was extremely unpopular - people called it grinding the faces of the poor. It was a very regressive tax, because everyone needed it.

A window tax, a tax on male servants, a tax on pleasure horses - I'm not quite sure what pleasure horses were. The tax on salt was extremely unpopular - people called it grinding the faces of the poor. It was a very regressive tax, because everyone needed it.

If there's a date in Budget history which taxpayers dread, it's 1799. William Pitt introduced Income Tax - purely as a temporary measure, you understand.

In fact, it's still legally regarded as temporary and has to be renewed every year, but don't hold your breath that - after 207 years - Gordon Brown is about to abolish it!

Banging on

Putting on a performance is an essential ingredient in presenting a budget. Gladstone took holy communion, and then banged on in the Commons for a record four and three quarter hours.

Disraeli kept it short and sweet at 45 minutes. Macmillan stayed in bed most of the morning fretting about it. Ken Clarke told me he was going to have some fun:

I greatly enjoyed it! My presentation obviously went down very well to a demoralised party who wanted to be cheered up, and to the House Of Commons.

I greatly enjoyed it! My presentation obviously went down very well to a demoralised party who wanted to be cheered up, and to the House Of Commons.

I got a tremendous reaction to the end of the speech. People were waving order papers and cheering; I kept pinching myself. I think I produced the budget whcih had raised more taxation than any other in living memory, so I had to wonder whether they'd been listening to it!

THE DAILY POLITICS

THE DAILY POLITICS

If you are cold, tea will warm you; if you are too heated, it will cool you; if you are depressed, it will cheer you; if you are excited, it will calm you.

If you are cold, tea will warm you; if you are too heated, it will cool you; if you are depressed, it will cheer you; if you are excited, it will calm you.

William Gladstone, sherry drinker

Latest show

Latest show

Sherry and beaten egg

Of course, all this speechifying is thirsty work - and the Chancellor's budget drink is a lifesaver. The only MP allowed to drink alcohol in the House of Commons is the Chancellor, on Budget day. Ken Clarke sipped on neat whisky; Disraeli went for brandy and water; Goschen drank port; Gladstone had a strange mixture of sherry and beaten egg. Jim Callaghan took a modest tonic water, whilst David Heathcoat-Amory favoured honey, milk and rum. And our own dear austere Chancellor? Surprise, surprise: he drinks water. Scottish, of course.

Most other countries' Financial Ministers will, quite boringly, just announce the Budget.

But this being Britain, there exist some little traditions that have taken place seemingly forever that are usually undertaken during the Budget.

One of them is the red Budget Box, a red briefcase which the Chancellor of the Exchequer uses to carry the details of his budget in. On the morning of the budget, it is traditional for the Chancellor to stand outside his home - 11 Downing Street - holding up his briefcase for the photographers, with several of his Treasury around him. He then proceeds to the Palace of Westminster to read his Budget to the House of Commons. The Budget Box has been used since 1860 by then-Chancellor William Gladstone, and that very one has been used by every Chancellor since, with the exception of Chancellor James Callaghan (1964-1967) and Chancellor Gordon Brown (1997-2007), who both used new ones.

Of course, the monarch is usually the first person to be told of the Budget and it is tradition that, the day before Budget Day (this year 22nd April), the Queen invites the Chancellor to Buckingham Palace for dinner where she is given an outline of the Budget.

Another, probably uniquely British, tradition is the fact that the Chancellor of the Exchequer is the only person allowed to drink alcohol in the Commons, and that is only when he is making his Budget speech on Budget Day, to calm nerves.

The current Chancellor of the Exchequer, Alistair Darling, actually only drinks water during the speech, but Kenneth Clarke (1993-1997) sipped on whisky, Benjamin Disraeli (1866-1868 ) drank brandy and water, George Goschen (1886-1887) drank port, and William Gladstone (1852-1855, 1859-1866, 1873-1874, 1880-1882) had a strang concoction of sherry and beaten egg.

Now onto today's Budget.

Darling has, amongst other things, unveiled a 50 per cent top tax rate for high earners as well as plans to scrap personal tax allowances for those on more than £100,000 from next April.

And he revealed the Government will need to borrow a jaw-dropping £703billion over the next five years to make ends meet, including £175billion this year alone.

Duty on alcohol and cigarettes is to rise by 2% today

And the British economy which, over the last 15 years or so has been remarkably brilliant and, until this year, Britain was the only G7 nation to have not experienced recession since 1997, has been forecast to grow by 3.5% from 2011.

BUDGET 2009: Darling puts Britain into debt for a decade (oh, but he will squeeze the rich)

By Kirsty Walker and Nicola Boden

22nd April 2009

Daily Mail

- UK debt to hit 79% of GDP before falling back in 2015

- Britain's economy to shrink by 3.5% this year

- IMF disagrees growth will return in 2010

- Government to borrow £703bn in next five years

- Top tax rate raised to 50% for earners above £150,000

- £2,000 incentive for drivers who trade in old cars

- Duty on alcohol and cigarettes to rise 2% today

- ISA limit to rise to £10,000 for everyone from next year

The Chancellor forecast net debt in the UK would soar to 79 per cent of GDP in the next six years, compared to 43 per cent when Labour first came to power.

In a Budget that harked back to the bleak days of Old Labour, Mr Darling stunned Westminster with plans to soak the rich to plug the huge hole in public finances.

He unveiled a new 50 per cent top tax rate for high earners as well as plans to scrap personal tax allowances for those on more than £100,000 from next April.

And he revealed the Government will need to borrow a jaw-dropping £703billion over the next five years to make ends meet, including £175billion this year alone.

Scroll down to see our tax tables

Years of debt: Alistair Darling delivers his devastating Budget to the Commons

A fresh assault on middle class pensions will also be implemented in April 2011 with the scrapping of high-rate tax relief on incomes above £150,000.

David Cameron said the devastating levels of Government debt meant any claim Labour had ever made to economic competence was 'dead, over, finished'.

'This Prime Minister has certainly got himself himself into the history books - he has written a whole chapter in red ink: Labour's decade of debt,' he declared.

The Government was the 'living dead' which had not only run out of money but out of 'moral authority', the Tory leader said.

In a humiliating 50-minute speech, the Chancellor was forced to admit his previous predictions about the extent of Britain's economic woes were a gross miscalculation.

He had predicted in his pre-budget report five months ago that the economy would shrink by between 0.75 per cent and 1.25 per cent.

But today he revealed the decline would be an astonishing 3.5 per cent, worst than many experts had feared, before the recovery started at the end of the year.

'Because of our underlying strength, the measures we are taking, domestically and internationally, I expect to see growth resume towards the end of the year,' he said.

The International Monetary Fund immediately contradicted this view, predicting the slump would be an even deeper 4.1 per cent this year.

And embarrassingly for Mr Darling, it disagreed the recovery would start towards the end of 2009 by predicting a further contraction of 0.4 per cent in 2010.

Ready for the off: Mr Darling and his Treasury team on the steps of Number 11 Downing Street before they head to the Commons

Meanwhile, borrowing will soar to £175billion this year - far greater than his forecast of £118billion in the autumn and equal to 12 per cent of GDP.

It means that struggling families are now facing the grim prospect of severe tax rises and spending cuts from 2011, which could last up to a decade.

Mr Darling forecast national debt would hit almost 80 per cent of GDP by 2015 before starting to drop back, while public finances would not be balanced until 2018.

In a sign of the tax rises to come, he announced that fuel duty will increase by 2p per litre in September and then by 1p a litre every year for the next four years.

Alcohol and tobacco duty will also go up by 2 per cent from midnight tonight - in a bid to raise over £6 billion by 2012.

In a rare glimmer of hope for savers, the threshold for tax-free ISAs will be raised from £7,000 to £10,200 for everyone from next year.

A £2,000 car scrappage scheme to try and boost the ailing motor industry was also unveiled, only to be ridiculed by the Tories.

'Let me see if I can get this right. You take something ten years old, completely clapped out, it pumps out hot air, pollutes its surroundings - it is absolutely ripe for the knackers yard. What a brilliant idea,' Mr Cameron said.

It's over: Mr Darling looks glum as the Prime Minister grins and gives him a pat on the shoulder after his 50-minute speech

Mr Darling tried to rescue his credibility by predicting the recovery will start at the end of the year, with growth at 1.25 per cent in 2010 rising to 3.5 per cent by 2011.

But this forecast will be met with deep scepticism following his wildly inaccurate predictions about the state of the public finances last year.

Despite gambling on a rapid recovery, Mr Darling said the economy will slump further into deflation with the Retail Prices Index plunging to minus 3 per cent by September.

His Budget - the gloomiest for a generation - comes amid a background of soaring unemployment and falling prices.

New figures released by the Office for National Statistics today have revealed that unemployment has soared to its highest level since Labour came to power in 1997.

And separate data showed public borrowing soared to £90billion in the last financial year, outstripping Mr Darling's forecast and almost double the previous figure.

In March alone, net borrowing was a record £19.1billion - the highest monthly figure since records began more than 15 years ago.

'Decade of debt: Mr Brown manages to crack a smile despite a withering response from the Tory leader David Cameron

Mr Darling did his best to paint the crisis as a global issue which had ravaged the world economy and insisted that Britain could once again be a 'world leader'.

The Budget would 'speed recovery and spread prosperity', he said, insisting the UK is well placed to weather the global storm.

Action taken to shore up the banking system would ensure that billions more was lent to struggling businesses and home owners.

Britain would 'invest and grow' its way out of the recession', he said, but admitted: 'There are no quick fixes, there is no overnight solution.'

'Getting credit flowing again is the essential precondition to economic recovery,' he told the Commons.

His Budget was one of the most eagerly awaited in recent history and had been dubbed the 'day of Judgement' for both him and the Prime Minister.

Likely to be the penultimate one before an expected general election next May and with the Tories soaring ahead in the polls, it is crucial to Labour's fortunes.

The worsening state of the public finances has left Mr Brown little scope for fresh action to revive the economy before going to the country.

Official figures underlined this yesterday by showing the economy has now entered a period of deflation for the first time in almost half a century.

The Tories have warned that the Government's attempt to spend its way out of recession is not working and that Britain needs a change of direction.

Enlarge

In a hole: Street artists depicted Mr Brown and Mr Darling in a 'financial black hole' today on the pavement outside the Treasury building

Labour's Credit Crunch Budget:

Tax

A new top income tax rate of 45 per cent for those earning more than £150,000 will be increased to 50 per cent.

The rise will also take effect from next April, a year earlier than planned.

It is a breach of Labour's manifesto pledge in 2005 not to increase the basic or top rates of income tax in the next parliament.

From April 2011, pension tax relief for people earning more than £150,000 will also be restricted.

Savers

The annual savings allowance for tax-free ISAs will rise to £10,200 a year, up from £7,000.

People aged 50 and over will be able to save more from this year with the rise coming into effect for everyone else from 2010.

Alistair Darling said the cash limit within the overall allowance would rise from £3,600 to £5,100.

Car scrappage scheme

A 'cash for bangers' scheme will be used to try and kick-start the ailing motor industry.

Anyone with a car registered before July 31 1999 will get a cash incentive of £2,000 to trade in their old vehicle for a brand new one.

A total of £1,000 will come from the Government and the remaining £1,000 from the industry itself.

Participants will be able to buy any new vehicle, including small vans, rather than just low-pollution models.

The £300million scheme could come into effect as early as the middle of next month and will last until the grant runs out - allowing 300,000 people to benefit.

Housing

The stamp duty holiday on properties of up to £175,000 will be extended until the end of the year.

Chancellor Alistair Darling said the exemption meant that 60 per cent of homebuyers would not be liable for the tax.

The threshold at which the tax kicks in was initially increased from £125,000 to £175,000 for one year in September 2008.

Alcohol and Cigarettes

Duty on both will rise 2 per cent in a move that will anger the struggling pub and drinks industry.

The increase on alcohol will be implemented from midnight tonight and on tobacco from 6pm this evening.

The British Beer and Pub Association (BBPA) has said the increase would mean an extra 5p on the average pint of beer.

The UK pub industry is already under great pressure, with pubs closing at an average of 39 a week.

Mr Darling said said these measures would raise more than £6 billion by 2012.

Fuel duty

This will increase by 2p a litre in September and there will be further rises of 1p a litre for the next four Aprils.

The AA billed the move an 'unexpected bombshell' while the RAC described it as a 'brutal blow for motorists'.

The Freight Transport Association said it 'could be the death knell for parts of the logistics sector'.

Having slipped below 90p a litre at the pumps, petrol prices are now around 95p, with this month's planned Government fuel duty rise adding 2.12p a litre on prices.

Employment

An extra £1.7billion will be poured into the Jobcentre Plus network on top of £1.3billion already announced.

From January, everyone under the age of 25 who has been out of work for 12 months will be offered a job or a place in training and those in work will receive a wage.

Some 250,000 jobs will be created or supported as part of these measures, Mr Darling said.

Business

Up to £5billion will be given in extra trade credit insurance to businesses who have seen their level of cover reduced.

Firms will be able to buy six months 'top up' insurance from the Government after May until the end of the year if credit limits on their UK customers are reduced.

The move follows growing concern from businesses that reductions in the value of insurance cover created pressure on suppliers to shorten payment terms.

Public debt and the economy

Public borrowing to soar to £175billion this year, equal to 12 per cent of GDP.

It is forecast to fall back to £173billion next year, then £140billion in 2011 and £118billion in 2012.

This means the Government is set to borrow a massive £606billion over the next four years.

The economy will shrink by 3.5 per cent this year, Mr Darling said, before returning to growth next year with a 1.25 per cent rise.

Annual growth of 3.5 per cent expected from 2011.

The Retail Prices Index will fall to minus 3 per cent by this September as deflation worsens.

Government cuts

The Government aims to make £9billion in efficiency savings a year by 2013/14 despite promising not to cut back on vital public spending.

Mr Darling said he had been seeking to find an additional £5billion of efficiency savings in 2010-11, on top of a total of £30 billion in the current spending review period.

Families and pensions

From April next year, the child element of child tax credit will go up £20.

Grandparents who are carers of children will see that work qualify towards state pension.

Winter fuel allowance for pensioners is to be maintained.

Capital disregard on Pension Credit will be raised from £6,000 to £10,000 from November.

Environment

The world's first 'carbon budgets' will require Britain to cut its emissions by a third by 2020.

An extra £1billion will be spent on tackling climate change by supporting low-carbon industries.

Offshore wind projects will receive £525million over the next two years and £435million will be set aside for energy efficiency schemes in homes, officers and public buildings.

Another £405million will be spent on encouraging low-carbon energy and 'advanced green manufacturing'.

... And here's how the markets responded

The Stock Exchange gave the Budget a lukewarm response this afternoon as the pound tanked after the devastating forecasts on public finance.

The FTSE-100 dipped into the red as the Chancellor's forecasts of soaring public debt hit home.

Life and pensions firms dropped in response to the move to restrict pension tax relief for top earners.

But the index later recovered some lost ground to stand around 40 points higher, or more than 1 per cent.

The pound fared less well, dropping nearly 2 per cent against the euro to 1.11 euros and falling to 1.45 U.S. dollars - a drop of more than 1 per cent.

******************************************************

The Chancellor's "little bag"

Watch Daniel's film

Watch Daniel's filmWhy is a budget called a budget, and how long has this been going on? Daniel Brittain reports for the Daily Politics from the East Street market in Southwark.

But as early as 1295, when Edward I wanted to raise taxes to fight the Scots and French, he thought it wise to get the backing of the Commons - because it gave his money-grabbing more legitimacy.

A little bag

The annual Budget first came about during Walpole's time in the 1720s. He was both PM and Chancellor. The word "budget" came from the French "bougette", a little bag. And from his little bag, Walpole certainly took some unpleasant pills and potions.

Paul Seward of the History Of Parliament Trust told me a few of them:

In fact, it's still legally regarded as temporary and has to be renewed every year, but don't hold your breath that - after 207 years - Gordon Brown is about to abolish it!

Banging on

Putting on a performance is an essential ingredient in presenting a budget. Gladstone took holy communion, and then banged on in the Commons for a record four and three quarter hours.

Disraeli kept it short and sweet at 45 minutes. Macmillan stayed in bed most of the morning fretting about it. Ken Clarke told me he was going to have some fun:

I got a tremendous reaction to the end of the speech. People were waving order papers and cheering; I kept pinching myself. I think I produced the budget whcih had raised more taxation than any other in living memory, so I had to wonder whether they'd been listening to it!

William Gladstone, sherry drinker

Latest show

Latest show Sherry and beaten egg

Of course, all this speechifying is thirsty work - and the Chancellor's budget drink is a lifesaver. The only MP allowed to drink alcohol in the House of Commons is the Chancellor, on Budget day. Ken Clarke sipped on neat whisky; Disraeli went for brandy and water; Goschen drank port; Gladstone had a strange mixture of sherry and beaten egg. Jim Callaghan took a modest tonic water, whilst David Heathcoat-Amory favoured honey, milk and rum. And our own dear austere Chancellor? Surprise, surprise: he drinks water. Scottish, of course.

The Chancellor's "little bag"

Watch Daniel's film

Watch Daniel's filmWhy is a budget called a budget, and how long has this been going on? Daniel Brittain reports for the Daily Politics from the East Street market in Southwark.

But as early as 1295, when Edward I wanted to raise taxes to fight the Scots and French, he thought it wise to get the backing of the Commons - because it gave his money-grabbing more legitimacy.

A little bag

The annual Budget first came about during Walpole's time in the 1720s. He was both PM and Chancellor. The word "budget" came from the French "bougette", a little bag. And from his little bag, Walpole certainly took some unpleasant pills and potions.

Paul Seward of the History Of Parliament Trust told me a few of them:

In fact, it's still legally regarded as temporary and has to be renewed every year, but don't hold your breath that - after 207 years - Gordon Brown is about to abolish it!

Banging on

Putting on a performance is an essential ingredient in presenting a budget. Gladstone took holy communion, and then banged on in the Commons for a record four and three quarter hours.

Disraeli kept it short and sweet at 45 minutes. Macmillan stayed in bed most of the morning fretting about it. Ken Clarke told me he was going to have some fun:

I got a tremendous reaction to the end of the speech. People were waving order papers and cheering; I kept pinching myself. I think I produced the budget whcih had raised more taxation than any other in living memory, so I had to wonder whether they'd been listening to it!

William Gladstone, sherry drinker

Latest show

Latest show Sherry and beaten egg

Of course, all this speechifying is thirsty work - and the Chancellor's budget drink is a lifesaver. The only MP allowed to drink alcohol in the House of Commons is the Chancellor, on Budget day. Ken Clarke sipped on neat whisky; Disraeli went for brandy and water; Goschen drank port; Gladstone had a strange mixture of sherry and beaten egg. Jim Callaghan took a modest tonic water, whilst David Heathcoat-Amory favoured honey, milk and rum. And our own dear austere Chancellor? Surprise, surprise: he drinks water. Scottish, of course.

Last edited: